Insight Focus

- We think global sugar production in 2022/23 will be the second largest on record.

- Despite this we think the surplus over consumption will fall by almost half compared to 2021/22.

- Global consumption is expected to strengthen despite inflationary pressure and recession threat.

2022/23 at a Glance…

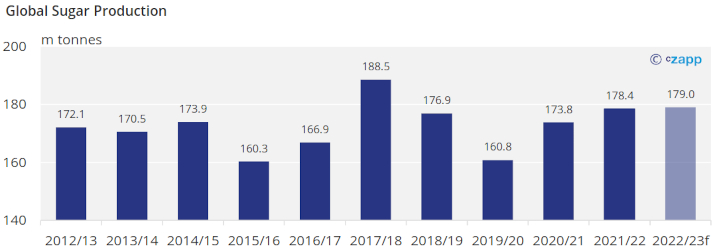

Global Sugar Production

Global sugar production in 2022/23 is expected to reach 179m tonnes, the second largest on record after the record 2017/18 season.

Since the previous update in December, we have reduced our forecast by 200k tonnes by downgrading the estimates for a few minor producers.

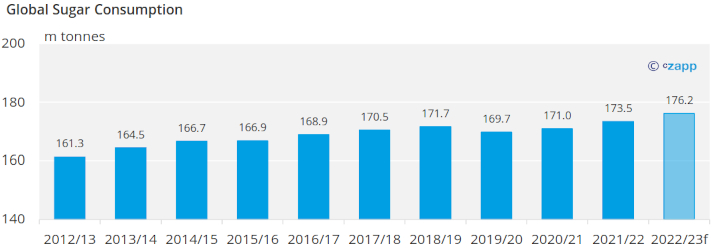

Global Sugar Consumption

In 2022/23 we think the world will consume over 176m tonnes of sugar, this will be the highest on record and represents almost 3m tonnes more than the Covid-19 affected 2021/22 season.

With per-capita consumption growth flat or declining in many developed countries, worsened by high inflation and threat of recessions, we think that the main driver of consumption growth globally is from a rising population. We have not made any changes to this forecast since the last update.

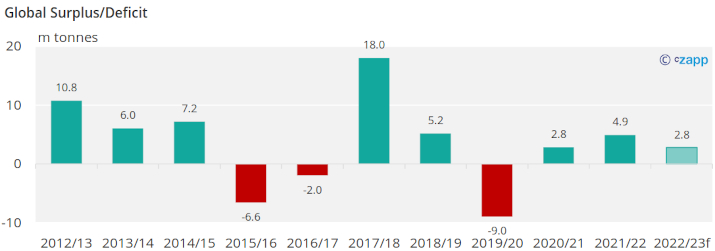

Small Production Surplus

We think the world will produce a surplus 2.8m tonnes of sugar in 2022/23, strong consumption growth from the previous season means this is over 2m tonnes less than the surplus in 2021/22.

Global production has been fairly static over the last decade, yet consumption keeps moving higher. Without significant investment in additional acreage by the world’s producers we think that the world market will continue to get tighter.

As such we are constructive for sugar prices in the longer term.

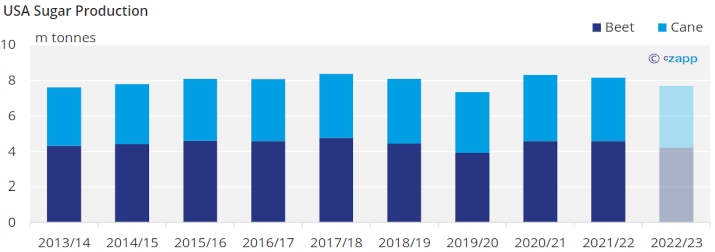

USA Sugar Production Update

Sugar production in the USA is expected to be below 8m tonnes in 2022/23, the first time since 2019/20 when freezing conditions heavily limited the beet harvest.

This season colder, wetter conditions have also hindered the beet growers in Minnesota, Idaho, North Dakota, and Michigan. We think total sugar beet production is likely to be around 300k tonnes lower on the year at 4.2m tonnes.

For the major southern sugar cane producing states, Florida, Louisiana, and Texas the cane crop has faired better, though production is still forecast to shrink by around 100k tonnes from 2021/22 to 3.5m tonnes.

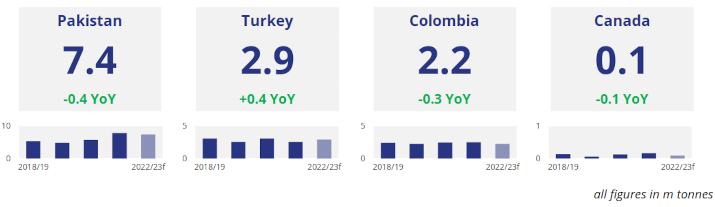

Other Sugar Producers at a Glance…

If you have any questions, please get in touch with us at Will@czapp.com.