Insight Focus

- The US Dollar and interest rates remain firm.

- There are signs the commodity trade are losing their bullishness.

- Sugar prices might be approaching a decision point – will they break higher or lower?

Click here for the full video!

Hi everyone, it’s Stephen from CZ with another video update on the state of the sugar market. It’s been a while since I last looked at how other markets are influencing sugar, so now’s a good time. If you want a bit more fundamental analysis of what’s been happening in sugar, check out my October video from a few days ago where I look at demand destruction and prices.

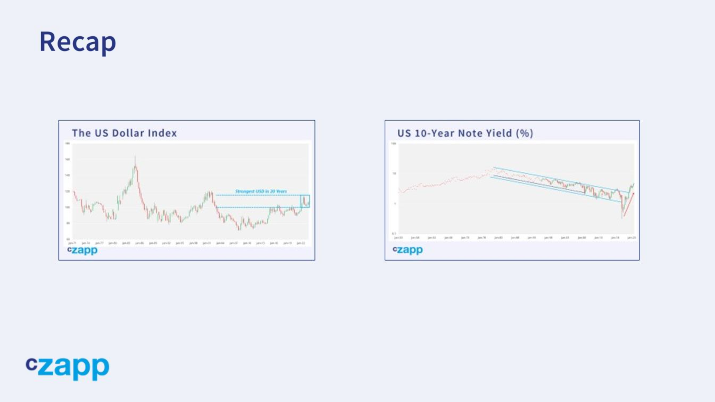

One reason I thought it would be good to revisit the wider financial markets is not so long ago we had a 1.5% move in the US Dollar in one day.

Our derivatives team sent a note around CZ at the time and it reminded me about how dull many major markets had been in 2023. Also, the textbooks will tell you that a weaker Dollar is positive for commodities, but I wasn’t so sure this was the right conclusion. For a start, although the US Dollar had indeed fallen 1.5% in a day, which is a big move for the Dollar, the move wasn’t terribly meaningful.

In 2023 it’s traded in a broad sideways range between 100 and 107, and the 1.5% move brought it back into the middle of its range and back to the 50-week moving average.

The US Dollar is the lifeblood of global trade. A strong Dollar slowly restricts trade by making it a bit more expensive. 2023’s range is expensive for the Dollar. That’s been slowly constricting global trade, weighing gently on commodities, which is the opposite of the one-day headline!

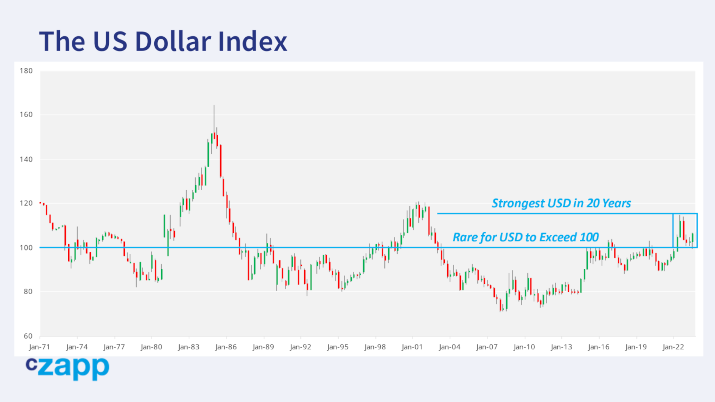

Let’s zoom right out and look at the US Dollar across the last 50 years. It’s a scary view. Every breath I’ve ever taken, every movement I’ve made, every word I’ve spoken is all encapsulated in this one chart, plus a few years more. But it’s useful, because a few things emerge.

Firstly, the US Dollar is the strongest it’s been in 20 years. Real Madrid and England footballer Jude Bellingham wasn’t even born last time the Dollar was this strong. For those of you who prefer the other type of football, Tom Brady was only 3 years into his career at the time.

Secondly, it’s really rare for the US Dollar Index to sustain above 100, with the mid-1970s to mid-1980s being the major decade-long exception.

The dollar today is unusually strong.

