- Thailand hopes renewable energy will account for 30% of its energy consumption by 2037.

- This bodes well for cane expansion, as to use more ethanol, Thailand needs more cane.

- However, competition from cassava is strengthening and could limit expansion.

Global Sugar Production is Barely Growing

Global sugar production has barely grown in the last decade. Meanwhile, consumption has been growing at around 1% per year. The world therefore needs 14m tonnes more sugar than it did 10 years ago.

Across this series, we’ll assess the feasibility for cane and beet expansion in some of the world’s largest sugar-producing regions: India, Brazil, Thailand, and Europe.

Can Thailand Help?

We think so as, in 2018, the Thai Government developed its Alternative Energy Development Plan (2018-37), often referred to as ‘AEDP 2018’.

Through this, it hopes renewable energy will account for 30% of Thailand’s energy consumption by 2037. This, in part, means increasing the amount of ethanol it blends with gasoline.

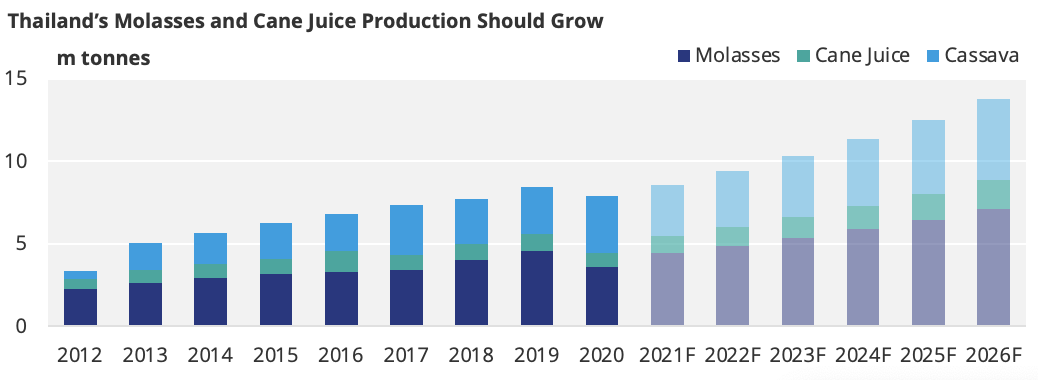

The Thai Government is reluctant to import the key feedstocks, molasses and cane juice, as this would hurt its cane farming industry. It’s therefore unable to make more ethanol without making more sugar first; molasses is a by-products of sugar production.

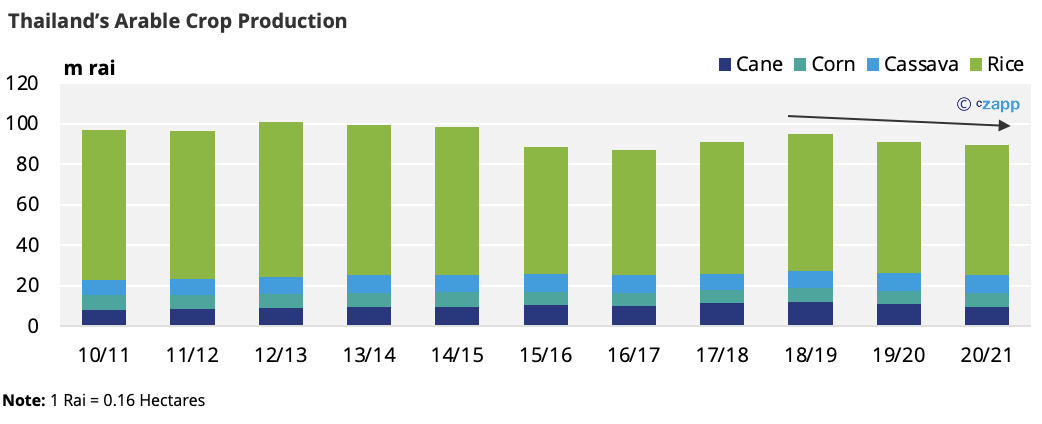

There’s a problem, though. As Thailand’s a sizeable producer of rice, cassava, cane and corn, the Government fears it could have fully utilised its arable farmland by 2026.

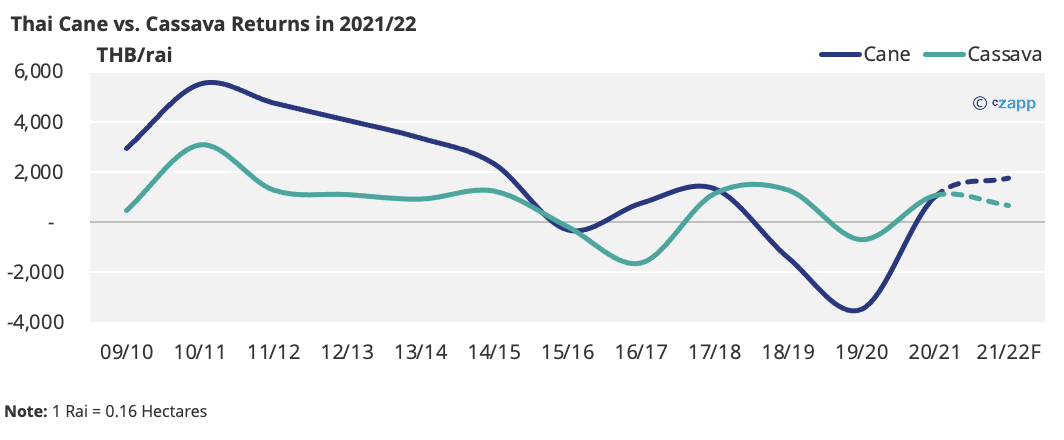

This means cane yields or area will have to increase. However, the competition from cassava has strengthened in recent years, alongside heightened demand from China.

Whilst we think cane will pay more than cassava this season, if Thailand suffers another season of poor rainfall, more farmers could turn to plant cassava. This is because it’s more resilient in the face of drought and has recently paid more than cane.

