For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

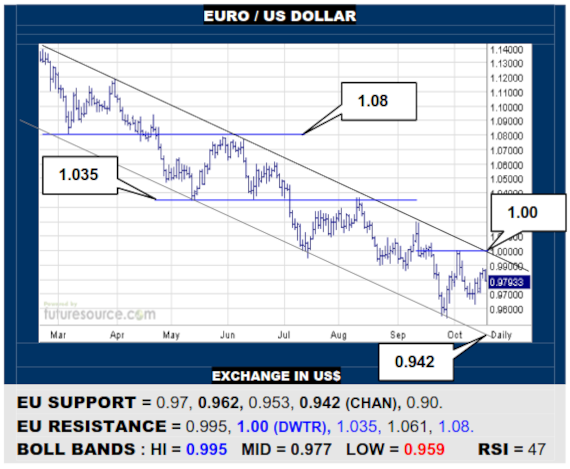

EURO / US DOLLAR

The EU has clawed back from the 0.96’s but the early Oct peak and now whereabouts of the main downtrend insist that an escape into the 1’s is necessary to truly alter the landscape here. Meantime early Q4 still only qualifies as corrective relief for now so watch 0.962 as a tripwire for a next flurry south to the overall channel floor (0.942).

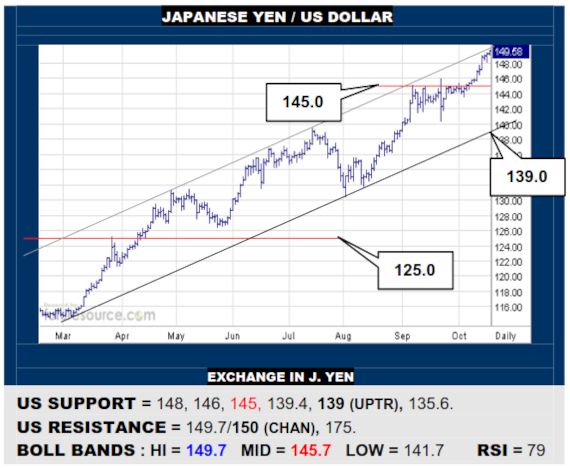

JAPANESE YEN / US DOLLAR

Finally shaking off the 145 restraint, the US has hustled on up to the 149.5 mini-base projection, bringing it close to the overall channel ceiling again now reaching 150. This is the logical place to exhale temporarily so keep watch on 148 as a trigger for a correction to 146. However, if able to blast through 150, there’s little else to block.

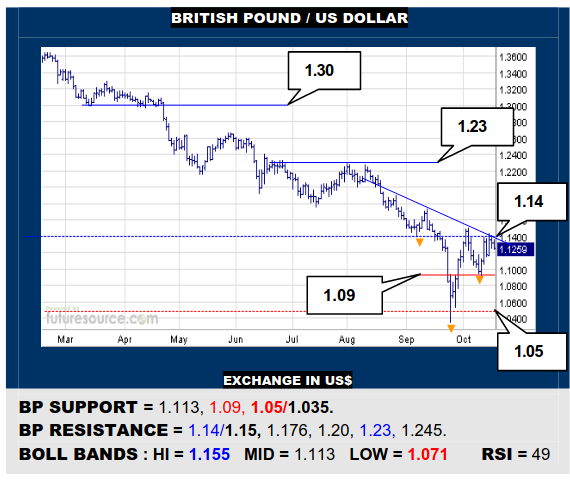

BRITISH POUND / US DOLLAR

“But the fever’s gonna catch you when the Boris gets back??” The BP is dueling with the 1.14/1.15 post Brexit low again and this looks like a pivotal hurdle. Resurface above and an inverse H&S would hail a better turn and scope on up to 1.23. Falter at 1.15 though and the fire could go out, then eying 1.09 as the trapdoor back to 1.05/1.035.

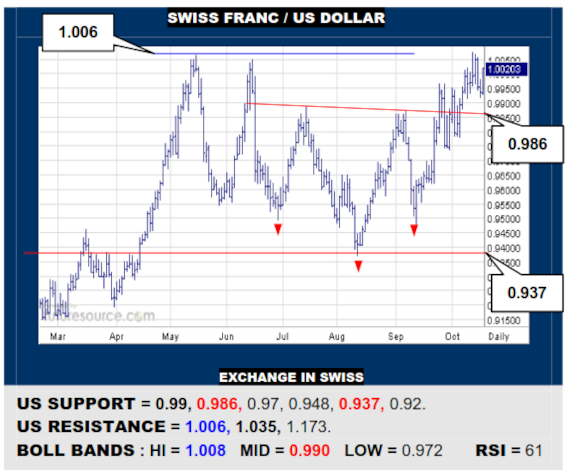

SWISS FRANC / US DOLLAR

The 1.006 Q2 peaks have initially warded off the US rally from the inverse H&S base but it has contained a nearby dip above the mid band (0.99) and so has a chance to try again, seeking to bust through to 1.035. Only slipping back below the mid band would more seriously undercut to put the base neckline itself in jeopardy (0.986).

