Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

Only available in March, Free 2-week trial to TechCom’s daily Sugar Technical Review. Please just reply ‘Yes’ with your e-mail address here.

ICE BRENT CRUDE OIL SPOT WEEKLY

A murky Q1 for Brent as it has frayed the ’22 downtrend but will have to still pierce 89 to score a more decisive release back up to attack the 97 top border again and give the B-Berg vital new oxygen. Little room for maneuver meantime as 80 marks a tripwire to instead create a new nearby H&S that could reassert the downtrend and crack 75.

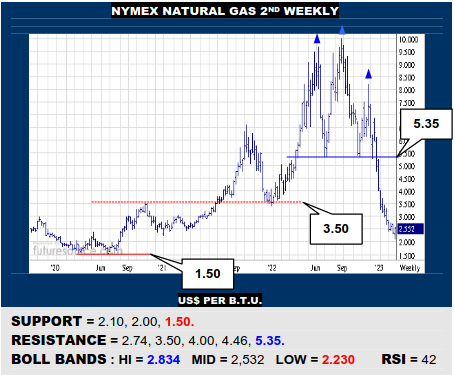

NYMEX NATURAL GAS 2ND WEEKLY

The fall from the large ’22 H&S above 5.35 has been cooling in Feb and Nat Gas showed more signs of rebellion this week, inching a break of its mid band Friday. If it can shore this up and soon pop 2.74, corrective scope to 3.50 and even the 4.40’s could aid in a B-Berg rescue. If the well faded at 2.74 though, still be open minded to a further slip to 1.50.

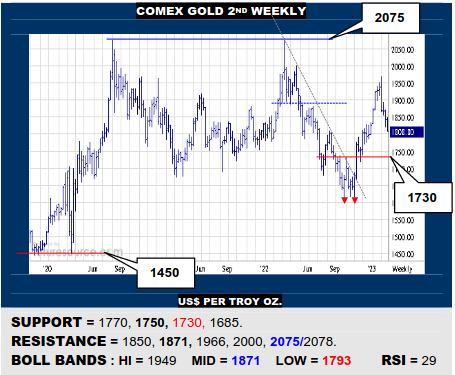

COMEX GOLD 2ND WEEKLY

Gnawing away its 1825 support, Gold is continuing its retreat opposite the reviving Dollar. Would thus now make room for a Fib retracement to 1750 and perhaps even brief tags of the 1730 base rim behind that. Must otherwise see the Dollar blunted at 105.6 to buoy ideas of a quicker catch here to try back up towards the mid band (1871).

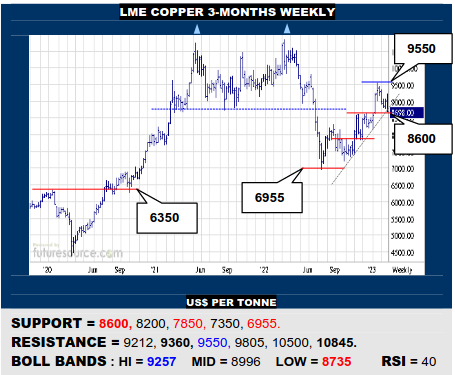

LME COPPER 3-MONTHS WEEKLY

An outside week lower has broken Coppers’ interim uptrend and pins the spotlight on the 8600 shelf. That looks the last chance to rein in this setback from the prior 9360 Fibonacci visit and get back on the upside track. If 8600 collapsed, it would signal the crest of a lengthy correction and further risk down to first 7850 and maybe even 6955 in due course.

CBOT SOYBEANS 2ND WEEKLY

Still Beans keep making rather toothless approaches to the 1560 top border from early ’22. The obvious lack of momentum duly warns to keep watch on 1500 as the immediate tripwire back to the 1460’s, by which point the overall uptrend could be drawing near (1435 now). Only a clean release over 1560 could finally inject some new vigor.

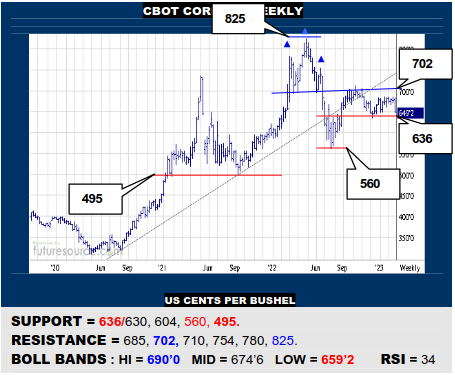

CBOT CORN 2ND WEEKLY

One too many rejections at 685 for Corn has finally taken a toll and it fell back harder this week towards the prior 636 base rim that held things up in Dec. This time down, those 630’s look vulnerable and breaking on through would open the door towards 560. Only another display of safe handling aboard 636 could rebuild faith of still trying 685 again.

