Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

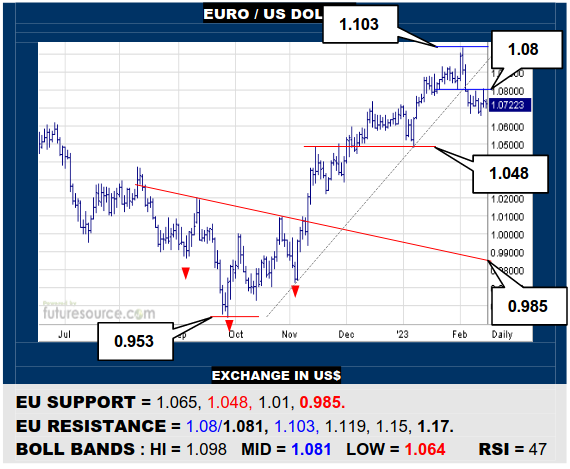

EURO / US DOLLAR

The EU has remained pinned under 1.08 and thus also the mid band since it broke its uptrend and this maintains risk of a bear flag forming so watch 1.065 as the tripwire from there down to 1.048 and even on back to 1:1 in due course. Only a decisive lunge back into the 1.08’s would ease the strain and present a chance to stabilize up here again.

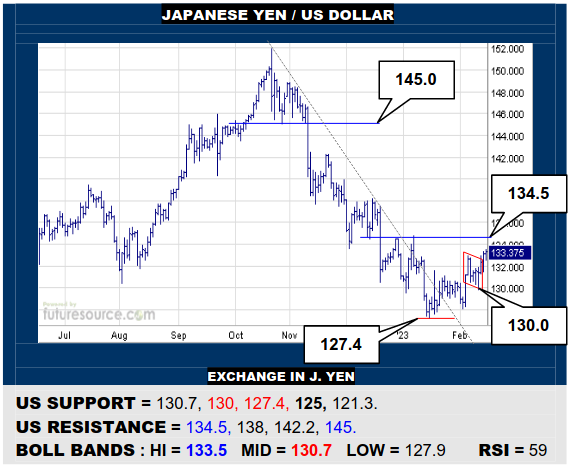

JAPANESE YEN / US DOLLAR

The US is steadily making progress after its downtrend escape with the 134.5 resistance next in the sights to open up more extensive terrain towards 145. Only getting into difficulties in the face of 134.5 and swerving back below 130 would take a serious bite out of this revival and reintroduce the risk of pressing on south to 125.

BRITISH POUND / US DOLLAR

The BP’s recovery effort has been curbed by the mid band (1.224) and so the past fortnight is showing bear flaggish traits. Duly beware any ousting from the 1.20’s as this could soon snowball into a break of 1.185 to resolve a 6₵ double top aimed down to at least 1.144. Only vaulting the mid band would otherwise truly bring 1.245 back into play.

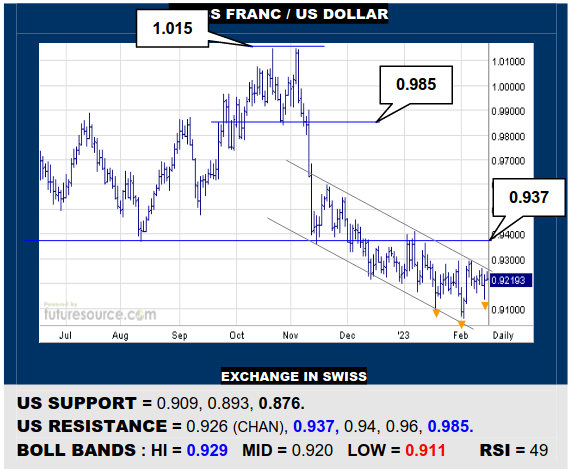

SWISS FRANC / US DOLLAR

It is proving hard work but the US keeps returning its attention to the ceiling of the interim channel (0.926) as the past month shows inverse H&S basing qualities. Popping the channel could thus stir a run at the main 0.937 top border to maybe open the door towards 0.985. It will take a clean snap of 0.909 to instead turn focus south again.

