Insight Focus

- Ukraine grains export corridor extended by 120 days.

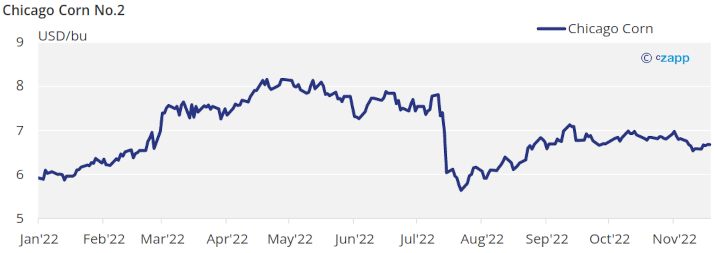

- This has led to some negative momentum on grains futures markets.

- The northern hemisphere corn crop is now virtually complete.

Forecast

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 5,8 to 6,3 USD/bu. The average price since Sep 1 is running at 6,8 USD/bu.

Market Commentary

Weekly gains in Chicago Corn but losses in all other markets following the extension of the Ukraine export corridor for 120 days. Sizable loses for European Corn.

The week did start negative in Chicago but recovered by the end of the week probably on some spec buying after two consecutive negative weeks. It was all around the extension of the grains corridor out of Ukraine which was finally extended for 120 days.

US Corn is now 93% harvested which continues to be above last year and well above the five year average. Corn harvest in France finished last week on November 7 almost one month ahead of last year. Crop condition was 42% good or excellent the lowest since condition has been tracked and terrible vs. last year’s 89%. Corn harvesting in Ukraine is 50% complete still very much delayed vs. 67% harvested last year and yields continue to be much lower than last year showing 5,8 ton/ha vs. 7,32 last year. Corn planting in Argentina advanced almost nothing last week and is 23,6% complete vs. 28,8% last year, and condition improved again but is just 11% good or excellent.

Wheat had small loses in all markets despite the news around the grain corridor, but prices had already anticipated the extension with two weeks of corrections and prices rallied after the fact.

US winter Wheat is 96% planted, which is now slightly above last year and the five year average. Weather starts to be the key factor for Wheat and soil moisture in the US is far from being optimal. Wheat planting in France was 97% ahead of 92% last year.

In the weather front, cold weather is expected in the US during the coming days including snowfall in the Corn Belt which will limit late harvesting activity. Weather is Europe is expected to be rainy, and Brazil is finally expected to see some dry and sunny weather during the weekend, but rains are expected again this week.

The major doubts around global supply have cleared with the extension of the grain corridor out of Ukraine and the Corn crop virtually completed in the northern hemisphere, except in Ukraine which should already be priced in. Expect the market to trade sideways with macro being the major influence to prices.