Insight Focus

- US EPA releases biofuel blending obligations.

- These are much lower than industry had hoped for.

- Industry investments support a much larger blend capacity.

Wednesday the market received the scheduled, final decision by the EPA for volumetric obligations for fuel distributors to blend biofuels into petroleum-based fuels for the years 2023 through 2025. In December the EPA had flashed “preliminary”, head-scratchingly low numbers, completely at odds with industry build out both for biofuel refining but also feedstock production to produce those biofuels. In the six month interim between EPA’s proposed and final decision, trade publications suggested lobbyists had gone to work to inform the EPA about plans in place and projects underway by private industry to support a much larger blend capacity that would necessarily require much more significant blend volumes from regulators, in this case the EPA, for the biofuels industry, in this case Big Oil PLUS Big Ag, to keep the capital, construction, and implementation momentum going.

Strangely enough several news agencies reported the “final” obligations late Tuesday afternoon, 17 hours in advance of the EPA’s “official release.” Chaos ensued when the futures markets opened Tuesday night with soybean oil trading to its lowest permissible limit and soybean meal soaring as the EPA had clearly ignored the biofuels’ lobbyists (and the facts about private industry) and provided limited upward adjustments to their December proposals.

As a brief aside, does the CFTC, FBI, or Congress ever investigate these government agency leaks? Do “leaky” government officials ever face any consequences for these unethical actions? Maybe the below wasn’t a comedy but a documentary?

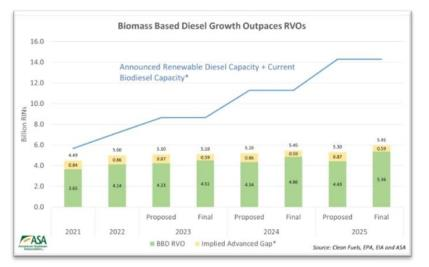

The above chart, produced by Scott Gerlt, chief economist for the American Soybean Association, does the best job of everything I have seen since Tuesday late afternoon to put the EPA’s decisions into perspective. The blue line, representing industry’s efforts to prepare for the renewable diesel (RD) and sustainable aviation fuel (SAF) expansive demand of the future, is WELL above the combined green and yellow bars (primarily renewable diesel PLUS biodiesel) that represents EPA’s official volume obligations to the US fuels’ industry. As they say in London, “please mind the gap.” In other words, the fuel industry (and its feedstock suppliers) is way out ahead of the regulators in preparing for a decarbonized era of road and aviation fuels. And has been. And likely continues to be.

In a prior post I noted the optimism by major players in the combined road and aviation biofuel feedstock production industries for potential, sustainable growth in both these combined sectors. Clearly renewable diesel and ethanol for road fuel meet consumer and regulatory demand today, and likely meet aviation fuel demand tomorrow. I wrote the essay following an industry event in New York City earlier this summer. If you missed that post you can review it here: https://tinyurl.com/4jk9n4zf

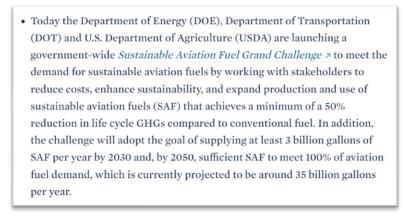

Industry leadership concluded the path for expansive, lower carbon fuel production was made clear by the current administration promoting it as part of the Deficit Expansion Inflation Reduction Act and instituting “grand challenges”, whatever that means. This from the White House website laying out the vision in September of 2021:

So on the one hand, the elected executive branch of government and its current administration speaks of “grand challenges” and expansion, while on another side of government, the bureaucrat class at EPA promotes limitation that fails to recognize the critical steps necessary to get to aviation fuels that meet the executive branches’ ambitions. Someone please help me. I am lost.

For clarity, I did what everyone in the petroleum and biofuels space does during periods of regulatory confusion, I turned to the private sector for sage guidance, in this instance from Mike Wirth, ceo of Chevron Corporation (NYSE: CVX). Mike, if I am ever out in San Francisco, can we do lunch?

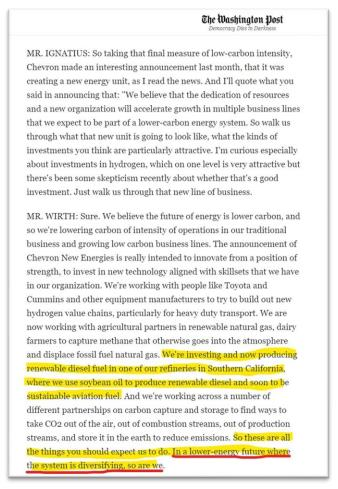

In an August 16, 2021, interview with David Ignatius of the Washington Post, Mike said this about the future of a lower carbon energy system:

“So these are all the things you should expect us to do. In a lower energy future where the system is diversifying, so are we.”

Those words have a bit of a suggestion of ethical obligation, don’t they? “You”, and here I think Mike refers to both the Chevron shareholder as well the fuel consuming customer, expect us, Chevron and its leadership, to pursue a diverse source of fuels, inclusive of, and here I am guessing, sustainable aviation fuel. And sustainable aviation fuel development for tomorrow requires sustained EXPANSIVE production of renewable diesel and ethanol today. FULL STOP.

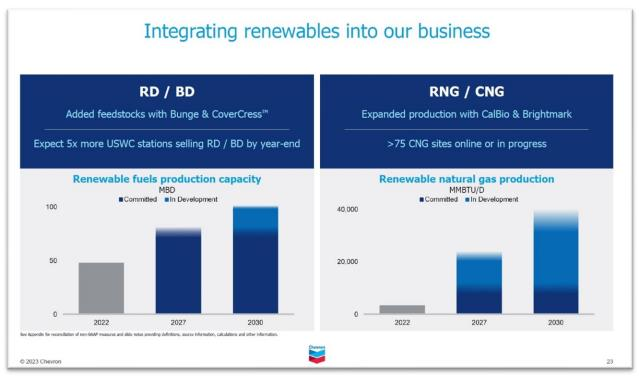

So, what do I think about the future following the EPA’s leaked and limited RVO? I think I will listen to Chevron’s second quarter earnings call to see if there is any change to this chart presented during the first quarter earnings call. And I am going to bet the chart remains the same.

And for the professional traders who read these posts, here is a quick update to RD 2.0. The middle part of the soybean oil futures curve continues to trend higher and remain above the 50% retracement level, even after the disappointing RVO announcement, which is supportive:

Source: Refinitiv Eikon

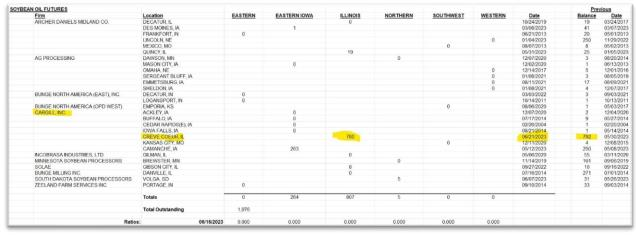

And the physical price of soybean oil remains above the futures price and Cargill’s delivery window inventory is being drawn down (by the owners ADM and Bunge?), which is supportive.

RD 2.0 and its expansive demand appears to be advancing.