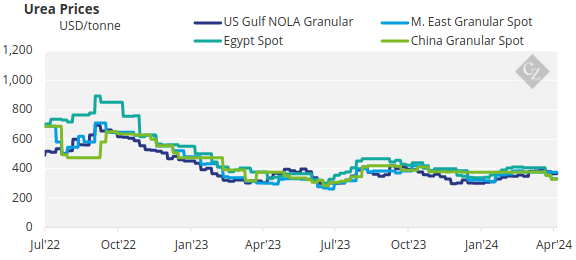

Urea prices have continued to fall. India’s decision to cut imports has hit the market hard. Plus the middle of the year is usually a slow time for northern hemisphere demand.

India Urea Import Cuts Dissolve Demand

The fallout from India’s decision to cut urea imports has been severe. Prices have fallen globally in all regions and now Middle East prices are around USD 280/tonne FOB. The latest deal is rumoured to be at USD 280/tonne FOB, which is about USD 100/tonne less than at the end of February this year.

This reflects CFR Australia prices of around USD 320/tonne. This is obviously a worry since Australian prices normally command a premium.

Iran is rumoured to have come down to as low as USD 230/tonne FOB, as has prilled urea from the Baltics. Egyptian FOB levels are also under pressure with traders looking for support sub-USD 300/tonne FOB. Full April NOLA/US prices are USD 304-308/short ton (USD 275-279/tonne) FOB in the barge while full May nosedived to around USD 270/short ton (USD 245/tonne) FOB in the barge.

The key question now is when is the price deterioration going to stop? Summer is coming in the northern hemisphere, which brings zero demand.

Still, we have yet to see any major impact on urea exports from China. There are rumours circulating that exports are again being restricted with some producers in China claiming they were not able to perform the export process. Domestic futures and physicals surged on the news of lifting of the export restrictions.

Neither NRDC nor Customs in China have made any announcement related to urea exports. If export restrictions again are being introduced, it would be timely to ask how reliable urea supplies from China would be. However, with China coming into the market we should expect that the pressure on prices will continue.

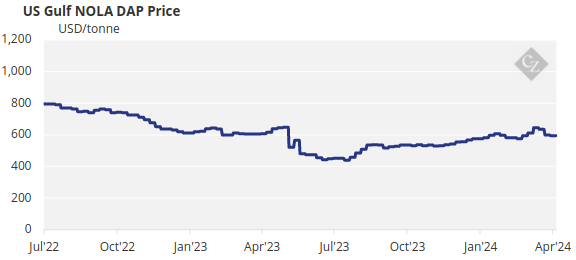

Processed Phosphate Price Sees Limited Drop

Processed phosphate prices are also under pressure with Chinese DAP now being offered in the low USD 520/tonne FOB range, which is below the announced floor price of USD 530/tonne FOB and an average of USD 65/tonne drop over the past five weeks. Still prices are expected to go lower.

DAP production costs in China vary between USD 400-500/tonne and are subject to availability of phosphate rock. The producers that have their own rock supply tend to land at the lower end of the scale. However, if DAP prices reach levels of around the USD 480-490/tonne FOB, the squeeze is on.

The export quota from China for the period May 1 to September 30 for DAP and MAP is set at 5.6 million tonnes. This is a massive number compared to Q1’24 exports totalling only 240,000 tonnes.

In India, the Q2’24 phosphoric acid contract was settled this week with JPMC of Jordan agreeing to a price of USD 948/tonne CFR for 100% P2O5, which is only USD 20/tonne lower than the previous contract. The market had expected a lower price in view of the deteriorating processed phosphate prices globally.

The general outlook for the processed phosphate market is of continued pressure on prices on the back of increased Chinese supplies, although a flood of supply has failed to materialise so far. The only bright spot is Brazil with MAP inventories depleting fast.

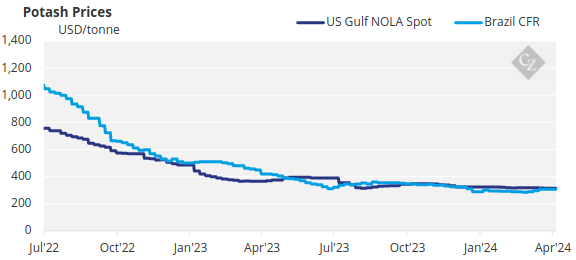

Middle East Concerns Potash Markets

Downward pressure hit potash markets across the globe this week, as slow demand has persisted longer than expected in many regions. Concerns of an escalation in the Middle East abound in the market, with many participants worried about how tensions between Israel and Iran may impact potash trade. MOP exports from the Middle East and Egypt totalled 11% of global MOP trade in 2023, highlighting the region’s importance for the fertilizer market.

The Southeast Asia standard MOP price range is assessed between USD 280-320/tonne CFR. Brazilian granular MOP is in the USD 305-315/tonne CFR region as producers are struggling to increase prices due to resistance from the market.

Indian potash contract negotiations are said to be approaching a conclusion. It is rumoured that Indian importers may have settled with one major supplier, although importers have not commented on the matter. An official statement from India is expected to be provided in the coming weeks, with the settlement priced rumoured at USD 280-290/t CFR, although this could not be confirmed.

Tide Turns for Ammonia

In a reversal of previous months, market sentiment in the East has begun to turn bullish on reduced supply and better demand, while prices in the West are now expected to ease soon on softening demand. However, given the fragile geopolitical situation in the Middle East – already on edge due to the Red Sea issues – activity remains rather limited, and the situation could change at short notice.

Firming natural gas prices, with one-month forward TTF at around USD 10/MMBtu, underlined the volatility of the energy markets, with any further increases likely to prompt discussions over capacity curtailments in Europe.

The outlook for ammonia prices is stable-to-firm in all regions with spot Arab Gulf assessed at between USD 250-280/tonne FOB, slightly stronger than last week’s assessed range of USD 240-270/tonne FOB.

The Far East spot CFR price range increased this week to between USD 290-310 CFR compared with last week’s assessed price range of USD 270-290/tonne CFR.