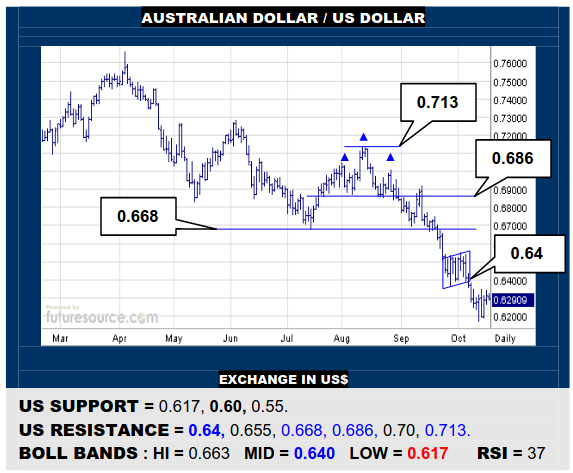

AUSTRALIAN DOLLAR / US DOLLAR

The AD has tamed the prior breakdown from a bear flag but must still react back over 0.64 to disrupt both flag and mid band, whereupon it might derive more pep to reach on up to 0.668. Alas, if only able to tread water beneath 0.64 temporarily, beware a second bear flag and an ongoing step down to first 0.60 but later even towards 0.55.

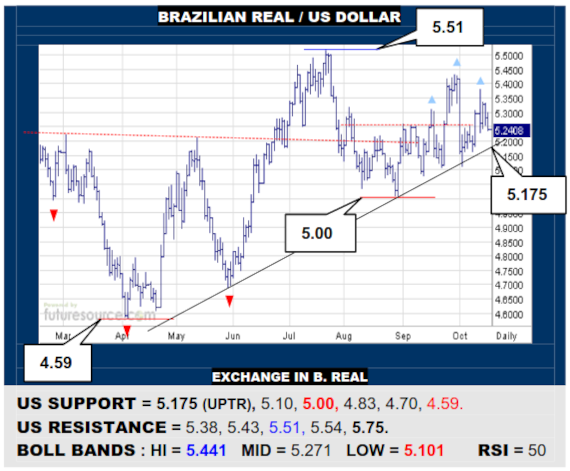

BRAZILIAN REAL / US DOLLAR

Very turbulent air means the US still hasn’t pulled away decisively from the large first half inverse H&S. That keeps the spotlight on the midyear uptrend (5.175). Still mulling the chance for it to rejuvenate the advance but keenly aware that if it failed to hold up, the past month or so could then evolve into an upright H&S to quickly lay siege to the 5.00 figure.

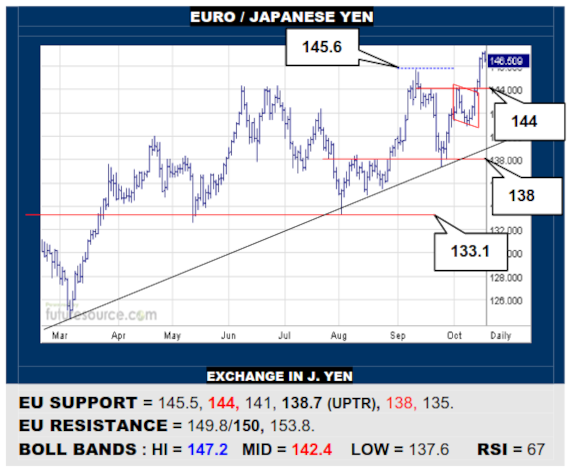

EURO / JAPANESE YEN

After a flaggish sort of early Oct dip, the EU has sprinted to new highs over 145.6. If optimally able to consolidate this effort above 145.5, it would keep the fire burning for further near term gains to 150 but could even cope with slightly deeper delves as long as 144 remained intact. Only reversing through there would hint at a false breakout.

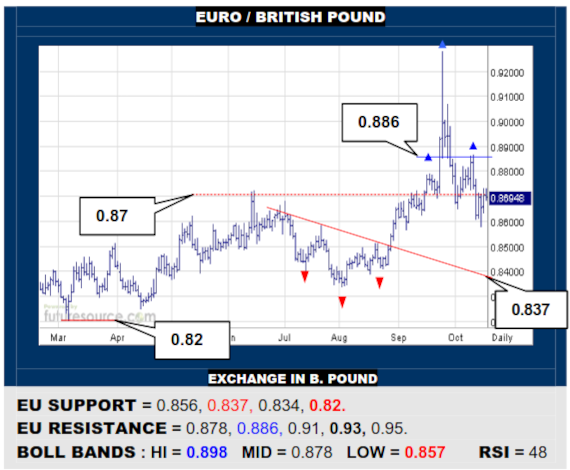

EURO / BRITISH POUND

The usual scrappy action but, with tannins of H&S and bear flags, the EU is looking quite fragile. It must jolt back over 0.886 to change this, then shedding any toppy impression and getting a fresh look at 0.93. Meantime beware failure in the face of the mid band (0.878) could warn of a next lash south towards a prior 0.837 base neckline.