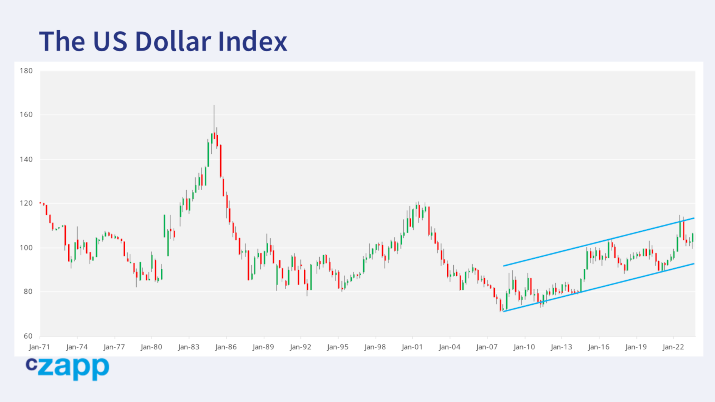

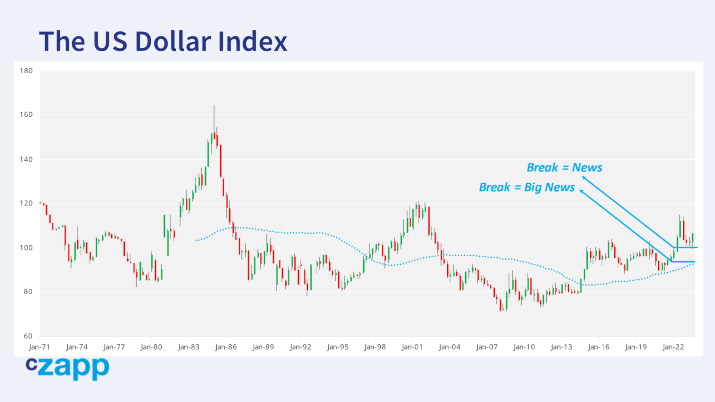

Thirdly, we’re bang in the middle of a 15-year uptrend that started in 2008, rising out of the ashes of the financial crisis.

Finally, the bottom of the uptrend currently coincides with the 50-quarter moving average at around 93.

It’s pretty hilarious that this year we’ve seen a spate of headlines pronouncing the death of the US Dollar, about how it will lose its reserve currency status and how we’re going to see growth in trade denominated in Yuan or Roubles or whatever and in reality it’s the strongest it’s been in decades. So the recent one-day move doesn’t mean much for sugar.

If anything, it’s the sustained strength in the Dollar we need to watch. This should make it increasingly hard for sugar to rally in the future.

Let’s keep watching what happens in the coming weeks. A break of 100 would be news. A break of 95 would indicate a proper regime change for all markets.

