Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

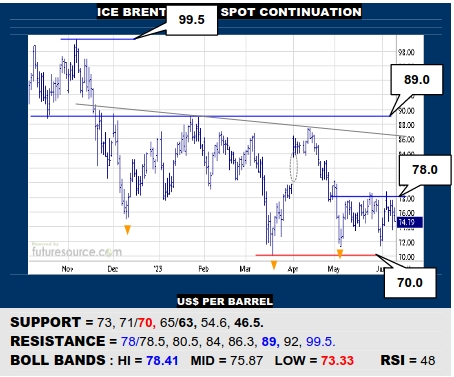

ICE BRENT CRUDE OIL SPOT

Another stab at the 78’s was blocked this week as the upper Bollinger band lingers there to obscure the road up to the broader escape hatch at 89. Meanwhile the lower band (73.3) seems to be offering the recent 70 troughs some shielding but if they were broken anyway, there would be a bear flaggish effect pointing on down to 63.

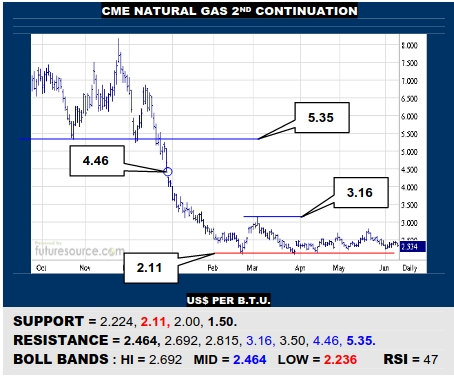

NYMEX NATURAL GAS 2ND CONTINUATION

Familiar events again early in Jun as Nat Gas has tried to steer north but is being held at bay by its mid band (2.464). An escape across there is the bare minimum needed to shift up a gear and restore a view of the low 2.80’s. Meantime the lower band (2.236) should guard the 2.11 troughs but don’t totally discount a delve on down to 1.50.

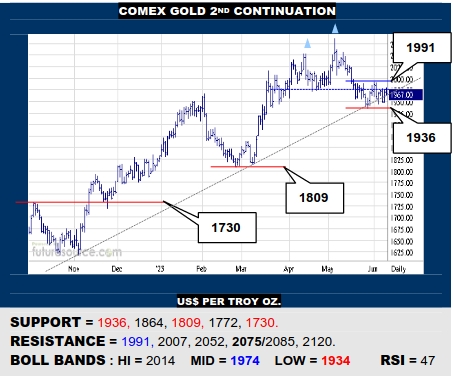

COMEX GOLD 2ND CONTINUATION

Sign of the times that Golds’ dual top has been punctured but it hasn’t rallied and its’ uptrend has frayed but it hasn’t fallen. So who is winning here? Can’t really say but it does raise the significance of the nearby range (1936-1991) because ultimately busting loose from it will give clearer resolution to aim at 2075 again or peel back to the low 1800’s.

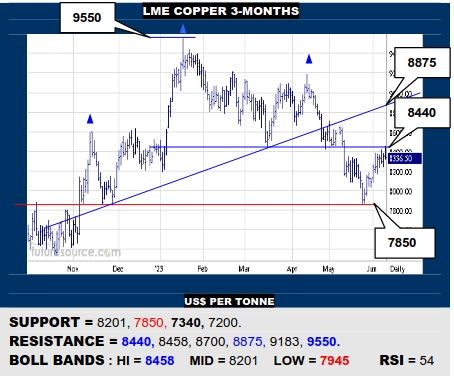

LME COPPER 3-MONTHS

While 7850 didn’t initially look that important, Copper has grappled back from it to challenge the broader 8440 resistance. This is the first serious test of the bounce. If able to bust clear while the Dollar was swatted below 103.4, look for a further stage up to 8875. If denied at 8440, then beware any reversal under the mid band (8201) attacking 7850 again.

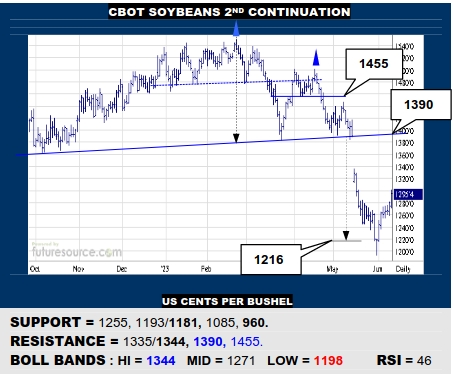

CBOT SOYBEANS 2ND CONTINUATION

Wrangling back over the mid band after previously reaching the H&S projection down to 1216 looks to expand the corrective path for Beans to the upper Bollinger band (1344) before becoming cautious again. If that band then began to veer higher itself, perhaps the 1390 neckline may also be possible but be prepared for the upper band to be a cap.

