Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

Only available in March, Free 2-week trial to TechCom’s daily Sugar Technical Review. Please just reply ‘Yes’ with your e-mail address here.

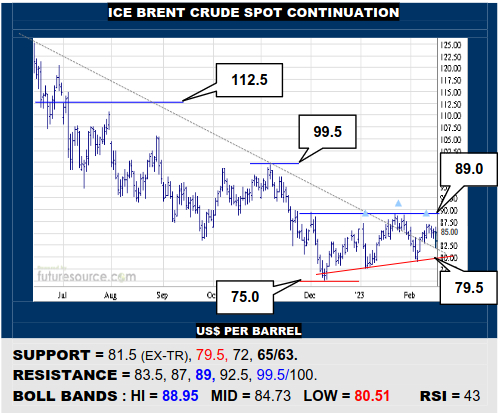

ICE BRENT CRUDE OIL SPOT CONTINUATION

A second emergence from its broader downtrend still didn’t catch light and Brent has faded back towards the ex-trend again this week (81.5). Alas, the greater concern is a neckline just behind (79.5) where a break could form a new H&S to end a corrective phase and press on through 75 towards 65. Must grip near 80 to keep recovery prospects alive.

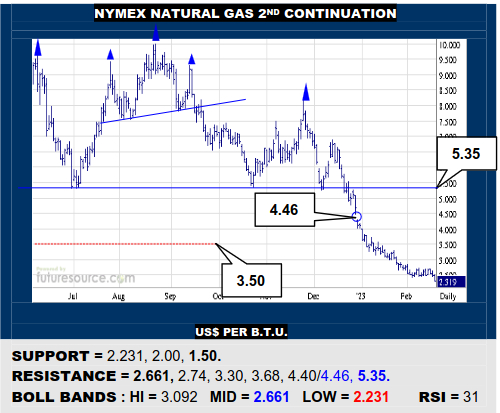

NYMEX NATURAL GAS 2ND CONTINUATION

Though leveling off in Feb and taking shots at scoring a turn, Nat Gas was always held at bay by its mid band (2.66) and tipped out of the 2.40’s Friday to resume south. Basically Feb seems to have merely provided some corrective respite then but the path to 1.50 still remains exposed, only a clean mid band vault giving sight of 3.50.

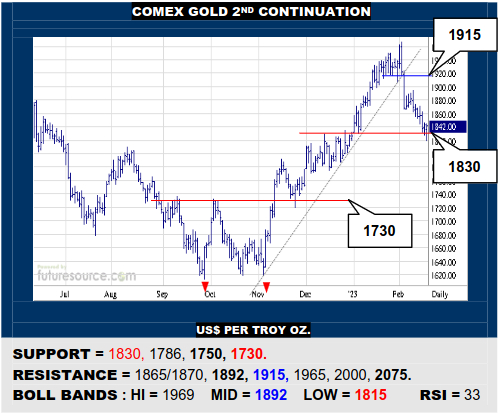

COMEX GOLD 2ND CONTINUATION

The Dollar retracing another 104’s prod helped Gold to retrieve a dunk under its 1830 support that is also a lesser 38.2% Fib retracement. Watching this closely then. If the Dollar truly flinched and the 1830 footing was secured, a reflex over 1870 would infer ending a correction. A clean break of 1830 however would point on down towards 1750.

LME COPPER 3-MONTHS

Nearing the bewitching hour in Copper as the uptrend pulls in ever closer underneath (8775), causing the market to flatten out into a nearby range. If Dollar fumbles became a downturn through 102.6, look for a vault of 9065 to hail the end of an early ’23 correction to crack the whip anew. If the trend snapped however, beware a broader retreat to 7850.

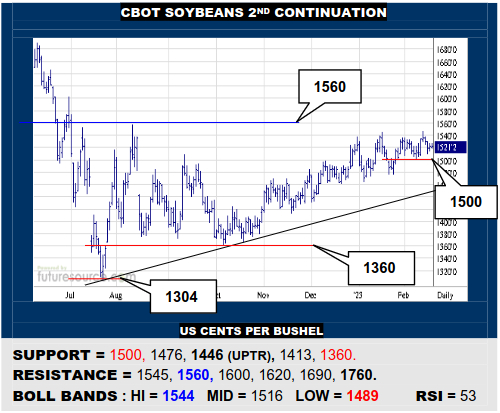

CBOT SOYBEANS 2ND CONTINUATION

Agonizingly tame progress and thus meek indicators in Beans but still the 1560 escape hatch is in view, with prospects to spark new zest and overhaul much of the 1600’s. Meanwhile 1500 has now become the pivotal prop underfoot and any swerve back beneath could finally pull out the rug to tumble away to attack the overall shallow uptrend (1446).

