Insight Focus

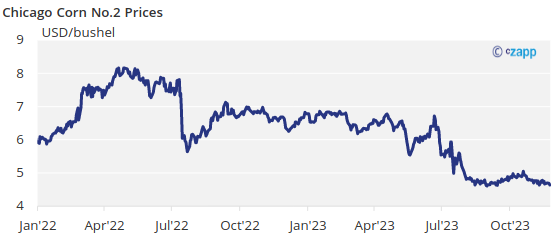

- The corn market remains in a downtrend.

- A large US corn crop is weighing on the market.

- Cold and rainy weather in the US should benefit the condition of the wheat crop.

Forecast

It was another small negative week for corn and wheat in all geographies due to comfortable global supply and a short trading week in the US. While a large US corn crop continues to weigh on the market, farmers are stubbornly holding onto stock and spec funds are holding a large short position. This means there is a small amount of downside risk unless spec funds decide to take advantage of profits and unwind positions.

There is no change to our forecast for Chicago corn, which remains in a range of USD 3.90 to USD 4.15 USD/bushel for the average of the 2023/24 (Sep/Aug) crop. The average price since September 1 is running at USD 4.79 USD/bushel.

Corn

Corn started the week negatively with poor export data from the US. A lower-than-expected harvesting pace in the US did not really influence market direction given that harvest is almost complete. US corn was 93% harvested versus 96% last year and slightly ahead of the five-year average of 91%.

Russian corn is 73% harvested and Ukrainian corn is 75% harvested. French corn is now fully harvested. In Brazil, the first corn crop is 80% planted – in line with 82% last year. But the summer corn crop is behind last year’s pace at 49% planted compared with 62.3%.

Brazil is expected to receive some rains across the whole Center South region, which could delay some planting, but only storms in Mato Grosso could cause some damage to planted corn and soybeans. The US is expected to have cold and rainy weather this week, which could once again delay corn harvesting. However, since harvesting is almost complete, it should have limited impact on prices.

The risk is limited from the big US corn crop as farmers continue to hold onto stocks and spec funds hold their large short positions.

Wheat

The cold and rainy weather projected for the US this week should be beneficial for the condition of the wheat crop. US winter wheat is now 95% planted versus 98% last year and compared with the five-year average of 96%. The condition improved one point to 48% good or excellent compared with 32% last year.

Russian winter wheat planting is 99% complete, while planting in Ukraine is 92% complete. Black Sea prices pressured wheat lower at the start of the week. Despite Russia again having attacked infrastructure in the port of Odessa, the line up in the Black Sea continues to increase. No further reports have emerged of ships being attacked, and exports are flowing.

On the weather front, very rainy weather in France could worsen the wheat condition but drier weather is forecast for this week which should help to alleviate that risk. Germany is expected to continue receiving rains.