Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

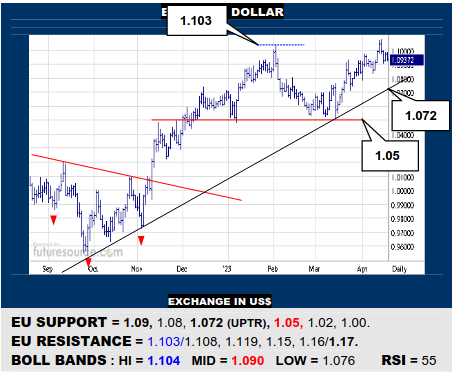

EURO / US DOLLAR

A glimpse over 1.103 was immediately undone by an outside day late last week and the EU’s balance on its mid band looks frail (1.09). If it broke beneath, beware a further slip to a pivotal uptrend test (1.072) where the ’23 landscape could really start to tip. Needing to dig in at the mid band to reassure the advance and try beyond 1.103 again.

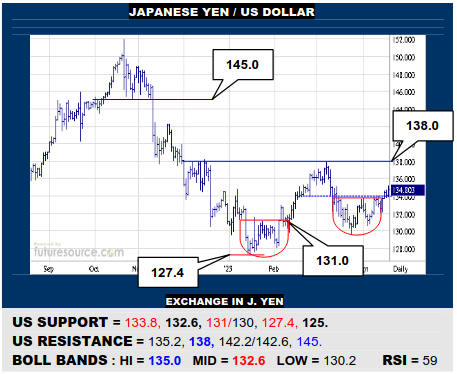

JAPANESE YEN / US DOLLAR

Pulling up over 134 departs a month of base-like action that is sitting on a previous similar pattern so the US appears to have scope to challenge 138 where a much bigger and more influential base might be possible. Only tentative moves though so keep minding the mid band (132.6) as the stumbling block to instead veer out of the 130’s.

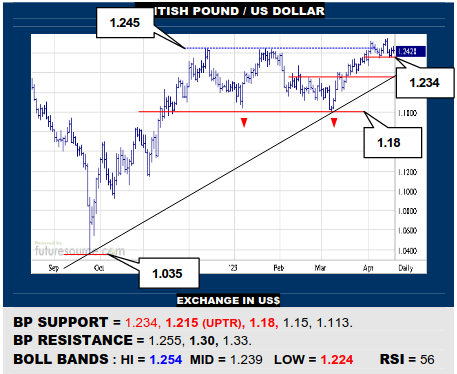

BRITISH POUND / US DOLLAR

Getaway attempts beyond 1.245 have been stumbling in April and so a nearby 1.234 ledge needs careful monitoring as the tripwire for a small H&S that would confirm the mid bands’ erosion and turn focus onto the 1.215 uptrend prop where things could really start to unravel. Must hang on at 1.234 to preserve the chance to revive the advance.

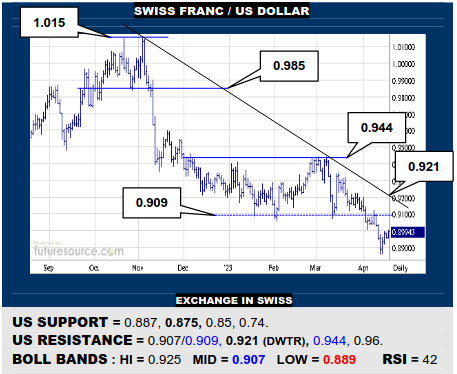

SWISS FRANC / US DOLLAR

The US is trying to fight back from an April break of 0.909 but must resurface over that level to really alter the context and start viewing it as a false breakdown that could then endanger the downtrend (0.921). If the swell fizzled shy of 0.909 it would fail to shift out of corrective gear and the deep canyon under 0.875 could still be vulnerable.

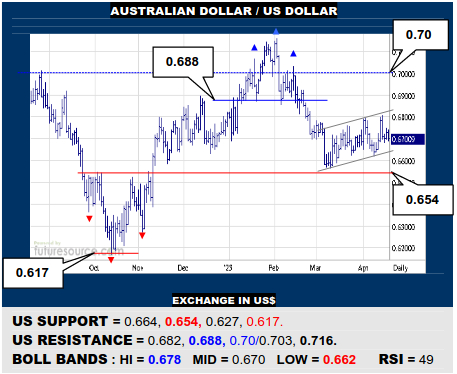

AUSTRALIAN DOLLAR / US DOLLAR

A succession of brief jabs higher by the AD have continued to falter well shy of the 0.688 early ’23 H&S rim so the action doesn’t feel very assertive, its channel-like nature seeming more corrective. Must vault 0.688 to make an impact then while otherwise leery of the channel succumbing and a break of 0.654 delivering a harder swat to 0.617.

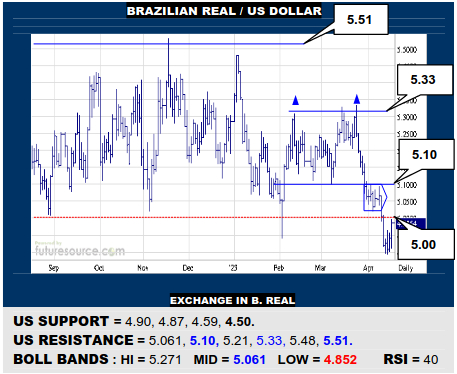

BRAZILIAN REAL / US DOLLAR

A break under 5.00 has shaped out a much larger top but the US is trying to fight back. Alas, aside from just returning to the 5’s, it must go on and pierce the 5.10 rim of a nearer term dual top to make a more reliable impact that could offer a real footing. Merely prodding the low 5’s would otherwise leave the path down to the 4.50’s exposed.

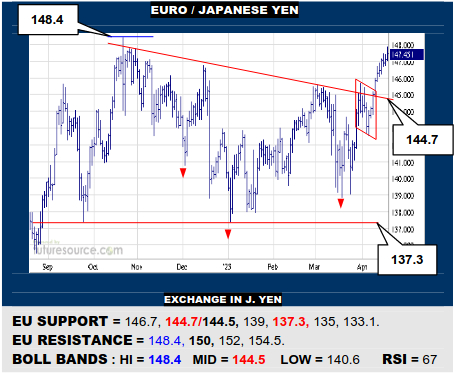

EURO / JAPANESE YEN

The EU has escaped a large inverse H&S and is tracking towards the 148.4 peak from last Oct. A rather pigeon step climb however and all the gains of the past month still haven’t interested the ADX so, while the base projects to 154, do be cautious of any flinch near 148.4, then watching 146.7 as a tripwire back to the 144.7 base neckline.

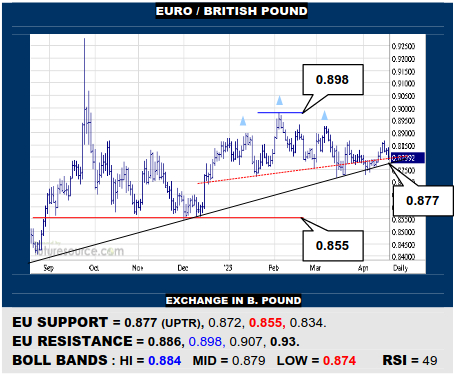

EURO / BRITISH POUND

Some gnawing at the H&S top failed to convert into a clean 0.886 break and the EU is slipping back into the clutches of the shallow uptrend (0.877). An actual trend break would accordingly reinstate the H&S and threaten a retreat to the key 0.855 defenses. Only a decisive lunge across 0.886 would suggest a new 0.90’s invasion.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.