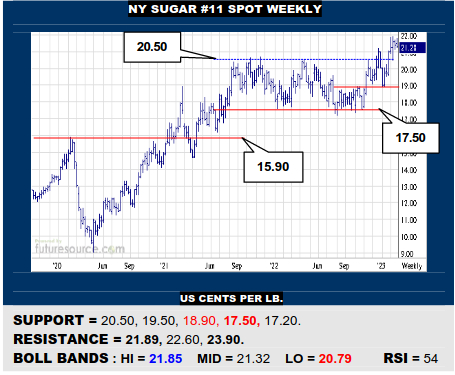

NY SUGAR #11 SPOT WEEKLY

Several stumbles at the 21.80’s in Feb and Sugar suffered an outside day lower to fray its mid band Friday. Facing a further 1½₵ drop as the baton passes to the May warns of being wrenched back into the former range and testing the 18.90 shelf. Hold there and the crisis could pass. Break 18.90 though and face a dice with the 17.50 cliff edge.

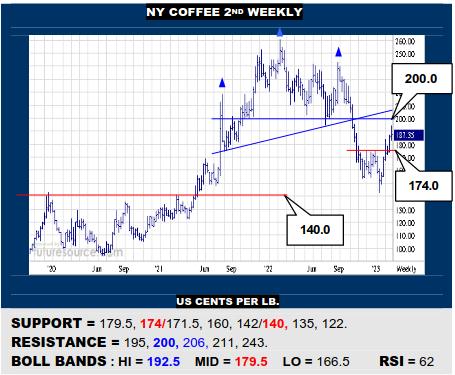

NY COFFEE 2ND WEEKLY

Coffee has staged a strong bounce off the 140 weekly base rim in ’23 and rallied much of the way back up to the large H&S looming above 200. Gains from here duly look a much tougher task with just some brief prods at the low 200’s foreseen. Meantime keep watch over 174/171.5 as a twist back under there could trigger a new dunk to the 140’s.

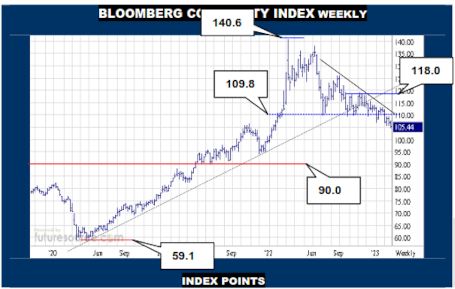

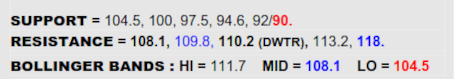

BLOOMBERG COMMODITY INDEX WEEKLY

While the B-Berg initially fought off a new year dive through 109.8, it couldn’t sustain that bounce and, though lacking for any really dramatic punishment, the commodity index has eased on down the hill as the Dollar has mounted a useful Feb recovery. The weekly chart duly then polarizes ’22 as an overall top that defeated the ‘20’s uptrend and with resistance now vividly outweighing support, the passage back to the next main shelf at 90, which is also the Fib retracement, inevitably seems to beckon. It would alternatively take a quick smothering of the Dollars’ revival and a hike back across 109.8 as the mid term downtrend intersects there to patch things up here.

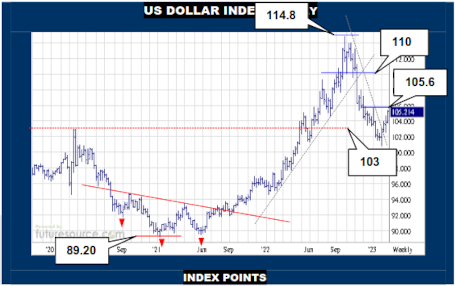

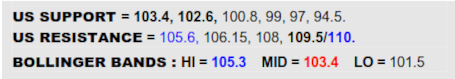

US DOLLAR INDEX WEEKLY

Feb has seen a resurgence of the Fed hike / inflation fears to release the Dollar from an extensive Oct-Jan downtrend and, despite the odd wobble in the 104’s, it is now dialing in its sights on the 105.6 pivot. If it can break beyond that and, just for reassurance purposes a 106.15 lesser Fib retracement figure, it would appear to get out into some bluer skies with little then barring the way until the main 61.8% retracement (109.5) that comes just before the 110 top frontier, a voyage that could meantime see the B-Berg much of the way down to 90. Would really need to see an imminent stumble in the 105.6 vicinity to raise doubts here that might give commodities hope still.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary