Insight Focus

- Soybean oil futures have rallied hard in the past month.

- This is because the renewable diesel industry continues to expand and look for feedstocks.

- US soybean yields will be determined in the coming 60-90 days.

The following are very brief thoughts about today’s USDA WASDE report after a much more important (for price forecasting) update to RD 2.0 (which for first time readers is explained here https://tinyurl.com/4743k8kv as well here https://tinyurl.com/3sk2c58x ).

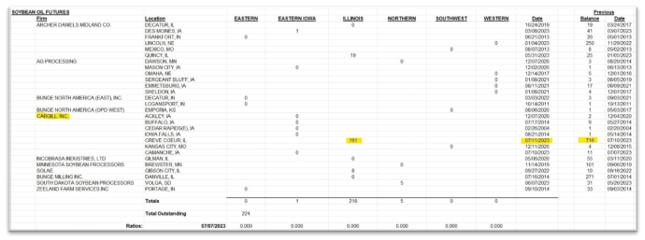

Big picture from the CME’s soybean oil delivery window which has been drained like a used cooking oil tank at your local McDonald’s: Cargill delivered a lot of frying oil to the CME against the May 2023 contract and other commercials took it and started delivering it to their customers but yesterday Cargill itself put an end to that and bought back most of their prior deliveries. I am not sure what changed the Cargill vegetable oil trade desk’s collective mind in less than 60 days but maybe it was a perception that EPA’s rumored and then confirmed limited expansion for biomass-based diesel’s participation in the RVO would be perceived bearishly by the trade. The market response to the EPA played out quite differently, quite.

Evidence that the EPA’s announcement did not set off a bearish response from the market: a chart of the nearby soybean oil futures curve (we fundamentalist traders always look at the curve first and foremost for guidance for overall price moves) represented by the August versus the December contracts. The EPA announcement instead launched a parabolic panic rally; see the flat price change in the USDA chart below.

Source: Refinitiv Eikon

The middle part of the curve, where I have been watching thebulls take charge as the US renewable diesel industry ramps up its production of RD and is expanding its demand for feedstocks (as detailed by the ADM and BG management teams during their February Q1 2023 earnings calls), continues to invert. Here is the middle, represented by the December 2023 versus the July 2024 spread:

Source: Refinitiv Eikon

The CME’s soybean oil window nearly drained here (Cargill tookback most of their outstanding receipts yesterday) as evidenced by the CME’s daily deliverable commodities under registration report:

I am not going to be surprised if all those soybean oil receipts get drained by the end of the week which means no more guaranteed supply via the futures market for the RD industry from the CME who now turns the RD feedstock buyers back to the physical markets, leans into them from the rear, and presidentially whispers into their collective ear, “best of luck.”

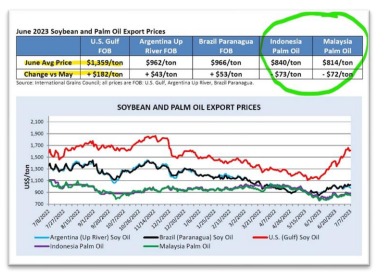

US soybean oil once again building a huge price premium relative to all global vegetable oils as represented by USDA’s chart in today’s Oilseeds, World Markets and Trade July 2023. Since the EPA announcement US soybean oil prices (yellow highlights) have completely decoupled from global palm prices (green circle) and likely resume building on that premium during the coming RD 2.0 quarters.

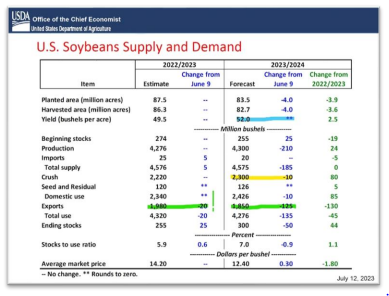

On to today’s WASDE US soybean detail and a brief review summarized in one word: punt, as in the USDA “punted the ball” and chose to take more time to look at Jul/Aug/Sep weather prior to adjusting the soybean yield which is their normal course and reasonable given the US soybean crop’s yield determinant period is ahead of us over the next 60-90 days.

Highlights include:

- No change in soybean yield so a punt (blue)

- Reduction in the crush estimates for the upcoming marketing year (Oct-Sep) (yellow) and I will take the unders on that estimate

- Reduction in the export estimates for both marketing years (green) and I will take the overs on that estimate as in the USDA will need to reduce exports even more in coming months

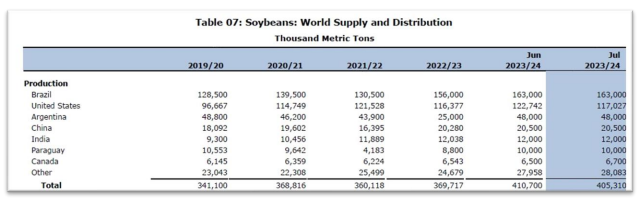

So as of this USDA WASDE global soybean supply moves LOWER as the USDA left the remaining two production estimates of the big three (Brazil, US, and Argentina) unchanged, as anticipated, while the acreage reduced US crop remains just that for now, acreage, not yield, reduced. When do we find out about the US soybean yield? Watch the US soybean belt weather every day for the next 90 days.

Does soybean yield have to decline to sustain the soybean bull market? No.

Why?

The RD industry’s demand for feedstock has launched a demand bull market for US soybean oil and by extension US soy crushing margins which is very supportive for soybean prices, i.e. a demand bull market for now possibly morphing into a supply bull market should adverse, yield reducing weather develop over the next 90 days.

How does that demand bull market end? When supply expands to increase the available supply relative to the projected demand known in the trade as the “stocks to use” ratio. When will that unfold? I would recommend watching the Brazilian, Argentine, and Paraguayan weather for the next 210 days. Without the above table’s projected production numbers (inclusive of a sequential record Brazilian crop) coming to fruition the global soybean supply gets tight, very, as the stocks to usage ratio declines even more.