This update is from Sosland Publishing Co.’s weekly Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- US Customs have begun action against sugar arrivals from the Dominican Republic

- The flow of up to 100k tonnes of raw sugar may be affected.

- This follows allegations of forced labor.

US Customs action against Dominican Republic refiner key event in sugar market last week

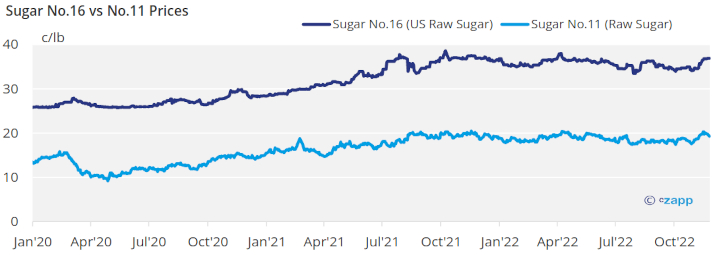

The sugar market last week entered what typically is a lull that runs from Thanksgiving until late February when business picks up around the time of the International Sweetener Colloquium. But the week wasn’t without news that may further tighten an already tight spot market. Prices were unchanged with a firm tone.

US Customs and Border Protection said it was detaining imports of raw sugar and sugar-based products from Central Romana Corp. Ltd., one of the two largest sugar producers in the Dominican Republic, due to indications of forced labor at the company’s operations. Trade sources indicated as much as 100,000 tonnes of US raw sugar imports may be affected, at least temporarily. The raws mainly go to refineries on the US Northeast, they said. Central Romana told Reuters, “We disagree vehemently with the decision as we do not believe it reflects the facts about our company and the treatment of our employees,” and said it would work with Customs to resolve the matter. The Dominican Republic has a US raw sugar tariff-rate import quota of about 208,713 short tons for the 2022-23 season (October-September) with 25,234 tons shipped in October.

The sugar beet harvest was essentially completed for the fall. Only Michigan reported data as of Nov. 20 with beets 98% harvested.

The sugar cane harvest progressed in Louisiana and Florida after some rain delays in the latter following Hurricane Nicole.

The US Department of Agriculture forecast record-high 2022-23 cane sugar production in Louisiana with outturn surpassing that of Florida for the first time ever if realized. Timely refining of the large cane crop in Louisiana will be key for sugar production to reach forecast levels. The crop is expected to exceed the state’s refining capacity, which means raws will need to be moved by barge up the Mississippi River and to East Coast refineries. Recent improvement in water levels in the lower Mississippi River have aided barge movement although some restrictions remain.

Processors noted deliveries of contracted sugar had begun to seasonally slow in November after strong deliveries through October.

No beet processors were offering sugar for 2022-23 after strong sales early and lower beet production in some areas. One cane refiner continued to offer spot sugar at 68¢ a lb f.o.b. at all refinery locations through Dec. 31, 2022. That was about the only source of spot sugar except for distributors or imports. That refiner also offered cane sugar for calendar 2023 at 61¢ a lb f.o.b. at all locations.

Some sales for the first quarter of 2023-24 (October-December 2023) and into early calendar 2024 were noted at steady levels. Recent offers for 2022-23 were 51¢ a lb f.o.b. Midwest for beet sugar and 52.50¢ a lb f.o.b.

Southeast for refined cane sugar. Most sellers still were not quoting 2023-24 prices.

Annual contracting of corn sweeteners for 2023 was moving towards completion by corn refiners, although some buyers still had uncovered needs. Prices for 2023 are up 20% to 40% from 2022 contracted levels, with high-fructose corn syrup up about $5 to $7 a cwt, glucose up about $10 to $11 a cwt and dextrose up $20 a cwt or more. Spot supplies are expected to be limited to nonexistent during 2023.