Insight Focus

- A positive week for grains futures.

- Black Sea grains line-up continues to increase.

- October WASDE lowered US corn production estimates slightly.

Forecast

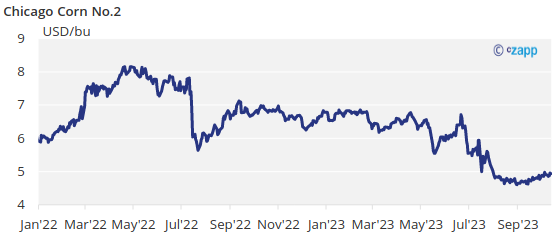

No changes to our forecast for Chicago Corn in a range of 3,9 to 4,15 USD/bu for the average of the 23/24 (Sep/Aug) crop. The average price since Sep 1 is running at 4,79 USD/bu.

Market Commentary

Grains closed the week positive, except for Corn in Europe after an October WASDE with small surprises. The line up in the Black Sea continues to increase.

Corn in Chicago had a positive week mostly on slightly lower production shown in the October WASDE which was not expected by the market, but we had warned about this possibility.

The October WASDE last Thursday lowered old crop stocks -in line with the quarterly report- and they lowered new crop yield to 173 bpa vs. 173,8 before. Old crop carry out fell to 1,36 bill bu vs. 1,45 before. New crop carry out fell to 2,1 bill bu vs. 2,2 before with the bulk of the lower stocks was coming from the old crop and the 70 mill bu of less production due to lower yield was partially offset by 50 mill bu of less demand (25 mill bu of less demand for feed and 25 mill bu of less exports). We are now transitioning from old crop stock to use of 9,9% to 14,8% of the new crop vs. 15,4% of the Sep WASDE.

Interesting is that one of the items to reduce old crop stocks was reducing harvested acres which is somehow contradictory with their number for the new crop: the USDA is using the highest relationship of harvested/planted acres for the new crop, so we wouldn’t be surprised to see less harvested acres.

World Corn stocks were marginally reduced by 1,6 mill ton which besides the lower production in the US, Argentina was revised upwards by 1 mill ton to 55 mill ton and no other changes were done.

Conab in Brazil lowered their Corn production forecast for 23/24 to 119,4 mill ton marginally lower than their previous forecast of 119,8 mill ton and vs. the WASDE projection of 129 mill ton.

Agreste in France increased their Corn production forecast 11,7 mill ton vs. 11,2 they had before and +10,5% year on year.

US Corn is 34% harvested vs. 29% last year and vs. 31% of the five year average. Condition was unchanged at 53% good or excellent vs. 54% last year. French Corn is 83% in good or excellent condition unchanged week on week and vs. 42% last year. Harvesting is 50% complete very much delayed vs. last year’s 81%. Russian Corn is 28% harvested. Ukrainian Corn is 22% harvested. In Brazil, Safrinha Corn is 99,9% harvested, virtually completed, and first Corn crop is 26,8% planted vs. 27% last year. Corn planting in Argentina is 19,4% complete.

In the Wheat front, the October WASDE increased US carry out for the old crop by 2 mill bu, and increased carry out of the new crop to 670 mill bu in line with the quarterly stock report and vs. 615 of the Sep WASDE. Almost all the increase came from higher yield of 48,6 bpa vs. 45,8 before. The higher stocks were partially offset by 30 mill bu of higher consumption.

World stocks were left basically unchanged (480k ton lower-immaterial) and besides the production change in the US, Australia was revised lower by 1,5 mill ton and Brazil lower by 500k ton.

In the Black Sea, the line up out of Ukraine continues to increase and around 1 mill ton of grains is being loaded these days which is a similar volume than when the grains corridor was in operation. Russia did attack some grain infrastructure in the Danube but apparently damage was limited and did not disrupt export activity.

US Winter Wheat is now 57% planted vs. 53% last year and 57% of the five year average. Russian spring Wheat is 92% harvested. Winter Wheat planting in France and is 17% complete vs. 19% last year. Winter Wheat in Ukraine is 54% planted.

In Argentina, BAGE lowered their 23/24 Wheat production forecast by 300k ton to 16,2 mill ton.

In the weather front, the US is expecting dry weather again but by mid week heavy rains are expected in parts of the Corn belt. Brazil is expected to receive another cold front in the south with not so much rainfall in the rest of the center south region. Europe is having a hot October with little rain but wetter and colder weather is expected this week.

Despite the small changes of the October WASDE the big picture has not changed with Corn production increasing significantly and should result in lower prices looking forward. Lower old crop stocks is keeping the market tight in the short term -basis has turned positive again- but as soon as new crop Corn hits the market we should see prices moving lower. Still geopolitical tensions in the Black Sea will bring volatility.