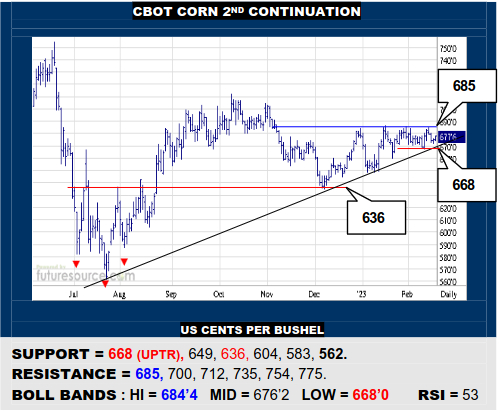

CBOT CORN 2ND CONTINUATION

Similarly lethargic in Corn but, despite many a 685 rebuke, it still hasn’t completely faltered, the overall uptrend just now drawing in next to the immediate 668 pivot. So popping 685 could inject new verve to make an escape over 712. On the other hand, breaking 668 could at last cause pent up longs to jump ship and attack the 636 base rim again.

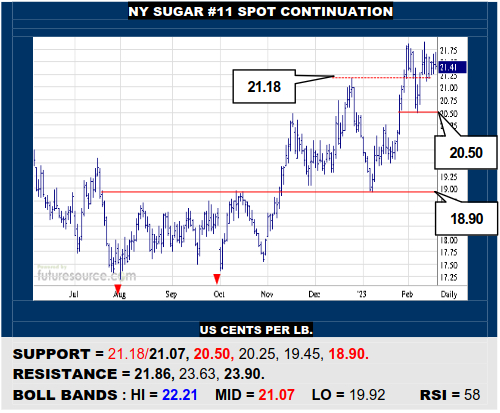

NY SUGAR #11 SPOT CONTINUATION

Sugar has stayed out ahead of its mid band (21.07) but must soon convert this into a clean breakaway across the 21.80’s to shake off a Feb correction and proceed on towards 23.90. Keenly minding the mid band meantime as a break and close below would undercut the climb and threaten a rapid delve back to 20.50 where a double top could form.

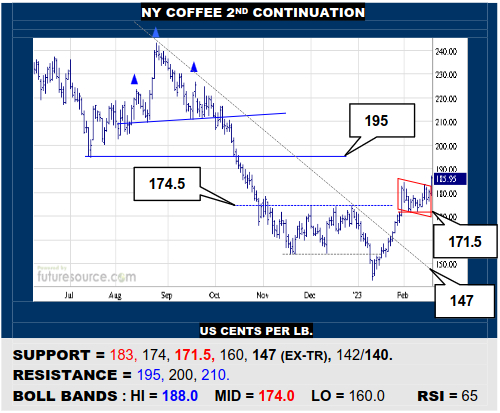

NY COFFEE 2ND CONTINUATION

Holding the 171’s early in Feb has finally delivered an implied bull flag breakout with successive breaks of 178.5 and 184. This targets a next goal of 195 with quite high hopes of breaking through to approach the heavier resistance of the 210+ H&S pattern. Only abruptly reeling back under 183 would dispute the flag and pose a new threat to 171.5.

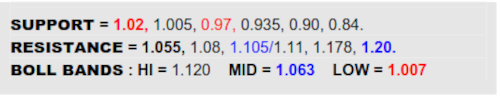

B-BERG / US DOLLAR RATIO

A weary finish to the week for the macro ratio but not as bad as it initially threatened to be, the 1.02 support hanging on by a thread. The warning light is still flashing of course and if 1.02 were to truly snap, more than three months of action would merge into a new top to pin the crosshairs back on the 0.97 Sep trough, ominous since the Dollar is still far shy of the 114’s it hit when that low in the ratio occurred. This polarizes the commodity decay that has taken place in the interim months and the new top height would technically propose to break 0.97 to reach 0.935. Must otherwise perform a rapid reshuffling to pop 1.055 here to signal pulling out of the malaise after a final failed dig.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary