This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Rush to contract sugar for next season continues.

- Some beet processors have sold 80% of their expected crop.

- Sugar beet planting should start in April.

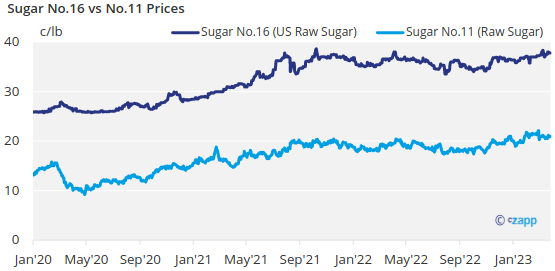

Cash sugar prices were raised in the week ended March 24 amid ongoing active sales that pushed beet processors’ percentage of prospective 2023-24 sugar production under contract to levels that signaled it was time to slow or stop sales.

The rush to contract sugar for next year continued for a third week. Indications were beet sugar sales neared 75% to 80% of prospective 2023-24 beet sugar production from around 40% less than a month ago. Some beet processors were stepping away from the market sooner (with a lower percentage sold) than in past years to avoid over-selling after adverse weather resulted in lower production and four force majeures since 2019. Plus, some are unsure of planted area as growers may opt to plant more profitable crops. One beet processor was temporarily out of the market, some had “stepped away” to reassess selling positions, and at least one indicated it still was selling sugar.

Sugar beet planting gets underway in some areas in April, with most activity in early May, and it remains to be seen when or if processors will re-enter the market with a small amount of sugar to sell in the early summer, and there is no guarantee offered prices will be lower.

Beet and cane sugar prices were raised for 2024, with more increases possible. One distributor said beet processors’ prices indicated they didn’t want to sell any more sugar, and he had buyers who stepped away from the market due to high prices. Despite the rapid sales in March, many medium and large buyers still were without 2024 sugar coverage.

Beet sugar was offered on the West Coast as high as 61¢ a lb delivered before the seller stepped away from the market. Prices in other regions had moved sharply higher as well but were hard to ascertain as most processors were out of the market. Sources indicated beet sugar prices were in the 55¢ to 58¢ a lb f.o.b. range.

Refined cane sugar for 2024 was offered at 59¢ a lb f.o.b. East and West Coasts, up 1¢ to 1½¢ from a week earlier, and at 57¢ a lb f.o.b. Gulf and Southeast, up about 1¢.

Typically, refined cane sugar is contracted at a slower pace than beet sugar as cane refiners can run year-round while beet processors are limited by having to process outside beet piles before the weather gets too warm in the spring. But this year, with beet sugar prices nearly at cane levels, cane refiners also are selling more sugar earlier than usual.

Some buyers indicated they were foregoing the fourth quarter of calendar 2024 hoping prices would be lower for that period at a later time.

Spot refined cane sugar was offered at 64¢ a lb nationwide, up 2¢ from a week earlier. Spot beet sugar prices remained nominal as most processors had no supply to offer unless it was a small amount due to underperformance on contracts.

The corn sweetener market mostly was routine with limited if any supplies available for spot sale.