Insight Focus

- Global production in 2022/23 falls marginally as several producers face bad weather.

- However, sugar beets in the EU-27 have faired slightly better than expected after the summer heatwave.

- Despite poor harvest conditions Russian production expected to improve on 2021/22 season.

2022/23 at a Glance…

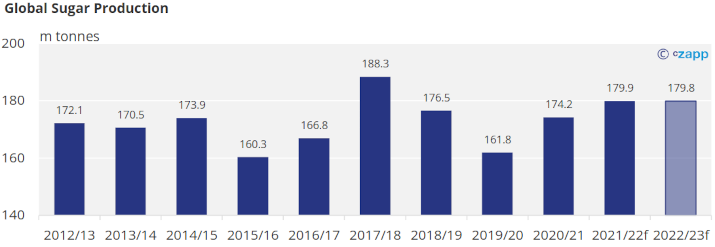

Global Production

The world will produce 179.8m tonnes of sugar in 2022/23, this is almost the second largest on record after 2021/22 and the record 2017/18 crop. This forecast is 100k tonnes lower than in our October update.

We have downgraded our CS Brazil and Russia forecasts by 100k tonnes each owing to excess rainfall in these regions.

Countering this is a minor uplift to production in the EU-27 owing to yields being more resilient to the dry summer than we earlier expected.

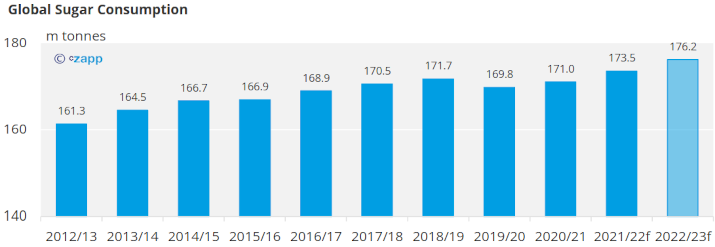

Global Consumption

In 2022/23 we think the world will consume over 176m tonnes of sugar, this will be the highest on record and represents almost 3m tonnes more than the Covid-19 affected 2021/22 season.

Minor adjustments to several regions means this forecast is 100k tonnes less than the previous update.

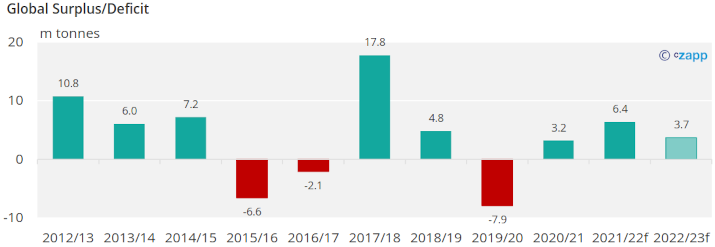

Small Production Surplus

A slight fall in our global consumption forecast for 2022/23 will see the global surplus grow by 100k tonnes to 3.7m tonnes since the October update.

Strong growth in consumption since 2021/22 means this is just over half the size of the surplus observed in 2021/22, despite similar production.

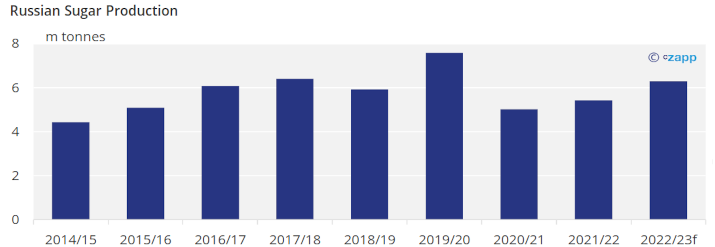

Russia Production Update

We think that Russia will produce around 6m tonnes of sugar from beet in 2022/23 and almost 300k tonnes from syrup and molasses. This is almost 1m tonnes more domestic production than in 2021/22.

A 5% increase in sowed area and beet yields so far around 15% better than in 2021/22 help account for this uplift however recent poor weather is hampering the pace of the harvest and the hindering the sugar content of the beets.

Looking ahead to 2023/24 and beyond, ongoing sanctions against Russia could likely affect future yields since their domestic industry heavily relies on importing high-productivity beet seeds from Europe and North America.

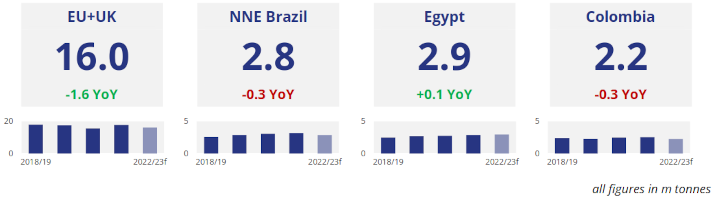

Other Producers at a Glance…

If you have any questions, please get in touch with us at Will@czapp.com.