Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

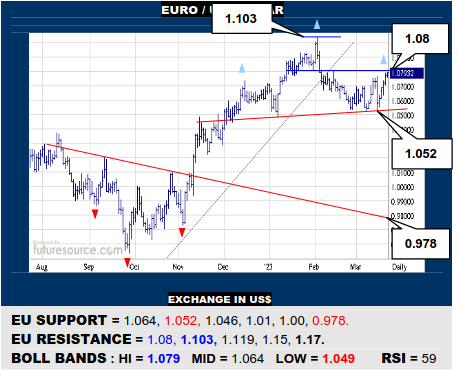

EURO / US DOLLAR

Another rebound from the low 1.05’s has headed off the H&S top risk but the EU needs to cleanly exceed 1.08 while the Dollar index broke 102.6 to underscore the turn higher here and take aim at 1.103 and even start eying 1.17 beyond. Meantime any twist back under the mid band (1.064) could quickly revive the H&S danger at 1.052.

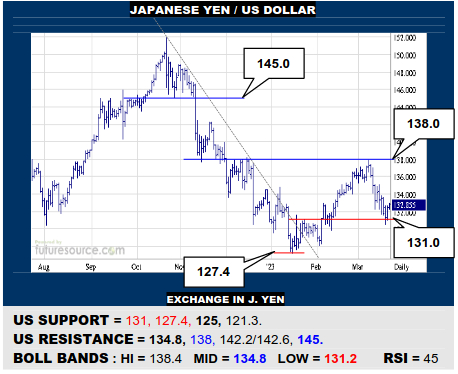

JAPANESE YEN / US DOLLAR

The mini-base rim at 131 has parried an initial attack but the US would have to react back over the mid band (134.8) to confirm that defence and retrain focus on 138 as an exit from a broader inverse H&S to expand sights up to 145. Otherwise any clean break of 131 would dull basing ideas and take aim at the 127.4 trough again.

BRITISH POUND / US DOLLAR

The nearby ex-downtrend scooped up a BP dip back to 1.20 and the subsequent break of 1.215 gives more of a base-like feel to the past months’ muddle while setting sights on 1.245 as a gateway to 1.30. However, if foiled by 1.245 for a key third time, watch the mid band (1.206) as a tripwire back to a break of 1.185 to press into the 1.14’s.

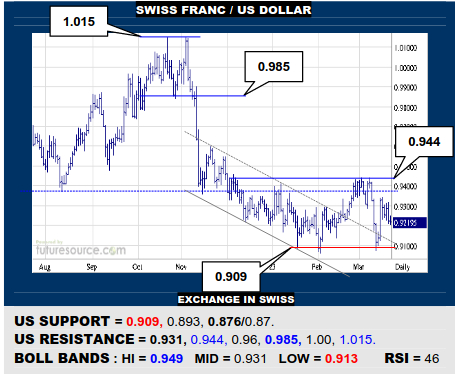

SWISS FRANC / US DOLLAR

Another rebound from 0.909 has been unable to cleanly overcome the mid band (0.931). A flag could be formed if the US still managed to do this shortly, wherein 0.944 would then beckon as a larger base exit. Still minding 0.909 meanwhile though as the trigger on down to 0.87’s that are ostensibly the underside of an eleven year range.

AUSTRALIAN DOLLAR / US DOLLAR

The AD has clawed its way free of a Q1 downtrend but needs a clean drive across 0.674 to reassure this and pin focus on the 0.688 H&S border that is realistically the door back into the 0.70’s. Further flinches in the low 0.67’s would otherwise dull the trend escape and warn of a minor correction cresting to threaten a next step down to 0.64.

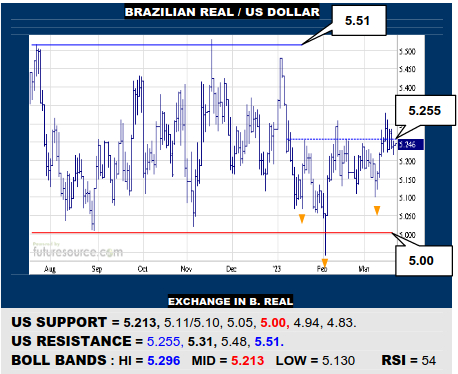

BRAZILIAN REAL / US DOLLAR

Scruffy action to say the least still has the US flirting with the chance of a Q1 inverse H&S but it now needs to punch decisively into the 5.30’s to hone the pattern and thereby take aim at 5.51. A tenuous footing meantime and watching the mid band closely (5.213) as its demise would dispel a flag-like shape and instead open the way back to 5.10.

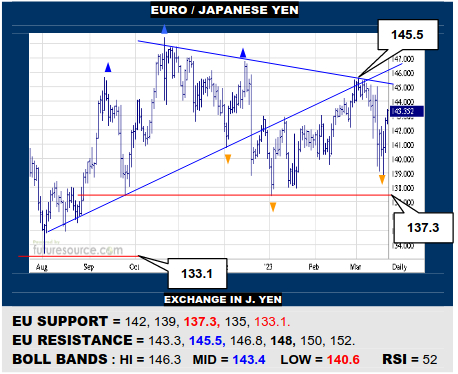

EURO / JAPANESE YEN

The latest sudden delve has been warded off clear of more important 137.3 support and the EU is battling back towards the 145’s. Escape over 145.5 would mark a key transition as a hefty new inverse H&S would wrestle control from a prior upright H&S to infer access to the 150’s. Stumbling shy of the 145’s would just keep the ranging going.

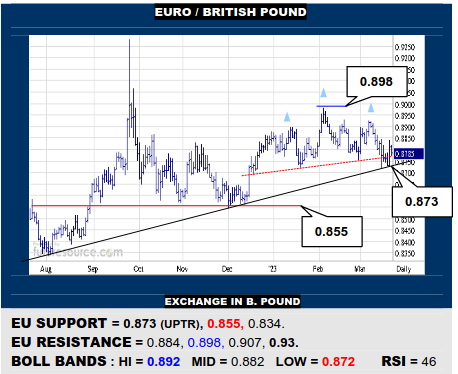

EURO / BRITISH POUND

Tremors of a new H&S top have been blunted by the shallow mid term uptrend so the EU currently still has view of the 0.89’s, although reaching the 0.90’s is clearly the price of admission to an enduring rally. Still closely minding the trend meantime (0.873) as the tripwire to instead prove the H&S and lead to a new attack on 0.855.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.