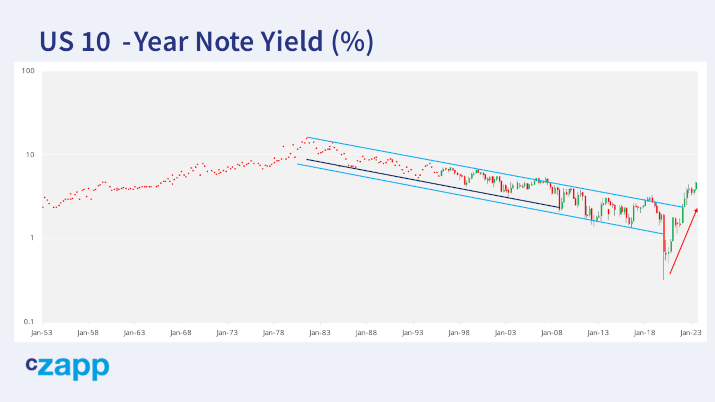

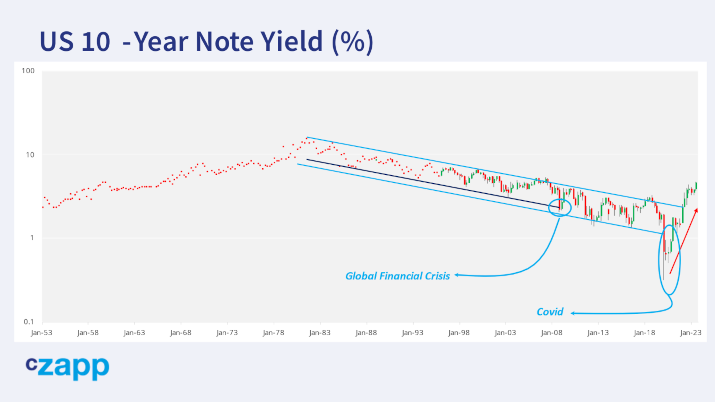

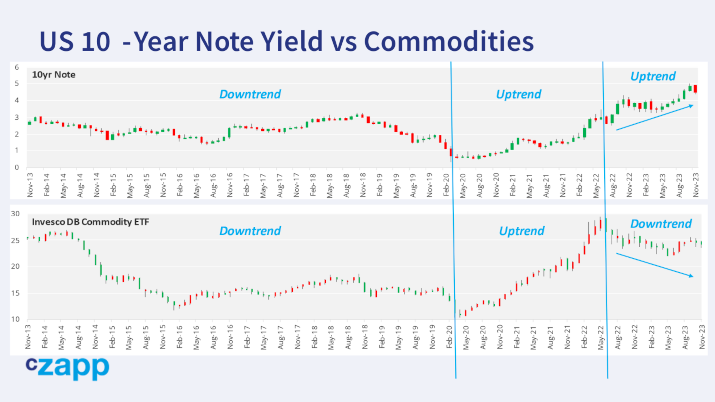

Speaking of regime change, it also looks like the 40-year US bond bull market is over. Here’s a chart of 10-year Treasury Yields over the past 70 years.

This doesn’t just encapsulate my entire life. It also covers virtually all of my parent’s lives too.

It probably goes without saying, but rising interest rates are also not great for global trade. They increase the cost of doing business, of carrying stock, of financing trades. This should be acting as a brake on commodity markets alongside the strength of the Dollar.

The downtrend in yields itself is remarkable. Firstly, let’s look at the 2008 financial crisis, which was the seminal event in the markets for people of my generation and shaped how we act and think. Central banks around the world flooded the market with liquidity and backstopped financial institutions which were teetering on the bring of solvency but were too big to fail. This huge injection of liquidity was a big deal for bond yields and was responsible for what felt like a major shift outside the old bottom end of the trend channel, shown in dark blue.

But it was nothing at all compared to the bailout we all got when Covid hit. The amount of money sprayed around by central banks then dwarfed all before it. It had to. Economies couldn’t be allowed to collapse in the face of the virus.

You can see the effect on US yields as they collapsed towards zero. If I recall correctly, some German government bonds became negative yielding. The downtrends were finally broken, and that meant something major had changed. That bond market rally had been intact for my whole life, so this might be the only major change in interest rate trends in my lifetime.

