This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Most sugar business for 2023/24 has now been booked.

- Some beet suppliers have sold 90% of expected production.

- The USDA expects the lowest beet acreage since 2008.

Sales of bulk refined sugar slowed during the week ended March 31 after active 2023-24 contracting during a busy March. Prices were unchanged.

Although most business for 2023-24 has been booked, some sellers noted some large buyers still were not fully covered, and some processors still had deals moving ahead but not yet completed. Some buyers backed away as prices shot higher amid the sales rush over the past three or four weeks in what was one of the most hectic contracting periods in memory. Most beet processors pulled back the past couple weeks to reassess their potential sugar supply from the as yet unplanted 2023 crop. Most have re-entered the market and are selling at least on a selective basis. Others continued to sell sugar without a pause, but at higher price levels, which also worked to slow the sales pace.

Indications were beet sugar sales were over 80% of prospective 2023-24 production with some processors likely approaching 90% sold. Some beet processors were limiting sales to a smaller percentage of prospective production than in past years to ensure they have adequate supplies to deliver on 2023-24 commitments and thus avoid potential shortfalls or force majeures as has occurred the past few years.

The US Department of Agriculture in its March 31 Prospective Plantings report said farmers intend to plant 1,110,800 acres of sugar beets in 2023, down 48,700 acres, or 4.2%, from 2022 and the lowest since 2008. There has been keen competition from other crops for planted area in some regions. At the same time, memberships in grower cooperatives limit how many sugar beet acres can be switched to other crops without incurring penalties as beet factories need adequate supplies to run efficiently. Strong sugar prices have boosted payouts to grower members, which may limit switching.

Persistent wet, cold weather in some areas, notably in the Upper Midwest, has raised concerns about delayed sugar beet planting. The cold weather has been good for outside beet piles waiting to be sliced, but not so good for farmers thinking about spring planting. The bulk of beet planting takes place in late April and May, so adequate time remains, but the window is getting narrower. Beets can be planted well into May, but later planted crops have less time to deposit sugar, have greater need for favorable weather during the growing season, and may limit much-needed early harvest prior to Oct. 1.

USDA condition ratings for the Louisiana sugar cane crop have declined the past two weeks but remained near the middle of recent years’ early-season ratings.

Beet sugar prices for 2023-24 were said to range from 54¢ to 58¢ a lb f.o.b., mostly unchanged from a week earlier but up about 35% or more from what the bulk of beet sugar was sold for in 2022 for delivery in 2022-23. Users who haven’t been in the spot market since contracting for 2022-23 early last year faced “sticker shock” from prices for 2023-24. Refined cane sugar offers for 2024 were steady at 59¢ a lb f.o.b. East and West Coasts and at 57¢ a lb f.o.b. Gulf and Southeast. Strong prices for beet sugar have pushed more business to cane sugar.

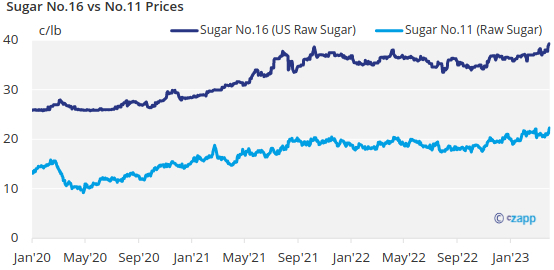

Domestic raw sugar futures soared to fresh 11-year highs as hedging progressed for 2023-24.

Corn sweetener markets mostly were routine with numerous buyers still not fully covered for 2023 amid expected tight supplies in 2023.