376 words / 2 minute reading time

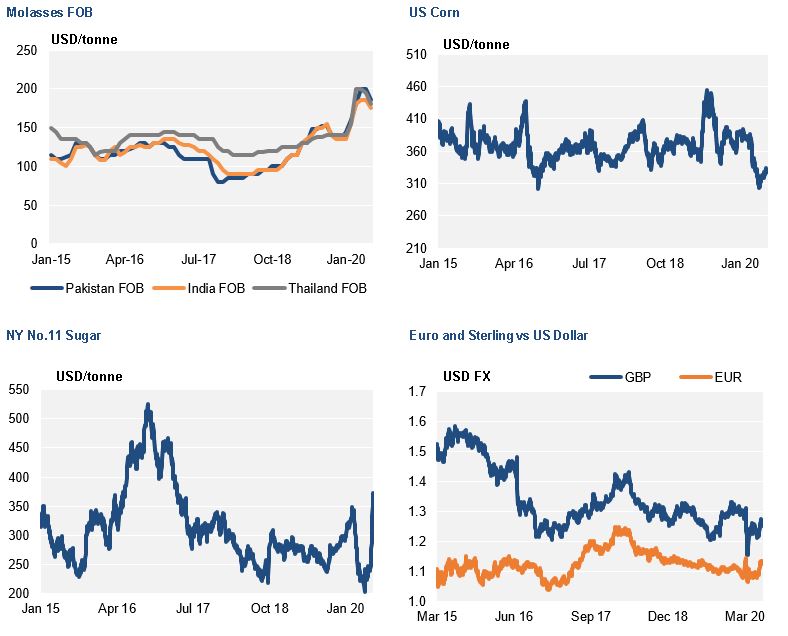

Once it became clear earlier this year that the impact of the COVD-19 virus was going to be far more deadly and disruptive than initially hoped we have witnessed an extremely volatile world. Commodity prices, in particular crude oil, have seen large swings, global equity markets have plunged and unemployment has soared. In our reports over the last few months we have outlined how the molasses price has been largely unaffected, with a fundamental supply deficit keeping prices high.

It finally seems as if the exceptionalism of molasses prices is now fading and it appears prices may start to moderate as we get towards the end of 2020 as 2020/21 Northern-Hemisphere cane molasses starts to become available.

India is an important factor in rebalancing supply and demand in the cane molasses market. In 2020 supply has been lower due to a poorer cane crop and a ban on cane molasses exports from Maharashtra. The ban on exports is due to expire in September and the Indian sugar crop looks to have better prospects than last year. This should increase the supply of cane molasses to the world market and help reduce the supply deficit.

There are forecasts for a better sugar crop in Thailand, the EU sugar beet crop looks to be similar to the five-year average and Central American crops looks stable year-on-year. Overall this should result in an increase of cane molasses supply of 300,000 mt – 500,000 mt which will address the majority of the supply shortfall experienced this year.

Demand is the other side of this equation. This is more difficult to estimate for later this year and into 2021, but we are going to see the lowest demand for cane molasses imports on record in 2020. The main reason for the fall in demand has been the price; if we see supply increase and prices moderate, we should hopefully see demand recover, the question will be how to what extent? We will be watching this closely over the next few months.

In summary it would appear that common sense is returning to the international molasses market with the current short-term shortage of supply ameliorating towards the end of 2020 and prices should reflect a more balanced market and molasses fundamentals in 2021.