Insight Focus

- Fertilizer imports to the EU will soon include carbon dioxide emission costs.

- The cost of fertilizers for EU farmers (and therefore food prices) could rise.

- Particularly since the EU imports plenty of fertilizers from high CO2-emitting origins.

Crop growers in the European Union are likely to face higher costs for some fertilizers. This is because of new EU legislation targeting the carbon dioxide emitted in the production of certain raw materials imported from outside the EU. These added costs could then be passed on to consumers, leading to higher food prices.

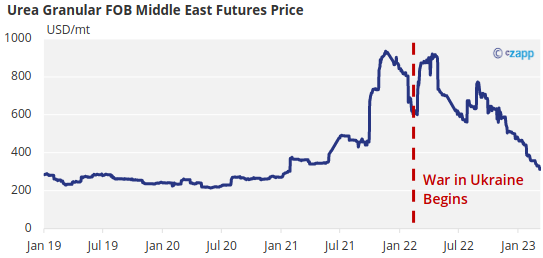

Fertilizers are a key input in agriculture, and growers have already been facing stronger price volatility since the Covid pandemic and the war in Ukraine (Russia and Belarus are major fertilizer exporters).

The EU Carbon Border Adjustment Mechanism (CBAM) being introduced this year is designed to put a price on the greenhouse gas emissions emitted in the production of fertilizers, steel, cement, aluminium, fertilizers, electricity, hydrogen, and nuts and bolts imported from outside the EU. If they are not already accounted for in the country of origin.

These products are generally produced using coal for heat or energy in 3rd countries.

It is one element of the bloc’s ‘Fit for 55’ package of legislation aimed at reducing carbon emissions throughout the region by at least 55% by 2030.

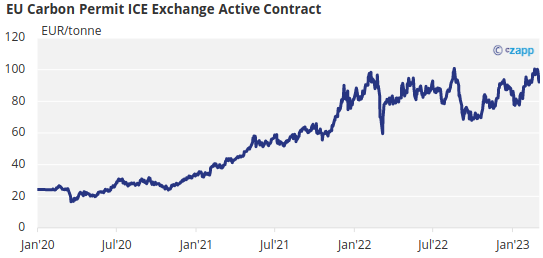

EU producers have been subject to similar legislation in the form of the emissions trading scheme (ETS), the latest iteration of which was introduced in 2018. This is particularly relevant with EU carbon permits shrinking every year, and prices recently breaking through 100USD/tonne, a record since the program began.

‘Carbon leakage’ where companies would relocate production to other parts of the world to avoid these added costs, meant until now emissions could be relocated outside the EU rather than reduced outright.

The EU Imports Fertilizers from High CO2 Origins

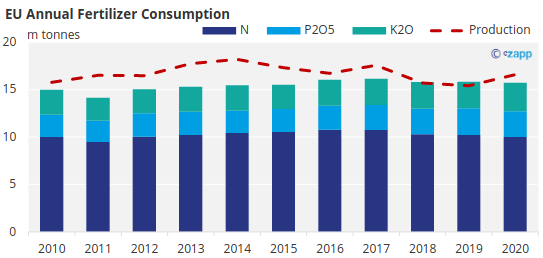

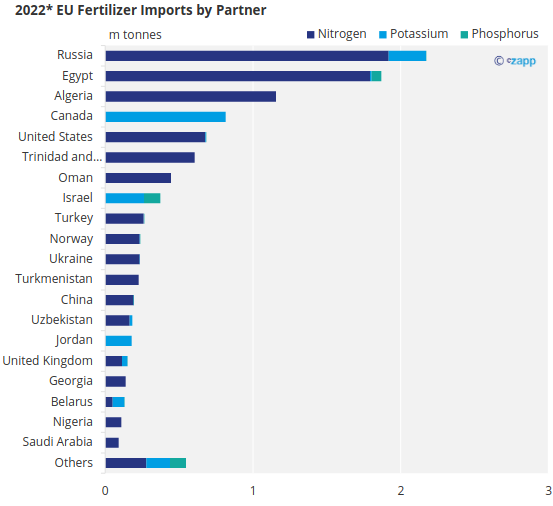

The European Union generally consumes 15-16m tonnes of fertilizers for plant nutrition annually, particularly nitrogen-based (around 10m tonnes). This is around 8% of global plant nutrition consumption.

Source: International Fertilizer Association

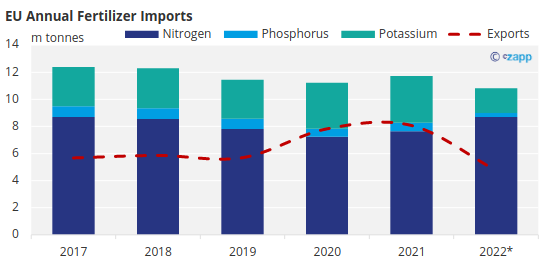

However, despite a regular production surplus, the broad range and variety of different fertilizer products and applications available means it is still necessary to import over 10m tonnes annually. This is where the CBAM will have an effect.

There are usually around 6m tonnes of exports from the region annually too.

Source: UN Comtrade, *up to October 2022

Producers in countries with less strict greenhouse gas emissions regulation will face a higher carbon cost and become less competitive on the EU market.