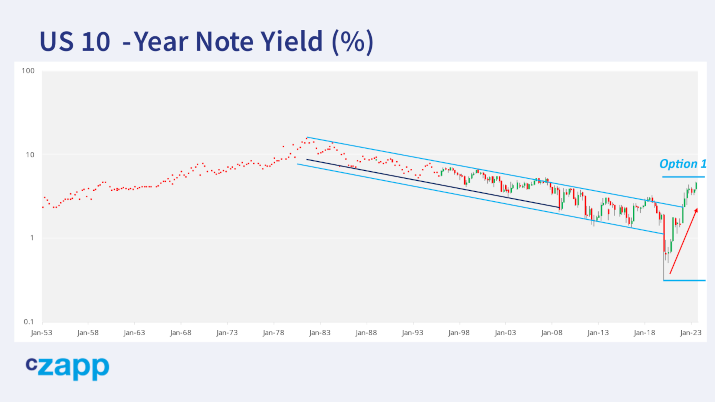

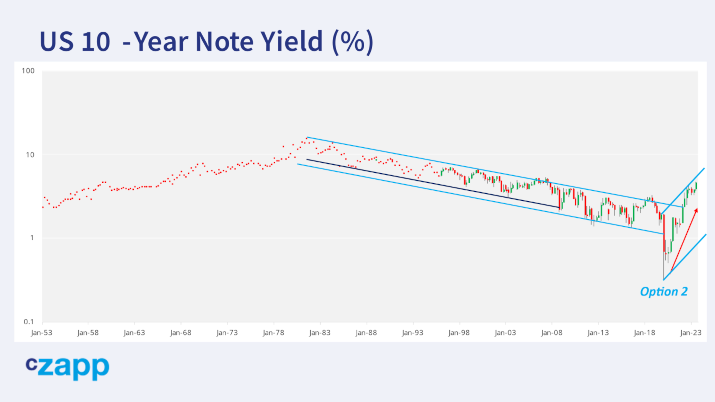

We’ve now had a pretty major rebound to the upside after the overthrow to the downside. I think there are two options.

The first is that yields stabilize in a sideways range for several decades between 0% and 5%.

The second one is that yields could start a multi-decade rally, with a pull back in the next few years to around 2.5% which would coincide with a retest of the top of the downtrend and 200 month moving average.

I sincerely hope it’s the first option, though I have a mortgage, so I’m not an impartial observer. To some extent I suspect interest rates are a function of human life expectancy and this tends to increase around the world, but I’m really not an expert.

As I hinted earlier, rising rates have huge implications across all of finance. At a basic level, holding a non-yielding financial asset makes a bit more sense when bonds also barely yield. It might make less sense when you can get 5% on medium-term US government debt.

Commodities generally don’t yield, unless the futures curve is heavily backwardated, in which case it’s possible to claim a roll yield when selling nearby contracts to buy longer-dated ones. I’ve also read recently that the 2nd hand market for luxury items like Rolexes, fine wines and whiskies are also falling. Cryptocurrencies have also famously been hit. It turns out that owning things as an inflation hedge doesn’t really work if there’s a credit crunch and you need liquidity.

Finally if US rates remain elevated and there’s a smaller interest rate differential between the Dollar and other currencies, it might make holding USD more attractive. This is relevant for the sugar market because of the FX impact on many of the world’s top suppliers and buyers.

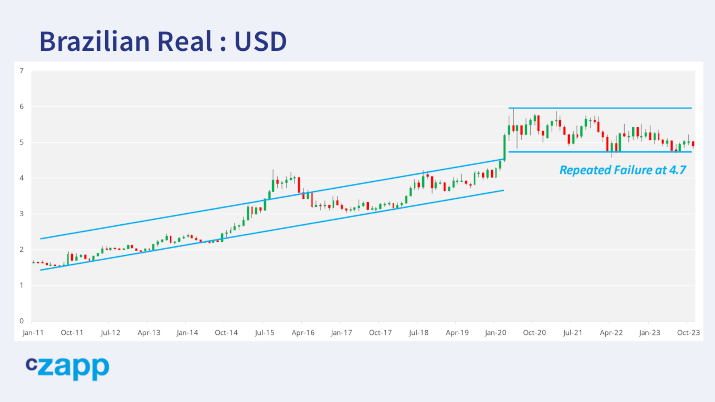

For example, let’s look at the Brazilian Real.

It’s broken its 2010s uptrend and has traded sideways in the 2020s so far. Pretty dull, but the longer it spends in the bottom half of this range without breaking 4.50, the more convinced I’ll become that it’ll weaken beyond 6 some time this decade. Brazilian Real weakness is generally negative for sugar prices.

Let’s look at the Indian Rupee too.

This is bang in the middle of its 15-year uptrend with no signs of reversal.

The Yuan has also been weakening for 8 years; but for now it’s close to the top of its uptrend so is perhaps due a correction to the downside.

This could make it easier for Chinese buyers to buy sugar at lower prices in the short term.

Now, I’d love to be able to bring this all back to give a concrete view on where sugar prices are going to go in the short to medium term. But the reality is that I don’t really know what happens next.

