Insight Focus

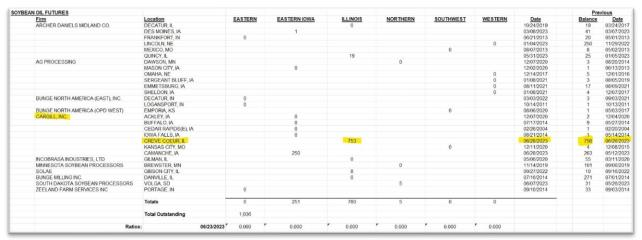

- Final 2023 planted acreage and stocks information released.

- Data was outside range of analyst estimates.

- Soybeans futures spreads soar.

This is a VERY brief note following USDA’s just released shocking final 2023 planted acreage and quarter end grain and oilseed stocks (US inventory) information. The USDA in effect (rolled a surprise grenade into the global oilseed trading arena) issued soybean statistics that caught ALL credible analysts completely by surprise. How do I know that? News media traditionally issues ranges of analysts’ estimates in advance of major USDA reports. Today’s USDA statistics were not in any of the analysts’ ranges; not even close. Soybean oil futures spreads, specifically the December 2023 versus the July 2024 spread, the middle part of the curve that in my opinion represents the DEMAND bull market in agricultural markets (and my oh my has the USDA just changed the equation to a SUPPLY bull market) coming from the renewable diesel industry’s outsized demand for vegetable oil feedstocks, have soared to new highs.

Source: Refinitiv Eikon

Wow!

Wow!

Wow!

The global oilseed situation has changed dramatically!

And Cargill’s delivered soybean oil inventory? Disappearing, slowly.

RD 2.0 is unfolding and now the USDA has changed the equation. Dramatically.

Wow!

Wow!

Wow!