For more than twenty years TechCom has been providing insightful technical analysis to brokers, trade houses and individual investors. Technical analysis uses certain terminology all its’ own (support, resistance, double tops, flags etc…) but in otherwise employing a concise everyday writing style and clearly illustrated charts, TechCom readers don’t have to sift through a sea of jargon to try to understand the outlook for each featured market.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

ICE BRENT CRUDE OIL SPOT CONTINUATION

Key moments as Brent has shed its summer downtrend to stab into the prior dual top above 97. If it can secure this, an even bigger monthly base below 86.7 would claim victory, most of ’22 then looking like a lengthy correction and sights rising to 106.9 and even 125. If quickly swatted back under 94 though, beware the top reasserting control.

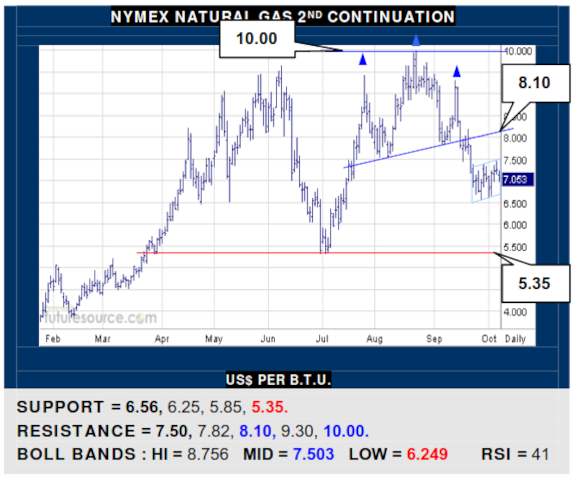

NYMEX NATURAL GAS 2ND CONTINUATION

Previously forming a Q3 H&S top, Nat Gas has since only managed a fortnights’ ranging hemmed in under its mid band (7.50). If it could rebound over that mid band, so the top neckline at 8.10 might come into play again but meantime wary of a bear flag evolving so watch 6.56 as a tripwire for a next leg south to try 5.35, a massive top then on the line.

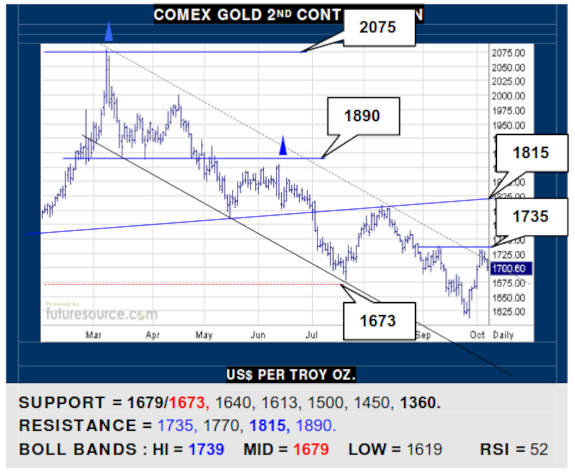

COMEX GOLD 2ND CONTINUATION

Gold has reacted back up from a slip off a major 1673 precipice but some fraying of the midyear downtrend must be shored up by conquest of 1735 to truly stabilize and light a path to a prior H&S neckline at 1815. Wavering meantime so beware veering back under the mid band (1679) and 1673 divide could promptly pull out the rug instead.

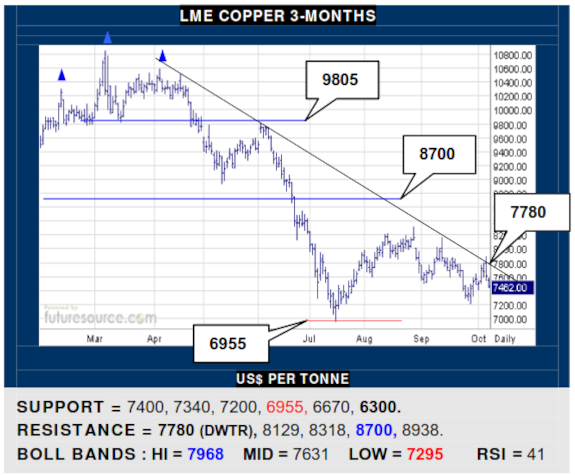

LME COPPER 3-MONTHS

Copper tagged its midyear downtrend (7780) this week but was repelled by an outside day as the Dollar shows new upside intent. Eying 7400 as a tripwire to intensify the trend rebuke then and suggest a crest to a brief correction to aim down at 6955 again, a gateway to 6300. Only reaching and holding the 7800’s would snap the trend and point to 8700.

