This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

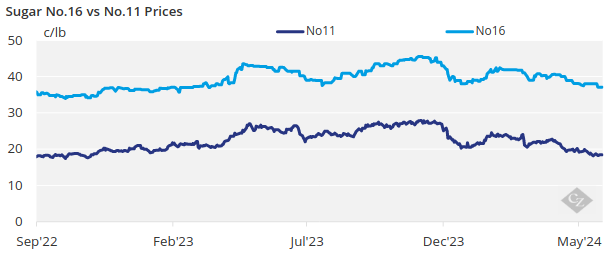

No. 16 sugar prices took a tumble this week on downward pressure from No. 11 raw sugar futures. Plantings forged ahead, with strong crops and good sucrose yields anticipated for the next season.

Weak No. 11 Prices Pull Down No. 16

Cash sugar prices were steady to weaker in the week ended May 24 amid softness in raw sugar futures, a strong start to the 2024 beet and cane crop and ongoing slow spot and 2024-25 sales.

Bulk refined beet sugar for 2024-25 and calendar 2025 was said to be trading in the upper 40¢/lb to lower 50¢/lb FOB area in the Midwest, depending on volume and other factors. Prices were lowered slightly to reflect more trading near or below the prior week’s quoted range.

Bulk refined cane sugar for 2025 was offered unchanged at 59¢/lb FOB Northeast and West Coast and 56¢/lb to 57¢/lb FOB Southeast and Gulf. Recent pressure in refined cane came mainly from weakness in No. 11 raw sugar futures that recently hit 18-month lows and pulled domestic No. 16 futures lower in their wake.

Sales for 2024-25 ranged from slow to moderate. One beet processor previously had withdrawn from the market until at least mid-September. Another previously considered withdrawing but has opted to stay in amid excellent sugar beet crop prospects. Other processors also remained in the market.

Picture Improves for Plantings

Beets in the four largest producing states were 98% planted as of May 19, up from 90% a year ago and 81% as the 2019-23 average for the date, the USDA said. Meanwhile, the Louisiana sugar cane rating jumped from a week earlier, and indications of dryness in Florida’s sugar cane areas dissipated.

The trade was anticipating good sugar beet and cane crops in 2024 and higher sugar production in 2024-25. When coupled with expectations of higher production in Mexico, the supply situation for next year was shaping up to be the best in recent years. That said, the growing season still has a long way to go, an above-average hurricane season is forecast, and some believe Mexico’s 2024-25 production may be overstated.

Brokers and others were urging buyers to lock in their 2024-25 needs as current forward prices are well below recent levels and some see more upside than downside in prices, especially in beet sugar prices as processors tend to raise prices as they hit internal sales thresholds. The sharp discount of beet sugar to refined cane sugar leaves room for beet sugar price increases.

Bulk refined beet sugar for the remainder of 2023-24 was lowered and was well below year-ago levels. Refined cane sugar prices were steady but also were sharply below last year’s values.

In addition to lower raw sugar futures, weakness in spot values reflected slightly better-than-expected late-season sucrose recovery by some beet processors, and slow deliveries in the first half of the marketing year. Most processors had sugar to sell, and in some cases a bit more than expected, for 2024, but they also were finding buyers. The delivery situation appeared to be improving with several processors reporting better shipments in April and May.

Further, increased exports of US sugar to Mexico, where supplies are tight and prices are above US levels, have helped offset the impact of slower domestic deliveries early in the year.

The corn sweetener market was quiet.