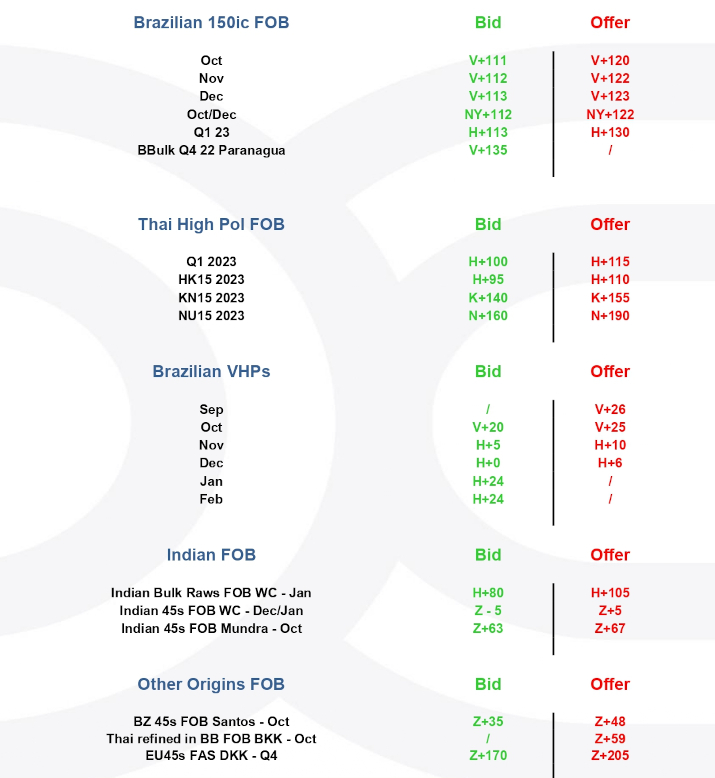

- Indian raw sugar offers remain at H+100pts.

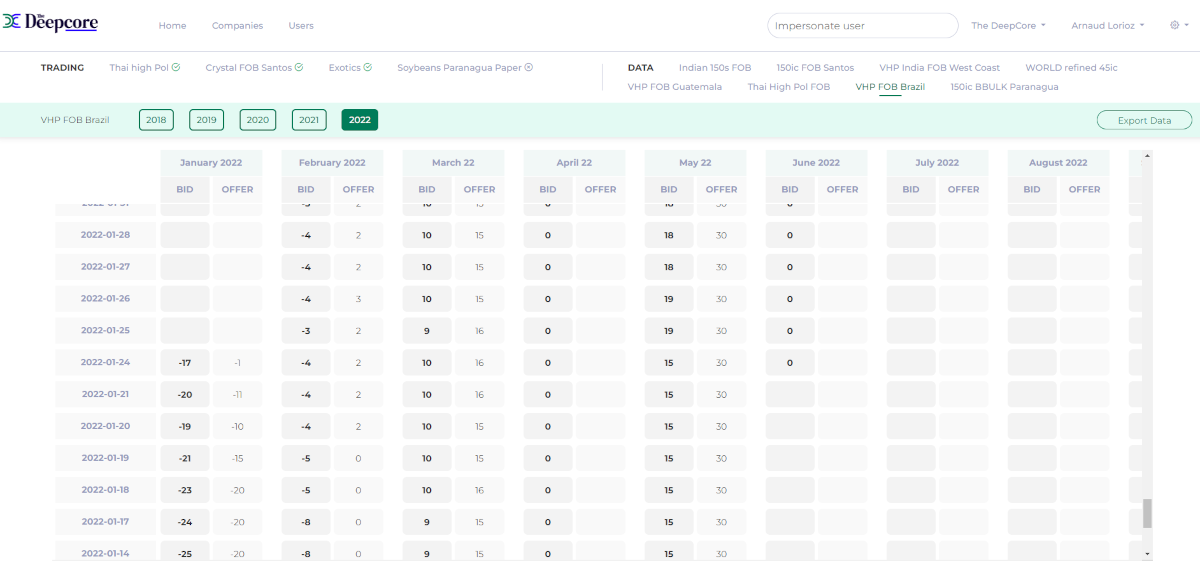

- No major changes to Brazilian VHP values.

- Indian Q4 refined at around Z+$65/mt.

Indian Raws bids are a bit better than the last week. From the mid-70s to the 80s at the time of this report. Despite those efforts from buyers, sellers remain in the triple digits area – 100/105 over NY MAR23 for DEC/JAN shipment FOB West Coast.

Indian whites are mostly active on refined for the spot shipments since the expiry, BID Z+63 OFFER 67/68 over LDN DEC for OCT shipment and OCT/NOV BID 60 OFFER 65, FOB Mundra.

Thais 45 are also appearing on sell side, but no demand so far from any traders. High Pol keeps going up weeks after weeks, until where?! Thats the big debate intertrade and everyone is waiting for the first crush numbers to adjust their numbers…. and BID/OFFER. Few more weeks to wait!

VHP brazil did not show any strong sign of volatility lately, despite the OCT NY expiry coming soon. OCT, NOV and DEC OFFERS gave up few points, but nothing to write home about.

Interested in having access to those data daily and the historical database, feel free to contact TheDeepcore.com.