I suspect that sugar prices will exceed 30c at some point in the next year.

The market’s utter dependence on Brazil for supply is too unhealthy and makes it vulnerable. This might mean that we go there in a straight line if the market has another adverse event it can’t cope with.

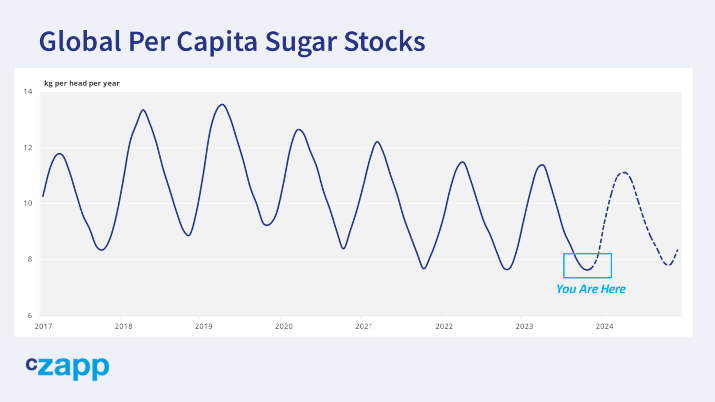

Remember, sugar stocks around the world are low. Buyers don’t have anything to fall back on, and Brazil is the only supplier and can’t sort its logistics out. There’s no spot availability for sugar.

BUT….having said that, I wonder if we’re overdue a correction? It’s also possible we go to 30c via the low 20s first. Firstly, it’s possible that the long line-up queues in Brazil are already leading to enforced demand destruction, as I mentioned in my October video. This is now mainstream news, but the media think it’s only bullish; they can’t see the potential bearish angle.

CZ’s raw sugar desk tells me that if we nominate a vessel to load sugar today, it won’t berth until February at the earliest, which means it won’t arrive at destination until March. Spot buyers today will have to do without.

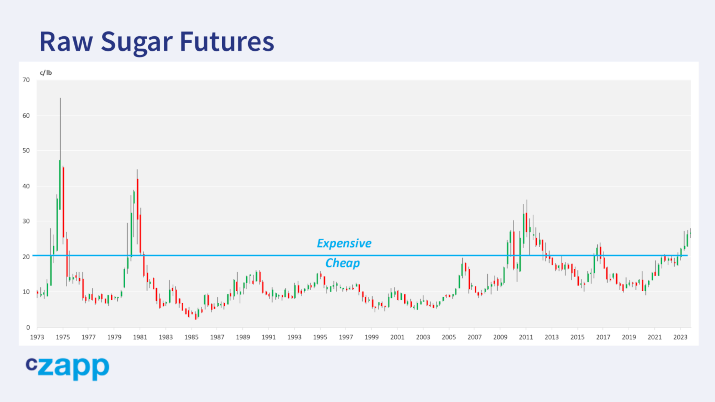

We also need to recall that a price above 20c is rare in sugar. Anything above 20c is expensive. It’s not just about price either, it’s about the time spent at a high price. The market has been above 20c for the whole year; buyers ran down their stocks in the first half of the year. We’re now at the stage where some sugar buyers may decide it’s just too expensive and they’d rather go without than pay up.

That’s the fundamental reasoning for market weakness. Let’s also look at order flow.

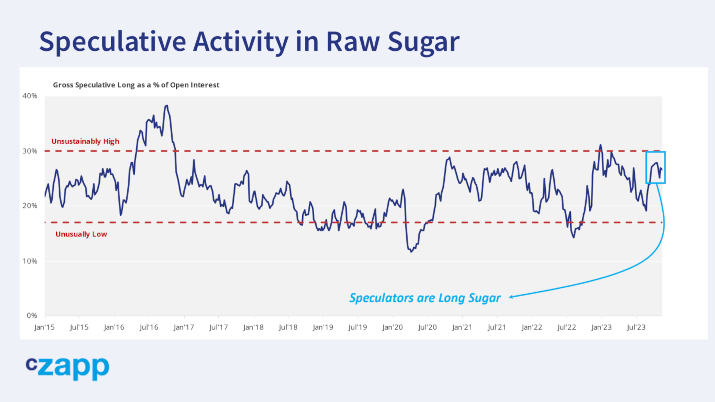

We know speculators are still bullish and are long the sugar market.

