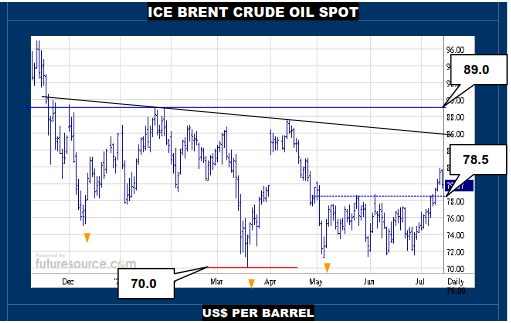

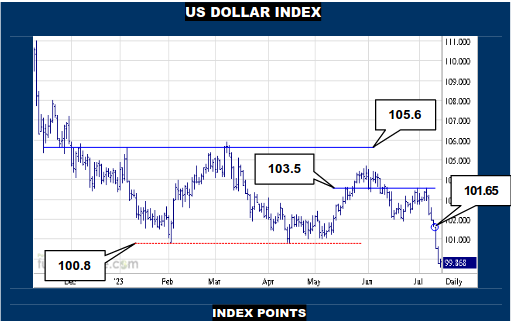

NEW YORK SUGAR #11 OCTOBER 2023

Perhaps not the most rampant of overthrows but NY did chew through the 24.01 double top rim and score a close just beyond the 24.23 spot equivalent Friday. This also hurdled the ex-trend and mid band so plenty of boxes checked if acknowledging the rather marginal extent initially. With the macro also favorable, the post Jly contract era looks ever brighter so one must duly give the market room for further gains into the 26’s. Nevertheless, in recognition of these being the wiliest of times, do still watch 23.70 as a nearby tripwire that could throw it all into disarray again.

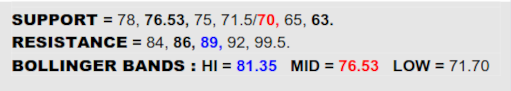

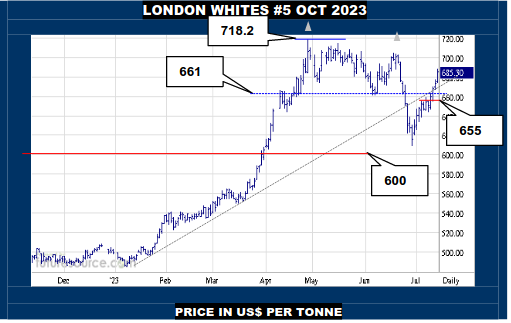

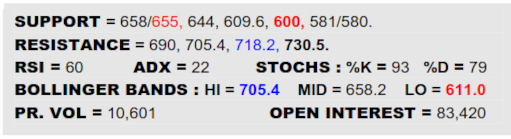

LONDON WHITES #5 OCTOBER 2023

Whites have championed the recovery all the way and London continued to rally Friday, scoring a new high for the Oct White Premium. Can’t really criticize the performance here then and the upper Bollinger band (705.4) is in sight and poised to start veering north itself where the 718.2 Oct peak and 730.5 weekly apex could begin to beckon. Even so, since ‘fickle’ has been a staple of the 2020’s, there is always due cause to keep one eye in the rear view mirror, in this case watching the mid band (658) to 655 ledge for any signs of things going off track again.

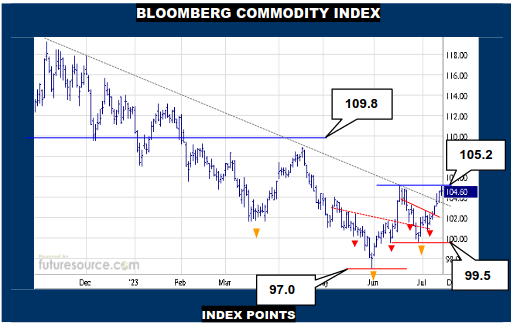

BLOOMBERG COMMODITY INDEX

Finally, after a whole Q2 of thrust and parry dicing, the two macro indices appear to be making more definitive commitments to a path. For the B-Berg this has left a couple of modest inverse H&S bases but, in now escaping the broader downtrend(s), defeat of 105.2 would merge the lions’ share of ’23 into a much bigger version of such a pattern and dial in the crosshairs on the final 109.8 escape hatch to a full blown turnaround. Whether exit into the 110’s would then start to affect those inflationary stats and thus renew ‘Fed fear’ we must just wait and see but for now only swerving back through the mid band (102.6) and below 102 would undercut the early Q3 achievements.

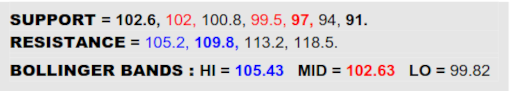

US DOLLAR INDEX

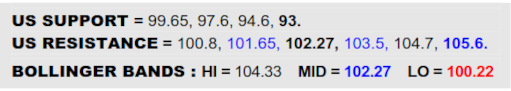

Though spending the first half of the year attempting to score a turn back upwards, the cooler inflation stats and thus calmer Fed one finally pulled out the rug in Jly and the Dollar has tumbled to new depths, departing triple digits. One would initially view the tiny 101.60’s gap as a ‘breakdown’ gap in this process but there is a little proving to do in that respect because, if instead also just considering the possibility of it being a lesser ‘measuring’ gap, then it just hit its mark at 99.65. So while further pressure next week would persuade of the wholehearted breakdown scenario and take aim at 94/93, if the mid 99’s held repeatedly, doubts could be sown in the event of a reflex back up across 100.8.

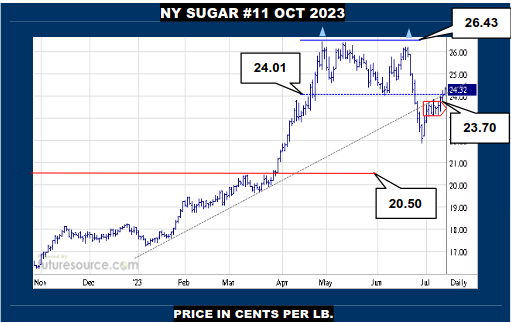

ICE BRENT CRUDE OIL SPOT

The other key ingredient aside from the Dollar dive to giving the B-Berg release from its downtrend has been Crude finally getting its act together and Brent busting clear of the 78.5 resistance. This has installed a preliminary two month base underfoot and looks like a prospective springboard towards 86, which marks the exit neckline from a much larger eight-month inverse H&S base that, in turn, will likely be the key to unlocking 109.8 on the B-Berg. RSI has responded with glee to this Jly rally so all looks well for the time being but do still keep an eye on the span between 78 and the mid band (76.53), doubling back through the entirety seriously undercutting the improvements.