This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

Forward sugar sales edged up but maintained a moderate pace. The spot market was quiet, and prices remained steady. Deliveries lagged last year, reflected in the USDA’s May WASDE lower forecasts.

Forward sugar sales in the cash market were moderate during the week ending May 16, gaining slightly from recent weeks but still not robust. The spot market was moribund. Forward and spot prices were unchanged.

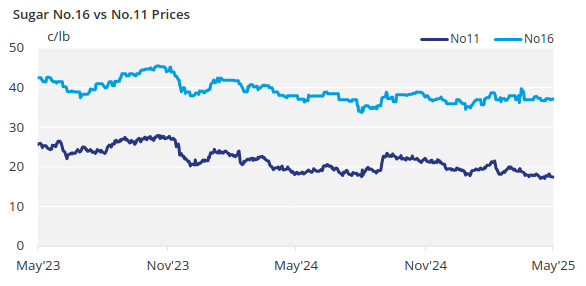

Bulk refined beet sugar for the balance of 2024-25 was offered at between 38c/lb and 40c/lb FOB Midwest. Prices remained nominal for spot beet sugar amid a lack of demand. One processor was out of the spot market, but others still had sugar to sell. Refined cane sugar for 2025 was offered at 53c/lb FOB Northeast and West Coast, and at 48c/lb to 51c/lb FOB Southeast and Gulf.

Beet sugar prices for 2025-26 were unchanged at 38c to 42c/lb FOB Midwest. Refined cane sugar prices for 2025-26 also were steady at 52c/lb FOB Northeast and West Coast, and at 50c/lb FOB Southeast and Gulf.

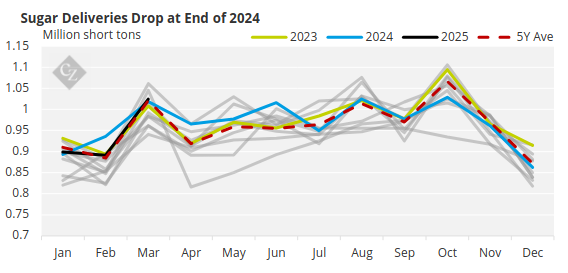

The pace of domestic deliveries was starting to pick up but remained below year-ago levels. Strong pulls from retailers were supportive and helped fill the void left by consumer-packaged goods and confectionery manufacturers. Processors also noticed a decline in demand from the foodservice sector.

Buyers Pause Beet Contracts as Demand Softens

Forward sales of cane sugar were a little more active than beet sales, with many buyers opting to “push the pause button” on extending beet contracts. The idea was that some customers had overbooked this year and were chewing through supplies. Plus, with deliveries trending lower, many buyers were hesitant to commit to set quantities, as their demand outlook was uncertain. This seemed especially relevant for large CPG companies, which have noticed a decrease in sales volumes in recent quarters.

Source: USDA

Also, the weak tone in the market had many buyers holding out for potential price declines. But sellers countered that the upside risks outweighed the downside prospects at the start of the growing season and that forward prices were already low enough.

Sugar beet planting was well advanced. Beets in the four largest producing states were an aggregate 91% planted as of May 11, up from 83% a week earlier and 69% as the 2020-24 average for the date, the USDA said. Sugar cane condition ratings in Louisiana jumped to 60% good-to-excellent as of May 11, from 50% a week earlier, marking the fifth consecutive week of higher ratings, the USDA state office said.

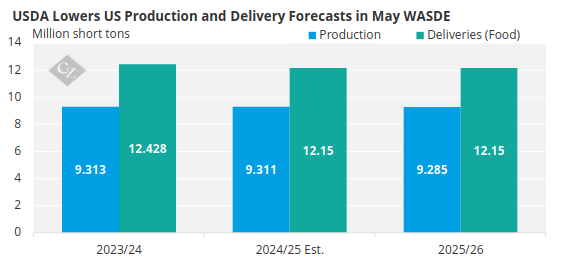

In the latest WASDE report, published May 12, the USDA lowered its outlook for 2024-25 US sugar production by 0.6% from April, to 9.3 million short tons (8.45 million tonnes). It also slightly reduced its import forecast and cut its projection for sugar deliveries for human consumption by 90,000 short tons, or 0.7% based on the pace of deliveries to date. For 2025-26, the USDA projected sugar production at 9.29 million short tons, down 0.3% from the prior year, with deliveries expected to remain flat.

Source: USDA

Corn sweetener markets were quiet. Deliveries were disrupted by mechanical issues for some wet millers.