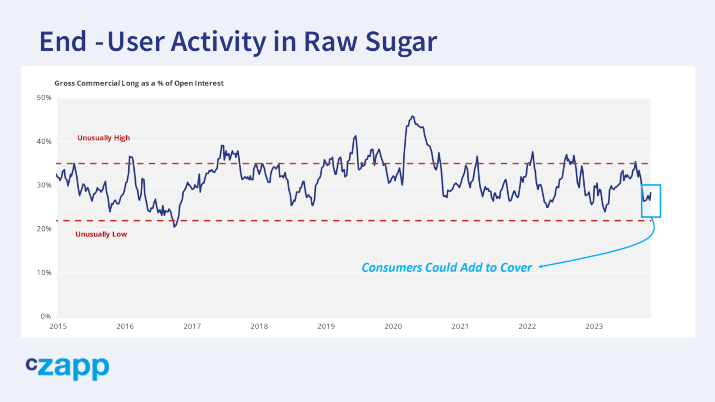

But sugar consumers aren’t chasing the market today. 2024 cover remains quite low.

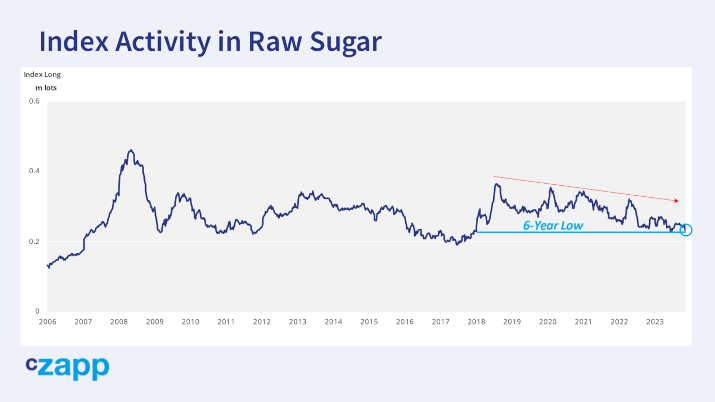

Commodity indices are reducing their long position. They are either re-allocating funds towards commodities that haven’t performed as strongly in 2023 or are rebalancing away from commodities altogether.

That leaves the trade. They’ve been bullish all year and this has paid off handsomely for them.

Most of the trade houses I’ve spoken to in the past week seem to have had a wonderful year trading sugar. It’s surely not a coincidence ED&F Man are back in play. But talking to the trade around the fringes of the ISO seminar this week, there’s much less bullish appetite for sugar in 2024. They are more reluctant to build large destination books at a discount and also reluctant to trade the futures from the long side. At 27c they simply don’t think the risk-reward is right.

Put this all together and this means the trade and consumers are sidelined until prices are cheaper and indices are actively selling. Only the speculators remain firm bulls. I wonder if their long is perhaps becoming stale….

