For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

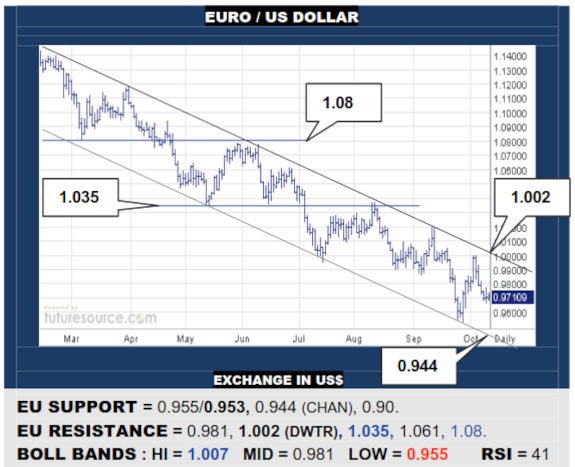

EURO / US DOLLAR

The EU’s late Sep bounce failed shy of the main downtrend and it has faded back towards the 0.95’s. How it fares there should be telling as the lower Bollinger band has arrived (0.955). A second catch would imply basing tendencies to keep the downtrend in play (1.002). Alas, breaking 0.953 would warn of a test of the channel floor (0.944).

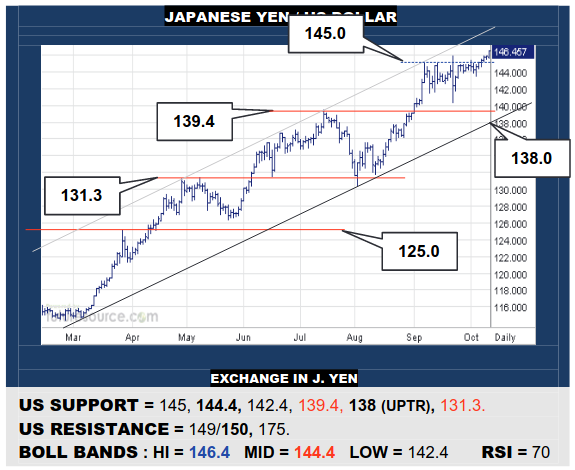

JAPANESE YEN / US DOLLAR

The mid band gave the US renewed drive and it has overcome the 145’s to cast Sep as a modest new base within the broader advance that projects to the 149’s where a channel ceiling is now arriving. So 150 becomes the next main obstacle while only a backlash through that mid band (144.4) would upend this effort and turn back to 139.4.

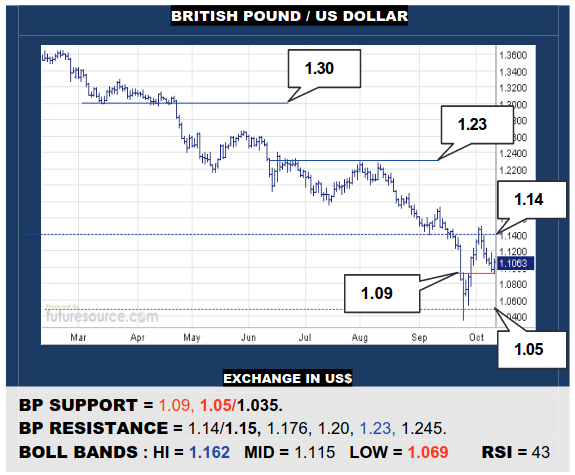

BRITISH POUND / US DOLLAR

The BP’s rebound from the 1.03’s flinched at the preceding 1.14 post Brexit low but losses since have been more controlled. Duly watching a small 1.09 ledge for clues. Its demise would warn of further scrutiny of the 1.05-1.035 long term lows, untold depths below. A chance to try 1.14/1.15 again meanwhile as a potential gateway back up to 1.23.

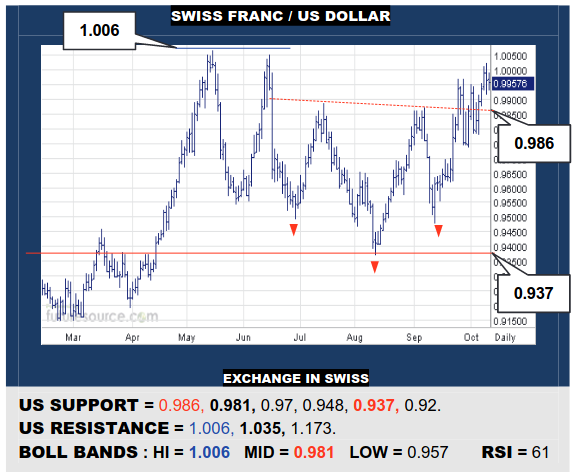

SWISS FRANC / US DOLLAR

A thrashy fortnight first but the US has pushed out across the 0.98’s to re-stake its claim to a hefty summer inverse H&S. This duly pins focus on the 1.006 May apex with an eye through there to a base projection at 1.035, the next main monthly barrier. Only a twist back under 0.986 and the mid band (0.981) would dissolve the base and turn the tide.

