Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

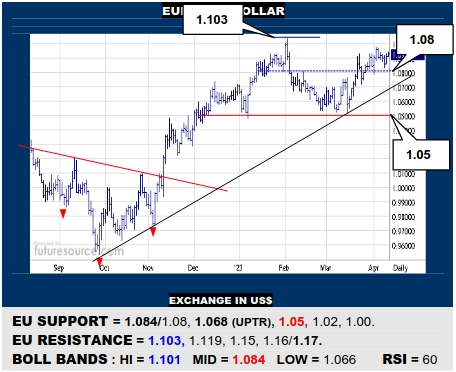

EURO / US DOLLAR

Mondays’ dip was retrieved by the mid band (1.084) as the EU keeps trying to reach the prior Feb apex at 1.103, seeking to pry open a next leg higher to 1.17. Clearly progress isn’t coming easily though and ADX is still idling in the teens so would continue minding the mid band to 1.08 niche for any stumble to turn focus onto the uptrend (1.068).

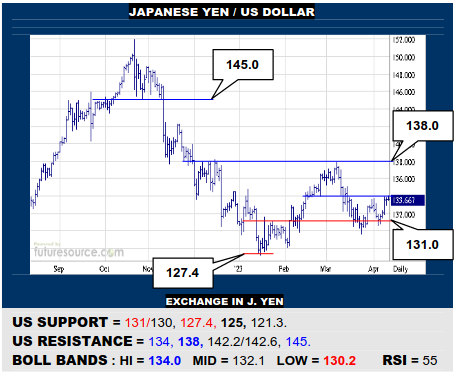

JAPANESE YEN / US DOLLAR

A small Jan base under 131 has warded off dips and the US is now bidding to pull together something similar sitting aboard it by breaking clear of 134, then raising sights onto 138 in search of a bigger and more effective base. Only several denials at 134 and falling out of the 130’s would reverse course and threaten a delve through to 125.

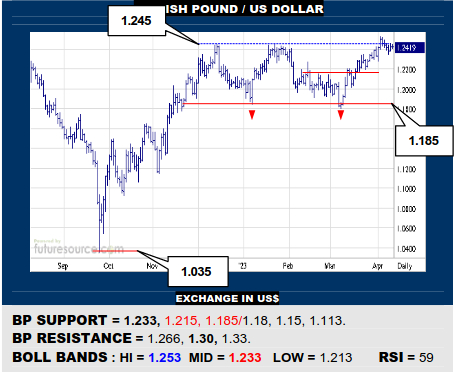

BRITISH POUND / US DOLLAR

An initial lunge over 1.245 failed to stick but the BP has stayed ahead of its oncoming mid band (1.233) and so still looks capable of making the 1.245 getaway to confirm a new base and reassure implied intent to push on up to 1.30. Only ripping back through the mid band would more seriously undercut this effort and warn of testing 1.215 support.

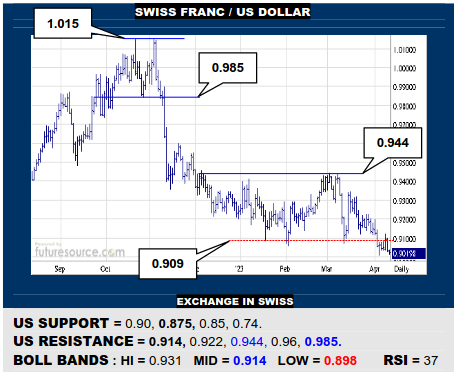

SWISS FRANC / US DOLLAR

The US has failed to retrieve the recent erosion of the 0.909 support, which has meanwhile breached a massive decade long uptrend. Wary of a bear flag now forming by cracking 0.90 to confirm the trend derailment and point down to attack 0.875, open air below. Only a jog back over the mid band (0.914) would suggest a clutch catch.

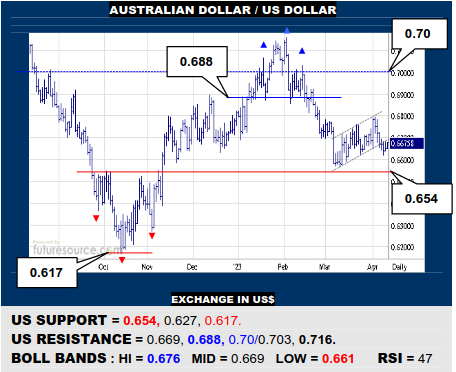

AUSTRALIAN DOLLAR / US DOLLAR

Though seeming to slip out of a Mch rising channel, the AD hasn’t suffered any serious repercussions so the former Q4 inverse H&S rim at 0.654 remains unscathed. That would have to succumb to hail a definitive breakdown and threaten a gouge into the 0.50’s. Meantime grappling back over the mid band (0.669) could restore some grip.

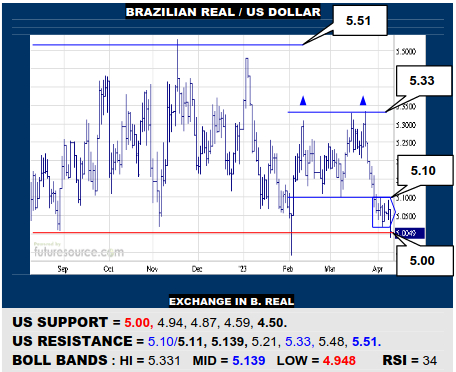

BRAZILIAN REAL / US DOLLAR

A bear pennant formed below the Feb-Mch double top is threatening to disrupt the pivotal 5.00 floor and so develop a much larger top. If that panned out, beware hastening losses to an initial 4.87 projection but with risk towards the decade long uptrend in due course (4.50). The US must reflex back over 5.11 to make any useful repairs here.

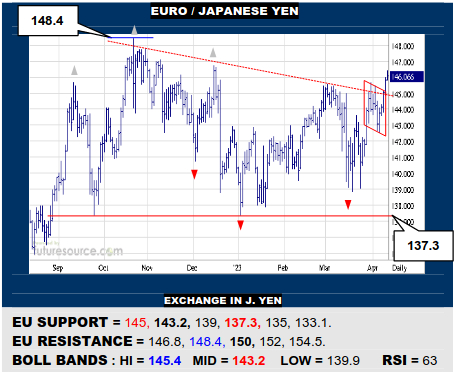

EURO / JAPANESE YEN

A drive across the 145’s is provisionally claiming a large new inverse H&S for the EU. If confirmed by holding 145 during any nearby dips, this pattern initially points to 148.4 but its full depth projection targets 154.5. Only reeling back under 145 would undermine this seemingly key step up and twist focus back onto the mid band (143.2).

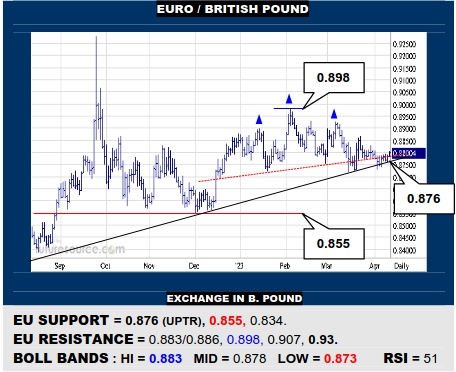

EURO / BRITISH POUND

Still no clear decision between the Q1 H&S and the shallow uptrend. A thrust to actually grip beyond 0.886 would dispel the H&S and win it for the trend, the EU then poised for a new foray into the 0.90’s. That trend is very close at hand though (0.876) and a swat back below would instead err for the H&S and a new attack on 0.855.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.