This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- The beet market was more active this week but US supplies were high.

- Both beet and cane remained muted ahead of February’s International Sweetener Colloquium.

- Central American producers may divert some exports to Mexico due to higher prices.

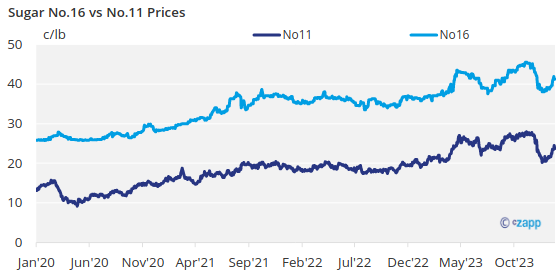

Sales of bulk refined sugar for 2024 were slow during the week ended January 26, while the pace of sales for 2025 picked up slightly. Prices were unchanged, with refined cane values for 2025 becoming better defined. Raw sugar futures were sharply higher as the market continued to rebound from late 2023 lows.

Beet Market Awaits Colloquium

Beet processors continued to add sales for 2024-25, and one noted more active sales in the past couple of weeks. But most buyers and sellers were awaiting sideline negotiations at the International Sweetener Colloquium on February 25-28 before making new commitments.

Prices for 2024-25 beet sugar were reported below 55¢/lb in the Midwest — mostly in the 52.5¢/lb to 54.5¢/lb range.

Beet sugar for 2024 was offered mostly steady at 55¢/lb to 58¢/lb FOB Midwest. Most processors have spot sugar to sell, and sales are occurring within the quoted range even as some other users have been slow to take their contracted supplies. There is no shortage of beet sugar, with the USDA forecasting 2023-24 production at a record high, although many in the trade expect final production will be lower than the USDA forecast.

Note: Values converted to metric tonnes from short tons

Source: USDA

Cane Sees Little Weakness

Initial refined cane sugar prices for calendar 2025 were announced with Northeast and West Coast cane sugar offered at 60¢/lb and Southeast and Gulf offered at 58¢/lb. Some cane sugar in the Southeast and Gulf was available below posted prices. Neither beet processors nor cane refiners expect much weakness in offers going forward, with the caveat of what develops during negotiations during the Colloquium.

Bulk refined cane sugar for 2024 was offered at 62¢/lb FOB Northeast and West Coast, and at 58¢/lb to 60¢/lb FOB Southeast and Gulf. Some cane refiners depend on imported raw cane sugar – a starkly different situation than beet processors are facing given the ample supplies of beets they have to slice.

Tight supplies of raw sugar have been a factor supporting refined cane sugar prices, as well as the unusually wide refined cane premium to beet sugar.

Central America Sugar May Divert to Mexico

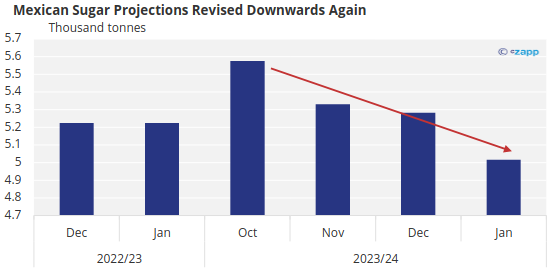

Refined cane sugar prices have been supported by seemingly constant declines in forecasts for Mexico’s 2023-24 sugar production. The USDA has lowered its forecast each month since September, shaving 784,000 tonnes off estimates.

The current forecast of 5.016 million tonnes, actual weight, is still above most trade expectations, which in some cases are below 4.7 million tonnes.

Further, with Mexican sugar imports forecast at 14-year highs (some estimates are as high as 700,000 tonnes versus the USDA’s 511,000 tonnes), Central American countries that typically ship to the US may opt for the shorter route to Mexico, where prices are higher, at least early in the season.

Corn sweetener contracting for 2024 was complete. Weather continued to present logistical challenges for corn refiners across the Midwest.