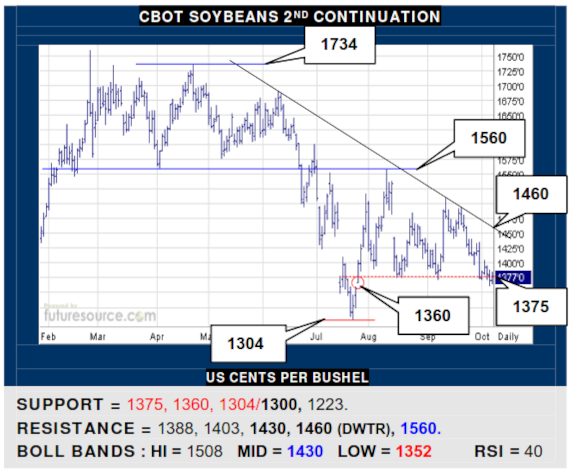

CBOT SOYBEANS 2ND CONTINUATION

A dink through the 1375 support still left a sliver of the 1360’s Jly gap unfilled and Beans scored an inside day Friday to suggest a desire to fight back. Piercing 1388 would reassure this intent to signal a try for the mid band then (1430) with the downtrend (1460) the real prize. Do still watch 1360 underneath meantime as a trigger for a delve to 1300.

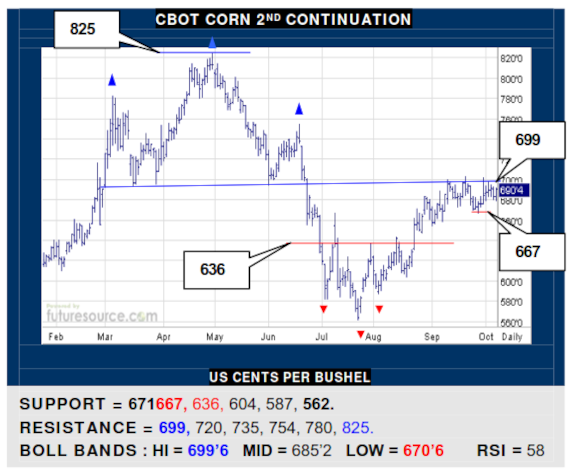

CBOT CORN 2ND CONTINUATION

Plainly Corns’ upside momentum faded in Sep as it met the prior H&S top neckline (699) but it gathered in a late Sep corrective dip and is still trying to pop that lid just overhead. Invasion of the 700’s would be a big step therefore and dispelling the top would infer scope to 754 and 780 but always minding the 667 ledge for any signal of finally surrendering.

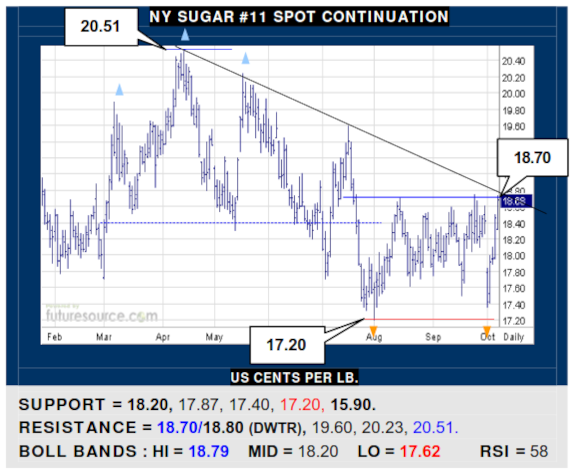

NY SUGAR #11 SPOT CONTINUATION

Mch took the spot baton this week and Sugar has hustled back up to challenge a pivotal 18.70/18.80 divide. Busting through would negate a midyear downtrend and prior H&S top while replacing with a hefty new 1.5₵ double bottom, setting up a run at the low 20’s. Alas, if blocked in the 18.70’s, watch the mid band (18.20) as the pivot back down.