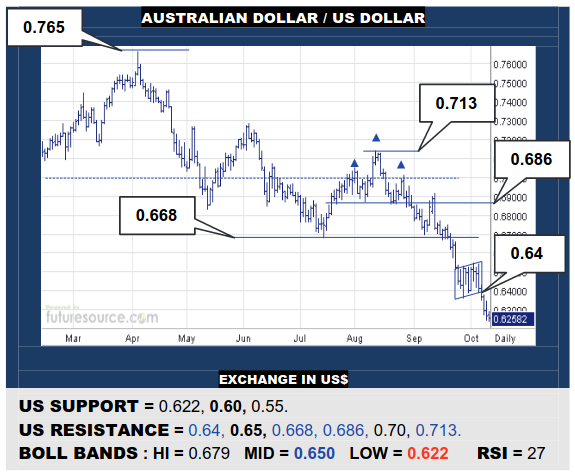

AUSTRALIAN DOLLAR / US DOLLAR

The AD couldn’t sustain the 0.64’s ranging and it has collapsed into a bear flag, threatening further losses to the 0.60 area and maybe even access to a ’20 trough at 0.55. Only a reflex back over 0.64 would dispute the flag and hint of a false breakdown, then seeking a vault of the mid band (0.65) to confirm and turn attention up to 0.668 again.

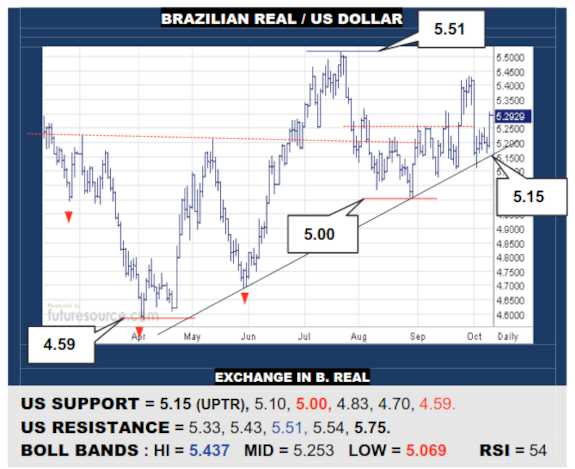

BRAZILIAN REAL / US DOLLAR

An initial Q4 flinch has been steadied by the arriving uptrend, jogging the US back into forward gears and still keeping the first half inverse H&S relevant. This preserves the view of the 5.51 Jly peak as a trigger on up to the ’20 high at 6.00. No more chances for stumbles though and any backlash through the trend (5.15) would likely go on to exit the 5’s.

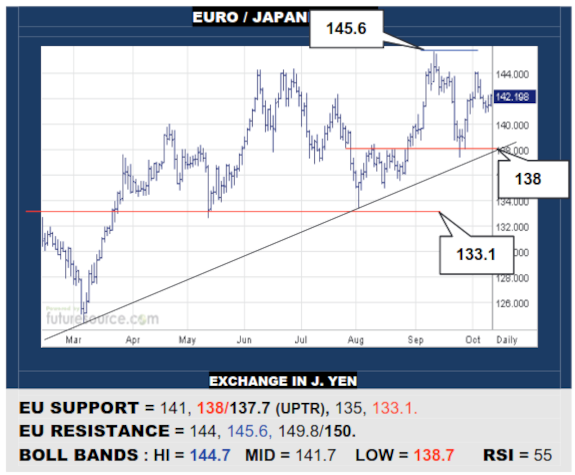

EURO / JAPANESE YEN

The mid 140’s remain a stumbling block but the EU has weathered a little mid band fraying of late. If it could duly pull up to pop 144, early Oct would assume a flaggish shape and buoy chances to overcome 145.6. Watch 141 as an important nearby pivot though, any break below liable to reel back to attack the key 138 uptrend support.

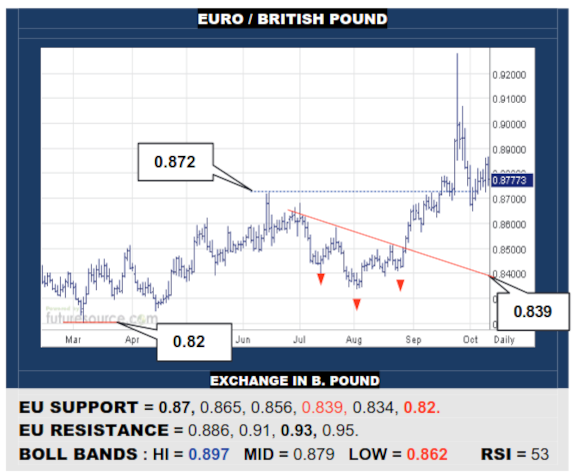

EURO / BRITISH POUND

The EU has stemmed the backlash from 0.93 in the 0.87’s but efforts to resume higher are looking more lethargic. Duly wary of a bear flag risk so being ousted from the 0.87’s would warn of a next leg south on back to the inverse H&S neckline (0.839). Otherwise needing to defeat 0.886 to instill new impetus into the 0.9’s again.