Insight Focus

- Global vegetable protein stocks will build.

- Vegetable oil demand will grow strongly thanks to renewable diesel.

- These forecasts may be dependent on Argentina’s economy recovering.

What the USDA just forecasted for global vegetable protein meal and oil production and consumption for the 2023/24 marketing year (see USDA’s explanatory note at the end of this note) in 6 pictures (big thumbs up to whomever prepared the USDA’s Oilseeds: World Markets and Trade May 2023. Very well done!) https://usda.library.cornell.edu/concern/publications/tx31qh68h?locale=en

Picture 1

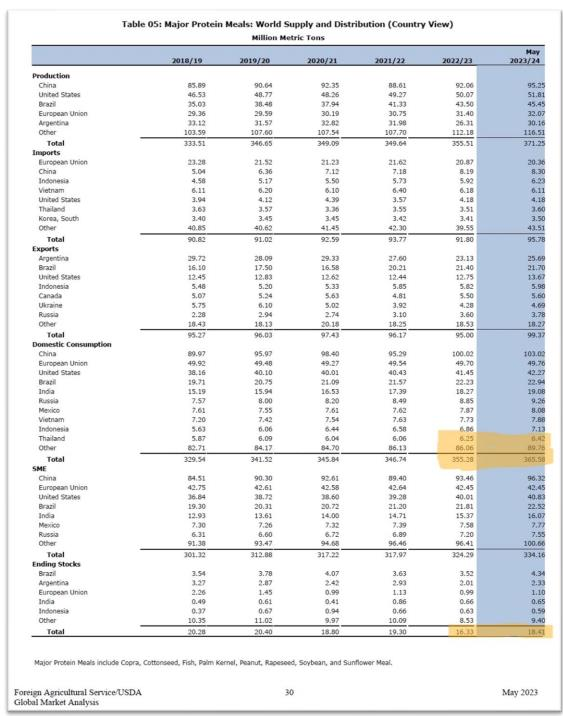

The marketing year will feature a significant expansion in protein production and consumption will not keep pace and so global ending stocks will build (spoiler alert, Argentina recovers to make this forecast possible).

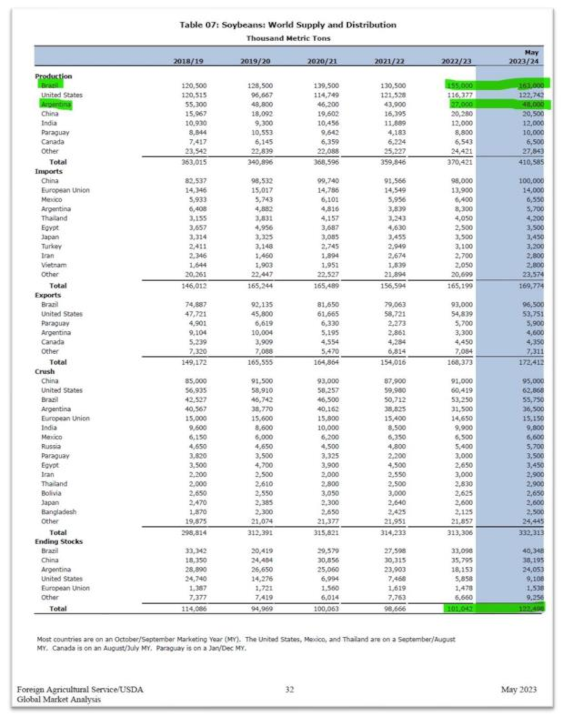

Brazilian record soybean production leads to record Chinese imports. No surprise there.