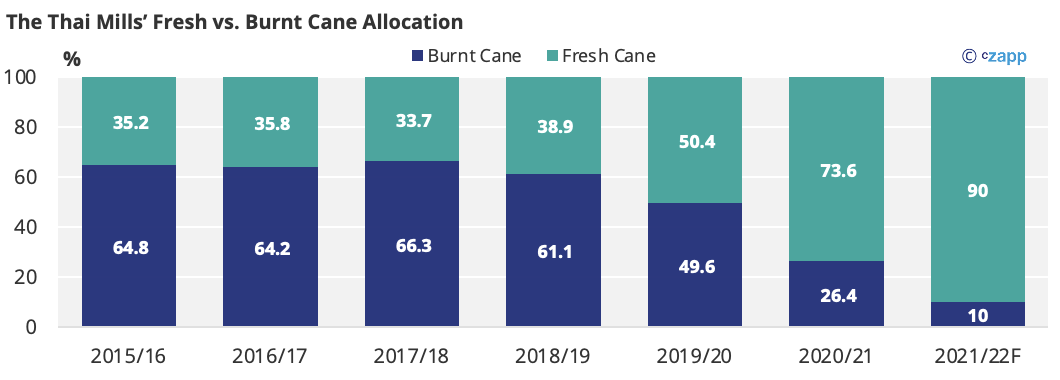

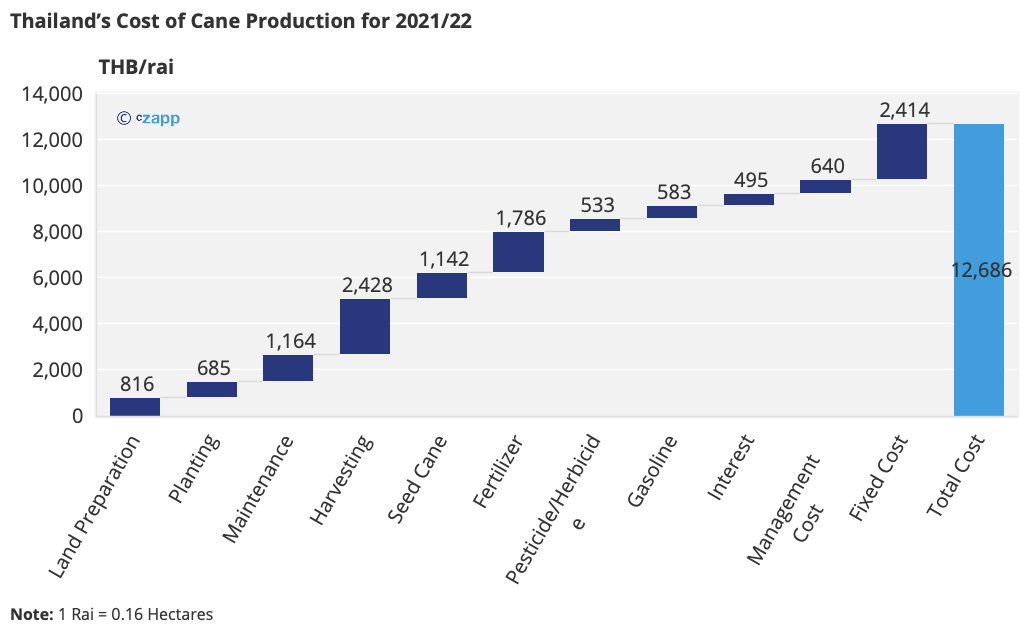

Going forward, it also seems Thailand’s cost of cane production will increase as the industry offers more money to farmers that harvest fresh, as opposed to burnt, cane.

Fresh cane harvesting costs more as the process requires expensive machinery, whilst burnt cane harvesting can be carried out manually more easily.

This machinery is already more costly as climbing energy prices have made gasoline more expensive.

With this, smaller farmers could stop planting cane as they simply cannot afford to adhere to the Government’s regulations surrounding cane burning. As a reminder, Thailand’s cane farmers get paid once per season (when they deliver their cane to the mill), whilst cassava farmers can harvest more regularly, making their payments more frequent.

The logistics surrounding cane expansion are also a concern. Thailand currently has 377 cassava chipping yards and 95 starch factories, and there are more on the way following a wave of investment from Chinese buyers, keen to import the finished products.

So, What Can be Done to Help Thai Cane Expansion?

Thailand’s push to increase the country’s ethanol consumption will play a pivotal role in cane expansion.

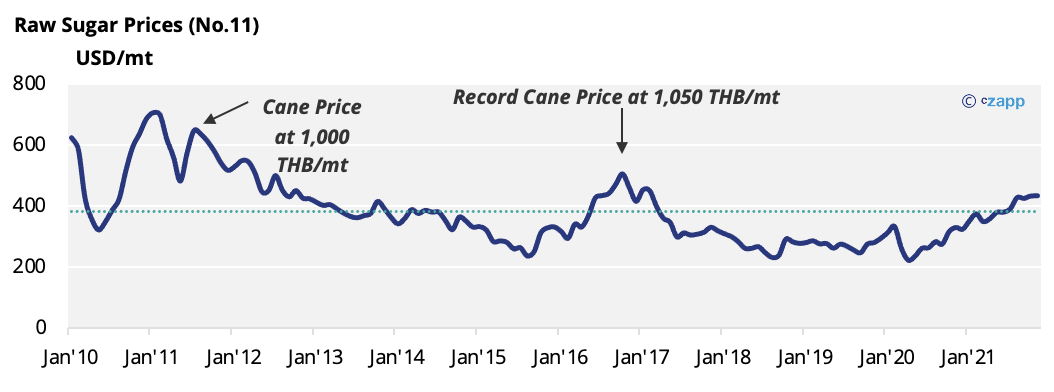

The country’s growing need for ethanol feedstocks, namely molasses and cane juice, means cane returns should continue to climb going forward. Higher returns often mean farmers invest more enthusiastically in things like fertilizer, pesticide, herbicide, and land management, as solid preparation in these areas can seriously improve yields.