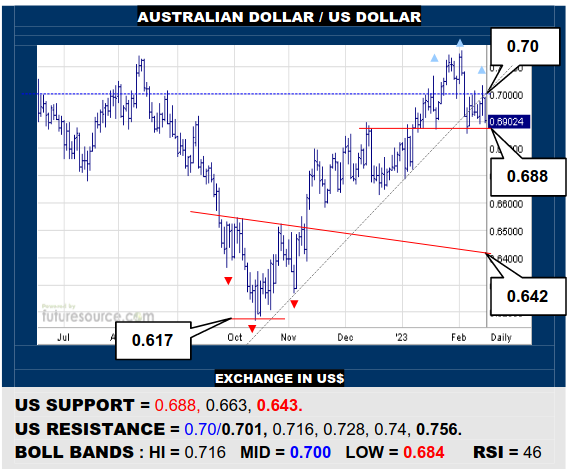

AUSTRALIAN DOLLAR / US DOLLAR

The AD has eroded away its uptrend and being pinned under 0.70 is giving early Feb an increasingly bear flaggish vibe while also creating risk of ’23 becoming a new H&S top if 0.688 gave way, in which case beware dropping away to the 0.64’s. Simply must overhaul 0.70 and secure grip in order to patch up the recent damage inflicted.

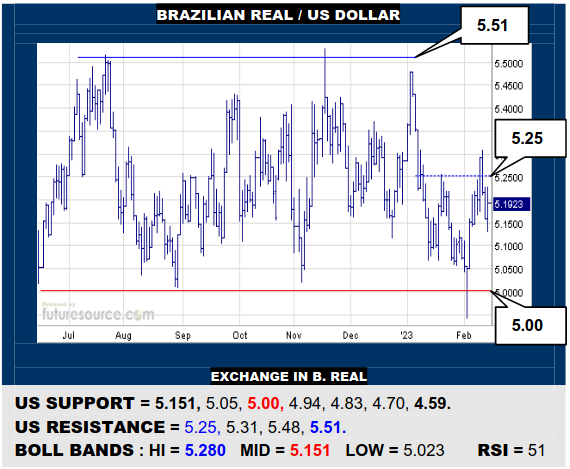

BRAZILIAN REAL / US DOLLAR

Still very volatile but the nearby US dip is currently being contained by the mid band (5.15) so a new lunge beyond 5.25 would buoy ideas of a scruffy looking flag emerging and raising scope towards the 5.51 peaks again. Only a clean snap below the mid band would dilute flag chances and return attentions to the main 5.00 figure brace.

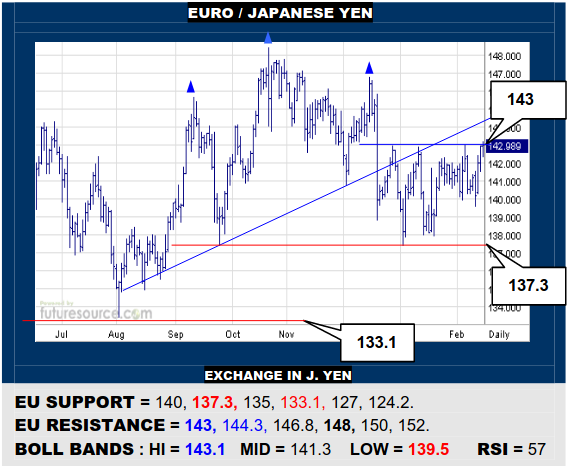

EURO / JAPANESE YEN

Gritting the teeth at 140, the EU is attacking the 143 resistance for the umpteenth time in search of a new two month base, a break liable to give it a jolt towards 148, even if not looking any further as yet. Only yet another 143 refusal and being ousted from the 140’s would tip the balance towards forming a larger top by breaking 137.3.

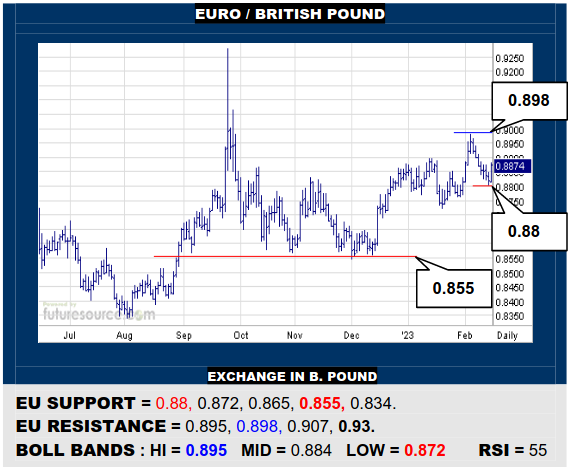

EURO / BRITISH POUND

The usual scruffy mess but the EU looks to be steering up out of a correction. The quest to reach the 0.90’s duly resumes, where the shackles could come off and a flurry to the 0.93 vicinity could then be triggered. Only breaking 0.88 would disprove the suggestion of relief from a correction and access the lower Bollinger band (0.872).

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.