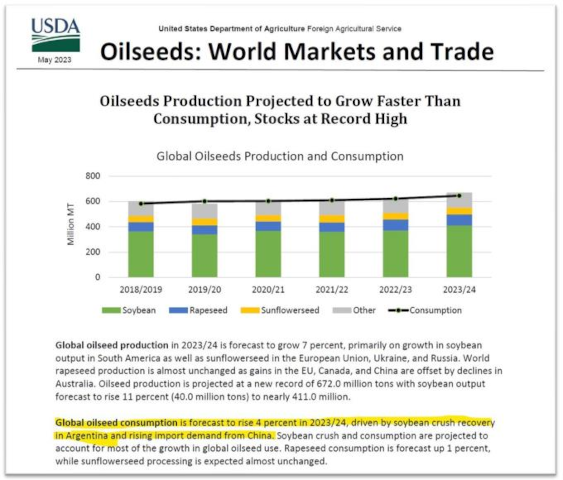

Picture 2

Global soybean meal consumption goes to its highest percent increase in four years and other protein meals revert to their consumption mean (because there is plenty of soybean meal that knocks them out of the feed ingredient mix, spoiler alert 2, because Argentine recovers).

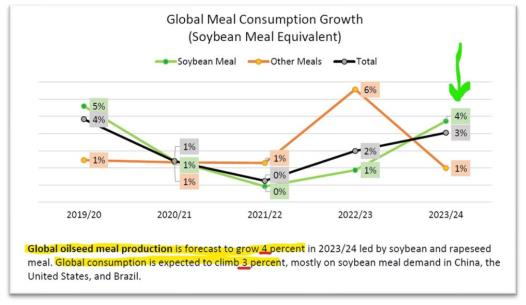

Picture 3

Three words: global biofuels policy (in the US known as biomass-based diesel primarily renewable diesel).

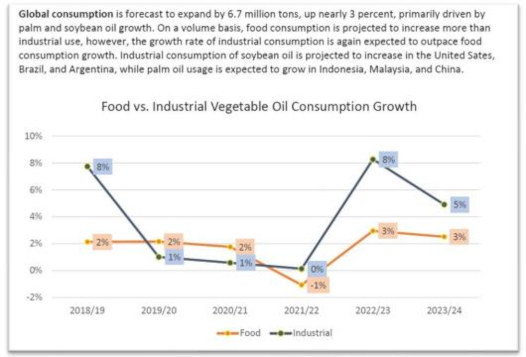

Picture 4

Global protein meal consumption steps up again; the other category (countries not making the USDA’s 6 million metric ton consumption cutoff to be highlighted and named but collectively the largest non-China global user) really steps up sequentially; and ending stocks increase just enough for consumers to breathe a bit easier (but, spoiler alert 3, requires Argentina to successfully recover).

Picture 5

Said recovery. Sequential record crop from Brazil. Record Chinese imports. Generous ending stocks.

Picture 6

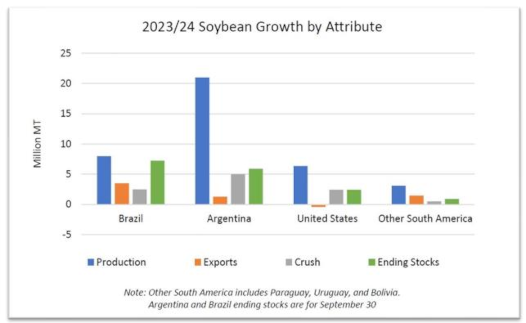

USDA’s economists’ big bet: an Argentine miracle recovery.

Summary: none of the above conclusions are valid if this Argentine recovery fails to materialize.

Question: do you think those of us in the global oilseed business will be watching Argentina very closely starting in January 2024 as it is the focus of all these pictures?

Answer: yes.

USDA’s explanation of marketing years:

Marketing Years (MY): MY refers to the 12-month period at the onset of the main harvest, when the crop is marketed (i.e., consumed, traded, or stored). The year first listed begins a country’s MY for that commodity (2022/23 starts in 2022); except for oilseeds in certain Southern Hemisphere countries, where the second year begins the MY (2022/23 starts in 2023). For a complete list of local marketing years, please see the FAS website (https://apps.fas.usda.gov/psdonline/): go to Reports, Reference Data, and then Data Availability.