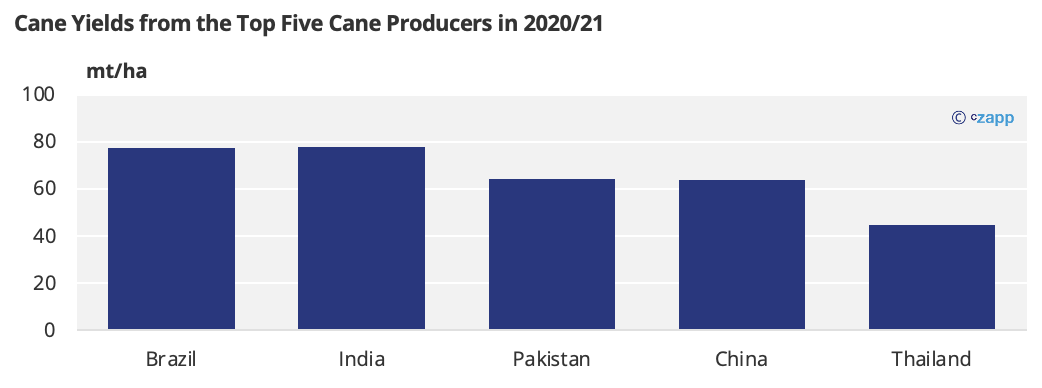

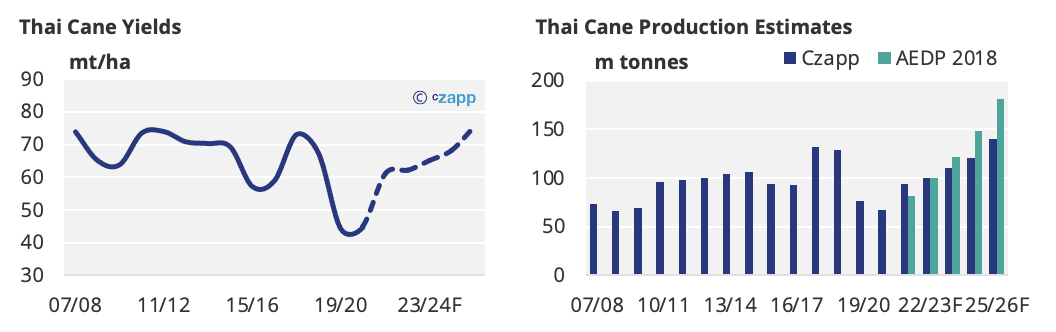

In 2020/21, for instance, Thailand’s cane farmers achieved yields of 44.8 mt/ha, which were weak compared to other key countries.

However, we think Thailand’s yields could climb to 75.1 mt/ha by 2025/26, if the No.11 holds firm above 18c and the industry introduces further top-up payments to provoke increased cane harvesting area and improved yields.

The weather conditions must still be considered, of course, but with optimal conditions, we think Thailand could crush a record 140m tonnes of cane in 2026. The factors mentioned above, however, make an 180m tonne crush seem unrealistic for 2026.

With energy prices set to rise until at least next year, it’s important farmers can cover all their costs and leave some margin for error; we’ll continue to monitor this.

Other Insights That May Be of Interest…

The World Needs More Sugar…Who Can Help?

The World Needs More Sugar…Can India Help?

The World Needs More Sugar…Can Brazil Help?

Explainers That May Be of Interest…