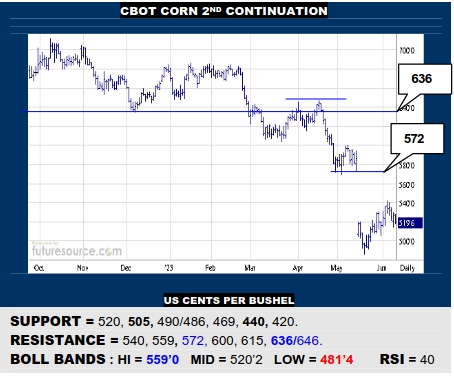

CBOT CORN 2ND CONTINUATION

Though popping its mid band, Corns’ revival has tailed off this week shy of the oncoming upper Bollinger (559). Friday showed signs of trying to pull up the socks again with an inside day but must pierce 530 to imply success and so still have a further shot towards 572. If instead the market swerved away through 505, beware a new leg down to 440.

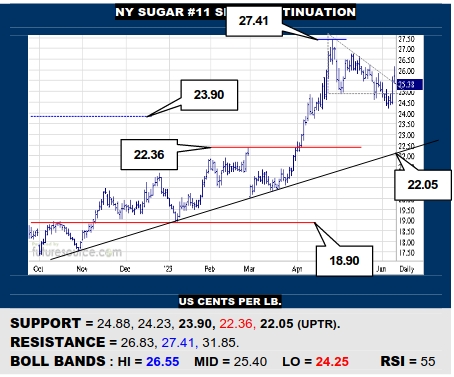

NY SUGAR #11 SPOT CONTINUATION

A Dollar wobble as it broke its mid band helped Sugar stay north of the 23.90 monthly pivot and it has stabbed back over its mid band but has not yet proven grip here. Must find a footing in the upper 25’s next week to dispel the triangle top and signal emerging from a correction then whereas delving back under 24.88 would warn of testing 23.90 still.

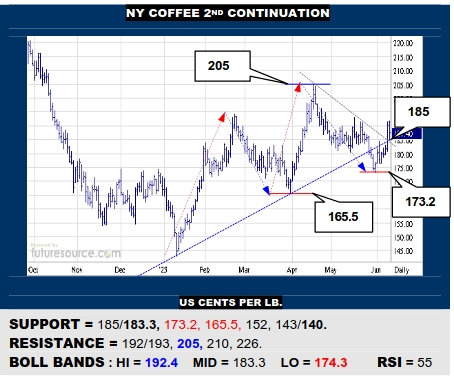

NY COFFEE 2ND CONTINUATION

Not adhering to optimal Fibonacci values but Coffees’ reflex back over 185 implies ending a 4th Elliot wave ready for a 5th wave higher. Must grip in the 185 to mid band (183.3) area to prove the upturn however if indeed a new rally is to potentially exceed 205. Otherwise swerving back under the mid band would speak to a much toppier design.

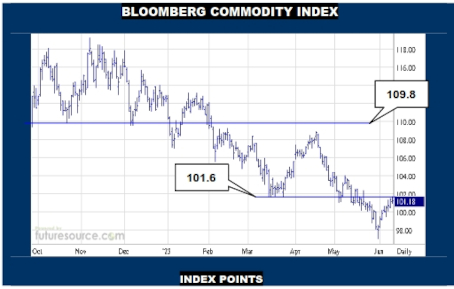

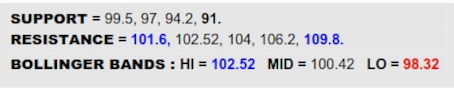

BLOOMBERG COMMODITY INDEX

An important litmus test for the B-Berg as it has reacted back up from 97 across its mid band but is now arriving at the preceding Mch lows of 101.6. If it can bust through there too, it would shore up the mid band crossing and make suggestion of late May being a false breakdown that could mark a more enduring conclusion to the decline that began a year ago, then watching the upper Bollinger band for a reaction higher to help prove the turnaround. On the other hand, if the commodity index was blunted at 101.6 for several days and the Dollar fought back into the 104’s, there would be growing concern of having just performed a correction and 99.5 would need monitoring as the tripwire back into trouble.

US DOLLAR INDEX

The fact is that the main range for the Dollar spans 100.8 to 105.6 (even 106 to include a 38.2% Fib retracement) so current action is clearly right in the center and not threatening any major next step. Even so, the greenback has broken its mid band to be teetering on the 103.4 trough just behind so it looks at risk of pulling together a small double top if that nearby brace were to succumb, which would at least temporarily put it back on the defensive with risk of pressing on to the 102.2 ledge and maybe involving 100.8. Otherwise it would seem to require an instant reflex back off 103.4 to prove a firmer footing than meets the eye and in that case insist a further push for 105.6 could be brewing.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.