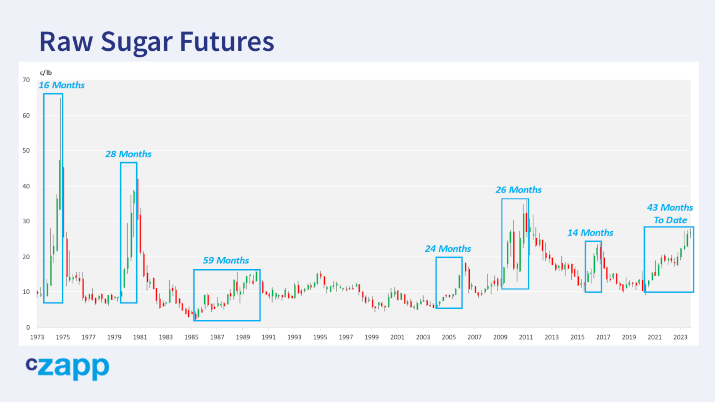

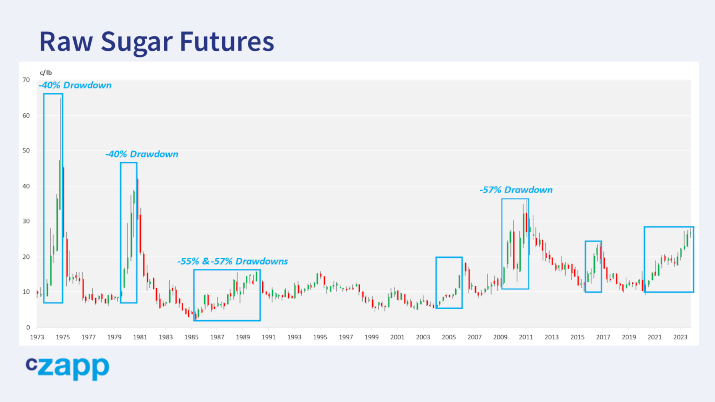

Speaking of stale, let’s put sugar’s current rally into context with another long-term chart. My lifetime on a page again.

There are two things to note here. The first is that the current bull market is already mature at 43 months. Typically they last from 15-30 months with the major exception being the 1985 – 1990 rally from 2c (!) to 16c.

The second is the complete lack of pull-backs in the current rally. The largest drop so far since 2020 was 23%. Only two other rallies have had milder pull-backs and they were both short-lived rallies. To get one in sugar of this duration without a 40% retracement is unique.

I well recall being bullish sugar in 2010 at 30c and then being cut in half as prices fell below 13c before the final rally to 36c. Just because the fundamental outlook for sugar is still bullish today doesn’t mean we aren’t overdue a nasty collapse. It feels like the sugar futures are now approaching decision time.

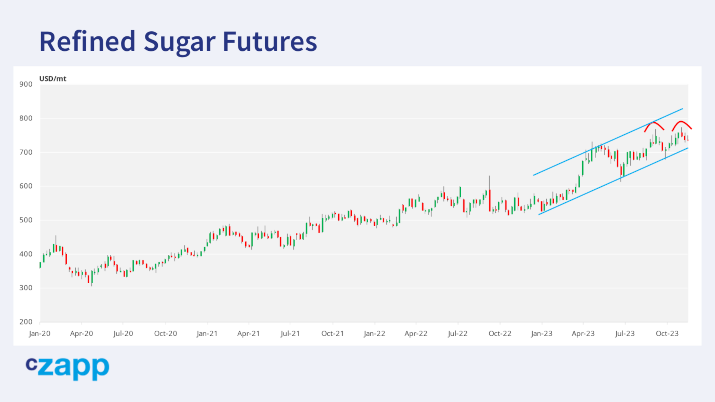

Refined sugar has been the price leader for much of 2023, but is not in danger of leaving a double-top on the charts in the wake of the December expiry. Expiries are often major events for the markets attracting high volume. We need the whites market to quickly break to new highs above $770, otherwise pressure will build to the downside.

Raw sugar has also been compressed between the upper end of 2023’s range and the 50-day moving average and hasn’t shown any inclination to break either in recent days… until now. On Friday the 50-day moving average broke.

If the move holds, then that leaves a decline to the 200-day moving average at 25c open.

As well as the bearish order flow and charts, don’t forget the message from the start of this video: a strong dollar and higher interest rates are bearish for commodity prices.

The sugar fundamentals are bullish, but if raw sugar is going to break 30c in the short term it’s going to have done it the hard way. I’m a longer term price bull, but this is the most nervous I’ve been about the sustainability of the rally for a while.

If you’re a sugar producer, please recognize how rare today’s prices are and hedge appropriately. I accept for sugar consumers that times are tough and a move to 30c isn’t what you want to hear. Please make sure you take full advantage of any pull-backs if they occur. I can’t guarantee we get to 20c, but low 20s might be possible with a bit of luck.

Thanks for watching and see you next time.