Insight Focus

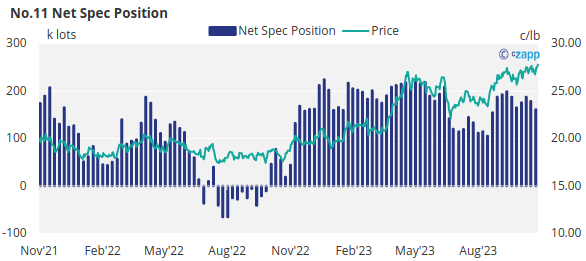

- Raw sugar futures remain near 27.5c/Ib.

- Speculators have closed a large number of long positions.

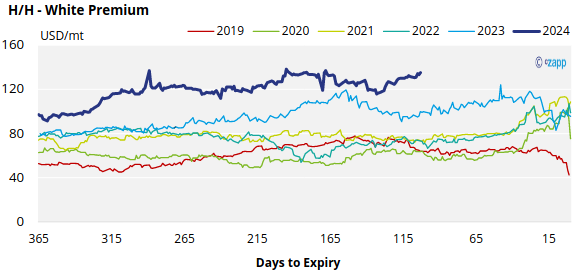

- Following the recent No.5 strength, the H/H white premium has risen to 135USD/mt.

New York No.11 Raw Sugar Futures

Over the past week, the No.11 sugar futures have traded close to 12-year highs near 28c/Ib.

Speculators have cut their long position by 21.6k lots, and also trimmed 3.9k lots of shorts.

This reduces their net long in raw sugar to around 160k lots, the lowest level since August. Futures prices then were 4c/lb lower than they are today.

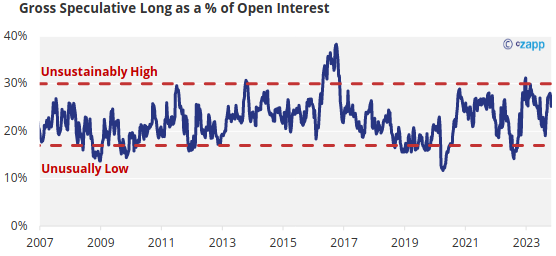

Speculators now hold 25% of long open interest in sugar, which is a normal level. At current open interest, speculators could add another 50k lots to their gross long without the position becoming unsustainably large.

In contrast, consumers have added nearly 9k lots of hedges despite the high futures prices. Producers, on the other hand, have chosen to close 7.3k lots of their short position.

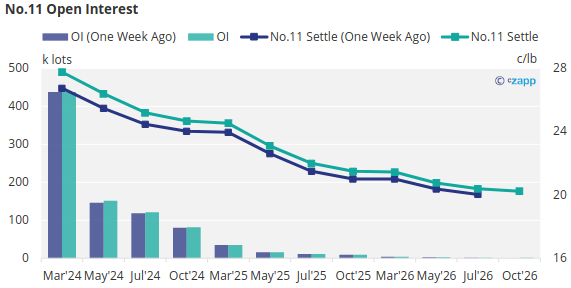

The No.11 forward curve remains inverted until Oct’26.

London No.5 Refined Sugar Futures

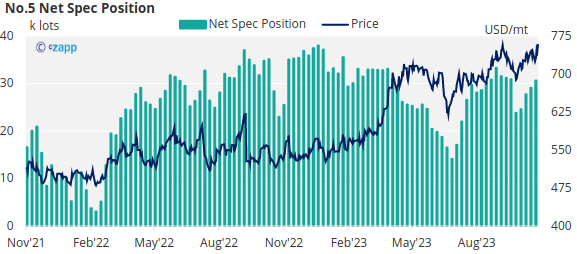

The soon-to-expire Dec’23 No.5 refined sugar price maintains its recent upward trend, closing at 757USD/mt last Friday.

That said, speculators of refined sugar have chosen to extend their long position by 1.5k lots, bringing the overall net spec position back up to 30.6k lots.

Whilst contracts down the board have lifted over the last week, the No.5 forward curve remains backwardated into 2025.

No.5 Open Interest

White Premium (Arbitrage)

The H/H sugar white premium has pushed back above 135USD/mt over the last week, following No.5 strength.

That said, we think re-exports refiners need around 100-110USD/mt above the No.11 to profitably produce refined sugar, therefore physical values should still be necessary to bridge this gap.

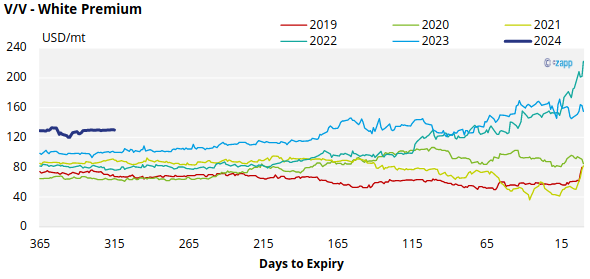

The refined sugar market is a little undersupplied for the majority of 2023 and this is reflected in comparatively strong K/K and Q/N white premiums which are both pushing toward 145USD/mt.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

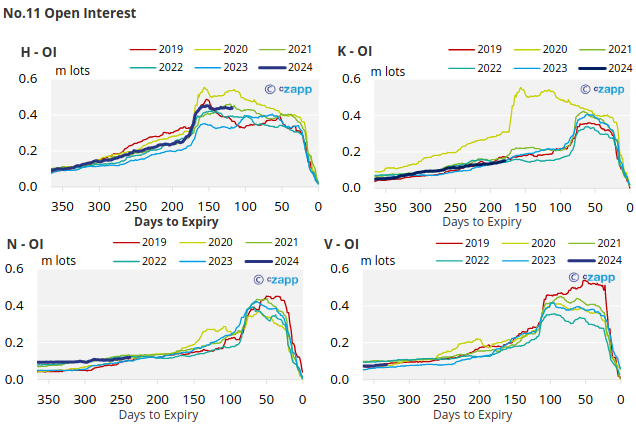

No.11 (Raw Sugar) Appendix

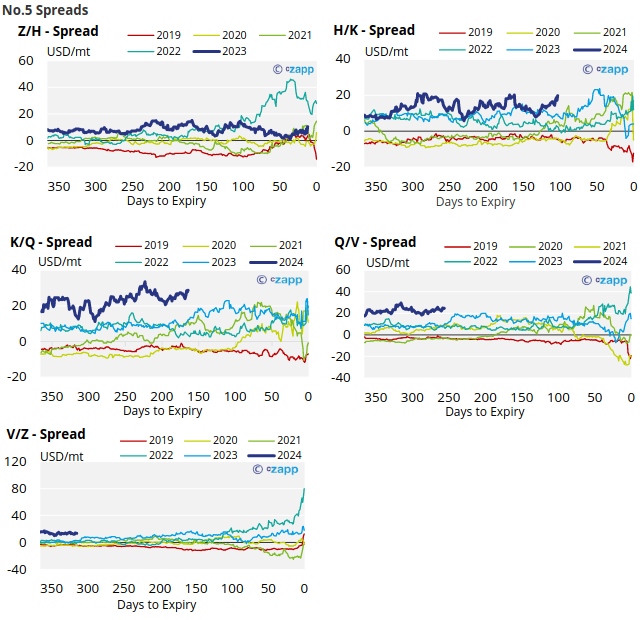

No.5 (White Sugar) Appendix

White Premium Appendix