Insight Focus

- The USDA forecast a 3% increase in American corn plantings in 2023.

- They also forecast higher corn stocks this year.

- EU wheat seems to have survived the winter without frost damage.

Forecast

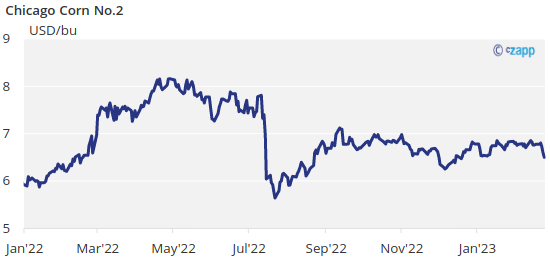

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,7 USD/bu.

Market Commentary

A 3% increase in US planting during 2023 forecasted by the USDA gave a reason for profit taking and Chicago sold off dragging all markets lower.

The USDA released the 2023 forecast in their annual agricultural forum causing a sell off in Corn and Wheat. Corn acreage was within expectations and it was higher stocks that brought the market lower. Wheat acreage was bigger than expected pressuring prices lower too.

The USDA forecasted 91 mill acres of Corn and 88,6 of Soybean planting during this spring, and then 49,5 mill acres of Wheat to be planted during the fall all in response to high prices. The combined acreage would be 3% higher year on year.

The EU published their February MARS bulletin basically eliminating any damage from frost, despite Wheat not having developed cold protection, but the relatively mild winter has been helpful. They did highlight the low rainfall may have a negative impact, mostly in southern Europe.

In Argentina BAGE lowered their Corn production forecast by 4,5 mill ton to just 41 mill ton following worsening conditions of the previous few weeks. This is to compare with 45 mill ton of the USDA estimate which will probably follow BAGE in the March WASDE. The new forecast of 41 mill ton would mean a 21% reduction year on year. Corn condition is only 9% good or excellent.

In Brazil, the Soybean harvest continues to run slow just 23% complete. The second corn crop is 33,3% planted. Logistics wise, the bumper soybean crop in Brazil together with ample rains is causing logistical bottlenecks and waiting times mostly in Santos port.

In the Wheat front, Chicago and Europe fell strong after the USDA released their production forecast for 2023 showing a bigger acreage than expected.

In Russia, they are targeting a goal of 60 mill ton of grain exports by the end of 2023 given the bumper production they had. This news caused European Wheat prices to plummet, somehow understandable given the big supply outlook. But in the Dubai conference, Rusagrotrans forecasted a 80 mill ton Wheat crop to be harvested in 2023 which is a huge fall vs. the 105 mill ton harvested last year. They are arguing lower acreage and weather concerns. Has Russian wheat suffered from winter killing? They are saying winter killing could be more than 8% vs. just 3% last year. Area planted is down 6%.

In the weather front, rains are expected in Brazil again but also in Argentina. Brazil is having too much rains causing slow soybean harvesting and slow corn planting, but in Argentina is very much needed. US weather is expected to be cold, and Europe is receiving a cold and rainy front.

We think the market reaction last week was a bit exaggerated as we still have all the planting to be done in front of us, there is no farmer poll done, and we have a lot of weather in front of us. The market needed a reason for some profit taking and took advantage of it. We do expect production growth and is included in our price forecast showing an average price for the crop below the year to date average. But the reality is that short term availability is tight and this is being reflected in Corn basis, and the projected growth will only be available from October onwards.

We would expect profit taking to have finished and prices should recover some of the losses of the last week. We still have problems in Argentinian production and delays in Brazil’s planting.