Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

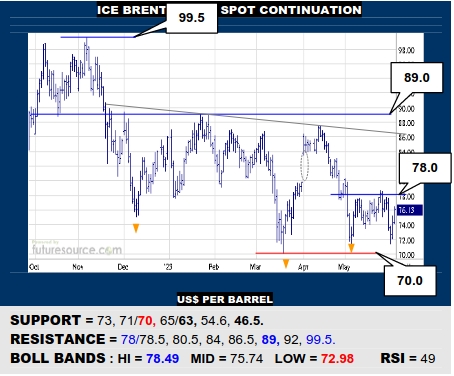

ICE BRENT CRUDE OIL SPOT

Several low 70’s catches since Mch have narrowed the Bollinger bands corridor (78.5-73) and hint at a pending flashpoint. With the upper band poised to swerve higher, escape across the 78’s would significantly boost the broader base candidacy, even if 89 is the final exit. The 70 brace looks better protected but does still guard a hole down to 63.

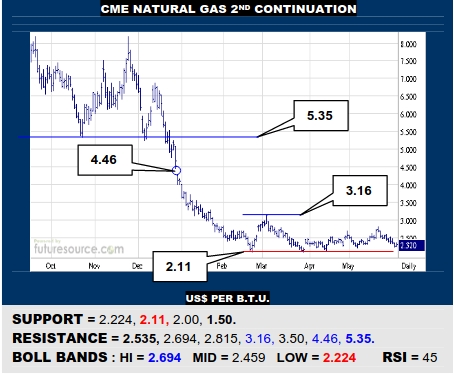

NYMEX NATURAL GAS 2ND CONTINUATION

Efforts to build ’23 into a saucer base have fumbled in the upper 2’s but the lower Bollinger band is still shielding the 2.11 support so, while not zero, the risk of gouging through towards 1.50 looks slim. Duly watching 2.535 as a pivot just beyond the mid band to trigger yet another try higher, which must ultimately carry 3.16 to really stick.

COMEX GOLD 2ND CONTINUATION

Is the uptrend (1949) or a newly implied Q2 double top winning? If the recent trend catch could fuel a lunge over the mid band (1991) into the 2K’s again, indeed the uptrend would get the nod and yet another try for 2075 might finally pop the lid. Alas, while blunted by the mid band, don’t totally trust the trend, its’ demise threatening a dunk down to 1864 next.

LME COPPER 3-MONTHS

Copper has jabbed back over its mid band into the vicinity of the main 8440 frontier marking much of the H&S top. That is still a crucial vault to make if this recovery is to graduate from corrective to something more offensive. If the Dollar largely held the 103’s and values tailed off shy of 8440 here, beware a new snap down to attack 7850 once more.

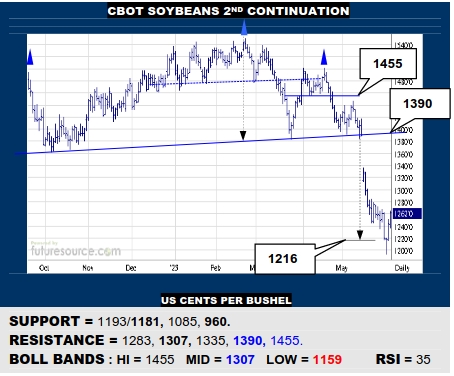

CBOT SOYBEANS 2ND CONTINUATION

A late overreach lower to the 1216 H&S projection almost hit the next monthly trough at 1181 before seeming to exhaust. Using the mid band now (1307) as a guide for what is likely to happen next. Pop it and there would be further scope to 1330 and maybe even the upper 1300’s. Fail at it and a correction could end and turn sights onto 1193/1181 again.

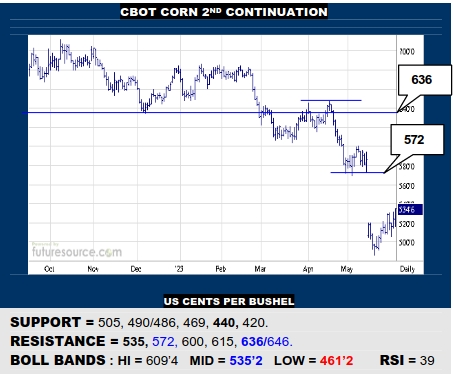

CBOT CORN 2ND CONTINUATION

Corn has taken a breath in the past fortnight to edge back up towards its oncoming mid band (535). If it could bust through there while seeing the B-Berg punch clear of 101.6, this bounce could even gather steam and have a shot into the 570 area before probably then fading. If halted by the mid band, beware a further delve towards 440 monthly support.

NY SUGAR #11 SPOT CONTINUATION

Breaking 24.88 support is rendering a triangle top on Sugar that warns of a further 2½₵ of downside risk through the 23.90 monthly pivot back to the 22.36 shelf that has the shallow uptrend drawing in behind. Only a harder hit knocking the Dollar out of the 103’s might offer more traction here but it would take a mid band vault (25.73) to really turn north again.

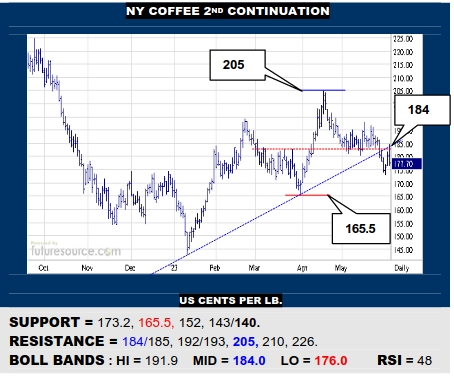

NY COFFEE 2ND CONTINUATION

Soon after the demise of the 182’s support and uptrend, Coffee was still allowed a breath late this week but it has been brusquely intercepted by the mid band and ex-uptrend (184) and turned lower again Friday. This looks like a failed rescue attempt so watch 173 as a tripwire on down to the 165’s. Only piercing 185 would pull off a more reliable retrieval here.

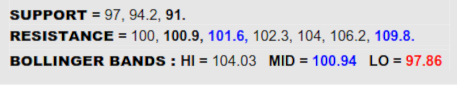

BLOOMBERG COMMODITY INDEX

Pulling the debt ceiling crisis together served to take some sting from the Dollar and has helped the B-Berg stage a bounce back to the 100 doorstep. What lies just beyond 100 however is what should better determine the value of this reaction. If able to dispatch the mid band (100.9) and vault the preceding Mch lows at 101.6 while seeing the Dollar at least swatted back beneath its mid band, there would be a sense of retrieving a false breakdown and suddenly a much brighter shaft of light would enter the tunnel with the broader barrier up at 109.8 coming back into view. Alas, if blocked by 101.6, it would be premature to deem the bounce anymore than corrective and the lower 90’s would keep calling.

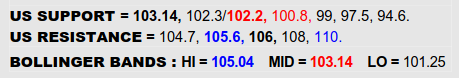

US DOLLAR INDEX

A vague accord in D.C. took the edge off the Dollars’ swell and it has ducked back towards its mid band (103.14). If the slip was swiftly gathered up there, it would suggest just a quick corrective twitch resulting from the debt crisis resolution but an underlying drive still that would keep 105.6/106 in the spotlight as a next major threshold where shedding the yearlong downtrend could evolve into a six month double bottom to pave the way on to 110. However, if the mid band succumbed, look for this dip to press back to the 102.2 shelf, the final chance to pull up on the stick again rather than face a continued gouge on into new depths under 100.8.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.