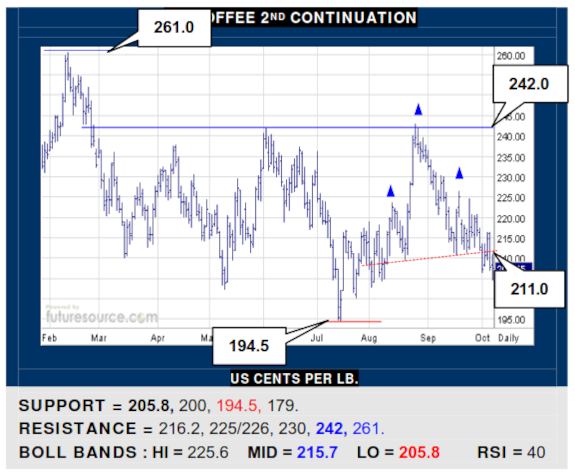

NY COFFEE 2ND CONTINUATION

Coffee has provisionally tipped over the 211 brink of a ragged new H&S this week and looks weary as a result. A confirming snap of 205 would thus point on down to 194.5 and even a full top projection to 179. Only if the lower Bollinger band can intercede (205.8) and spark a reflex back over 216.2 would the top be dispelled and new scope to 242 implied.

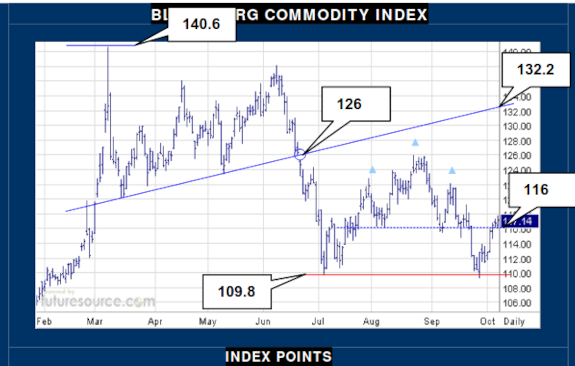

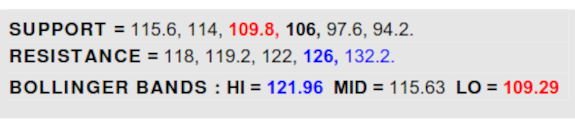

BLOOMBERG COMMODITY INDEX

With Brent laying siege to the $97 border of the large top built in ’22, the B-Berg is managing to sustain its provisional lunge back into the Q3 H&S. If Crude could actually solidify the return to 97+ values and thereby spirit the commodity index up out of the 117’s, the H&S would appear to be diluted and there would be scope on up to the 122 area next. Must be mindful for now however that the Dollar is bidding to recover as well and it usually requires a dramatic geopolitical event to keep them all rising in sync. If Brent couldn’t hold the 97’s though, watch the mid band (115.6) here as a tripwire to signal a correction cresting and a looming third test of the big weekly uptrend precipice at 109.8.

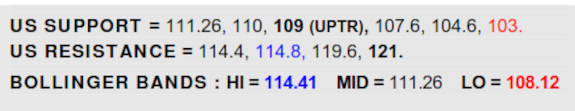

US DOLLAR INDEX

A delve through the 110.8 ledge was promptly retrieved so, as with prior dips along the way, one must be mindful that this could just be the latest in a string of short lived corrective exhales for the Dollar. Having said that, the RSI had hit its highest reading in five months as the 114.8 apex was set and has been reined back substantially so there are rumbles of it no longer being such an easy meander north. Making room temporarily for a new try into the 114’s then but with a watchful eye on the mid band (111.26) as a nearby tripwire. Any twist back under there would give more signs of fatigue and would then warn of a critical uptrend test (109) where a significant turn of the tide could take place.