Looking at the first 10 months of 2022 (to account for effects of the Russia-Ukraine war), Russia is still the largest import partner of the EU, followed closely by Egypt, Algeria, Canada, and the USA.

Source: UN Comtrade, *up to October 2022

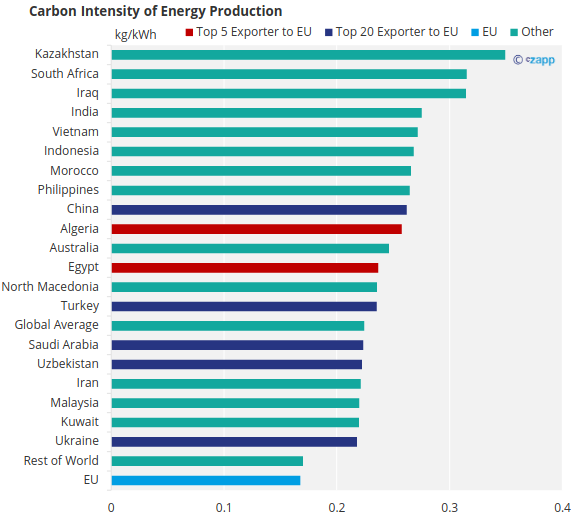

Whilst it is difficult to attribute the greenhouse gases directly used in the production of fertilizers, looking instead at how much carbon dioxide is produced in the production of energy in a country could provide a good point of reference.

For 2021, the second and third largest exporters to the EU feature in the top 20 most carbon intensive energy producers, Algeria and Egypt.

Source: Our World in Data

Compared to the EU, Algeria and Egypt are around 50% more carbon dioxide intensive in the production of energy.

A further five of the EU’s largest suppliers China, Turkey, Saudi Arabia, Uzbekistan, and Ukraine also feature amongst the most carbon-intensive energy producers.

Whilst this doesn’t offer a direct comparison in terms of fertilizers since these countries emit more emissions when producing energy it is likely to be correlated with the amount of emissions emitted when producing fertilizers.

This would mean that under CBAM, producers in these countries could well face a greater carbon cost on the EU market compared to cleaner EU fertilizer producers, putting them at a disadvantage.

This means EU farmers will now be exposed to the carbon cost of fertilizers, regardless of origin, and those buying from these more carbon-intensive origins will face the highest burden. These added costs could then be passed down to the consumer in the form of higher food prices.

Farmers Buying from Some Origins May Be Less Affected

Whilst CBAM is designed to allow for the cost of carbon emissions to be accounted for in the country of origin, it is still unclear how this mechanism will precisely operate.

Source: World Bank

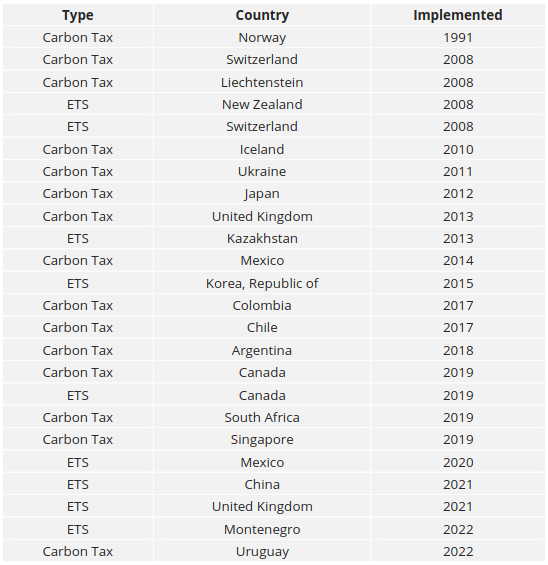

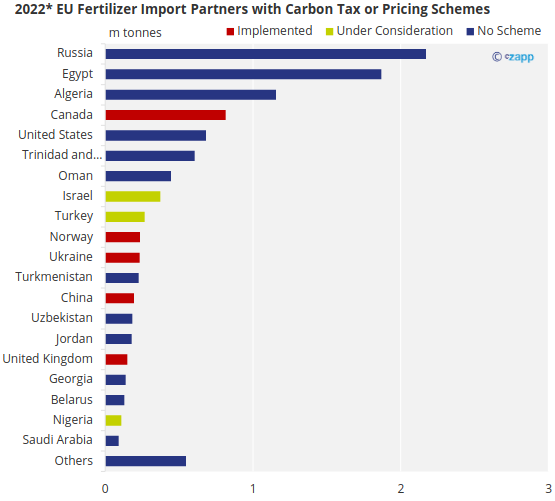

Of these, 8 feature in the EU’s largest fertilizer suppliers.

The key takeaway here is that none of the top 3 fertilizer suppliers to the EU, which account for half of all imports, have plans to implement or have already implemented some form of carbon tax or emissions trading scheme. This leaves a lot of EU farmers potentially exposed to higher costs for fertilizers.

Canada, the 4th largest, and by far the largest potassium supplier does operate a similar emissions trading scheme. All industrial facilities emitting more than 50k tonnes of CO2 equivalent per year are covered. This could help mitigate the introduction of CBAM for buyers of Canadian origin fertilizers.

Likewise, Norway and the United Kingdom each run an ETS closely linked to the EU scheme, and Turkey and Ukraine are either exposed to or considering launching their own in a similar style to the EU.

China’s ETS is currently only applied to direct energy production, not necessarily energy use in production of goods.