YouTube Insight Focus

- US Soybean oil will remain in a bull market for foreseeable future

- Demand from renewable fuel industry is overwhelming supply.

- Supply is very tight in the next delivery window.

A day like today, a market trading day that precedes a significant USDA report (in this case a World Agricultural Supply and Demand Estimate [WASDE] report but other significant reports include quarter ending Stocks in All Positions [SIAP] reports as well planted acreage) normally features traders catching up on travel and expense reports, human resource performance reviews, and deleting aged voicemails; the day drags along, no concern about the long line at Chick-fil-A on the “quick” run to lunch, and an early departure from the office for a round of golf or fun with the kids finishes the day.

While there is not much for traders to “do” in the often low volume, limited liquidity trading session that precedes the report day it is a good day to put things into perspective in case the USDA decides to insert a statistic bomb into the reports. Traders like to go into reports with a market perspective (there are 3: bullish, bearish, and neutral) but the key to successful trading is to have the ability to change that prereport perspective 4 nanoseconds after the USDA issues the data.

One perspective that likely should not change post the USDA report is the one that I have posted about frequently: the vegetable oil market is and remains in a secular bull market for the foreseeable future. I have named the bull “RD 2.0”. US soybean oil is the most obvious winner and will remain in a bull market for the foreseeable due to new demand overwhelming available supply. The demand comes from the US renewable fuels industry buying US soybean oil to produce biodiesel and renewable diesel for today and sustainable aviation fuel in the future. For evidence of the “bull” let’s update the current state of affairs with help from the Chicago Mercantile Exchange’s (CME’s) publicly available soybean oil statistics.

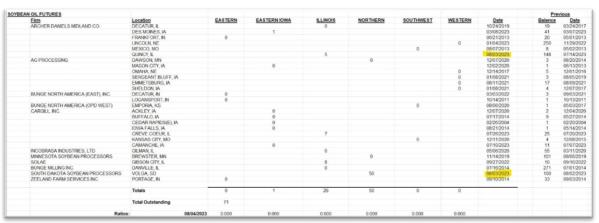

We fundamentalist traders normally begin forming a market opinion first with a review of the current stocks of a commodity sitting in an exchange delivery window, in this case soybean oil but it could be copper or crude oil. As I have noted in prior posts, if commercial entities merchandise a commodity through an exchange (delivery) which is necessarily a publicly documented and recorded event, then their commodity customers and speculative traders conclude that demand in the physical markets has waned to the point that the delivering commercials had no other choice. A commodity processor does not take lightly putting the company’s inventory out for full public display (bearish evidence that physical consumers will turn against the company with demands for lower prices) and the risk that a competitor takes the delivery (stops) and controls the inventory and most importantly the timing of the disposition of the inventory. Often this combination of a commodity producer proclaiming to the public that there is too much physical supply, thus the delivery, and losing control of the supply delivered, it will get disposed of at the least opportune moment for sure, does not pay in the long run: the storage fees earned by delivery to the exchange is insufficient relative to the economic damage to overall pricing power.

There is more to these delivery economics (the pros are rolling their eyes at my brief explanation above) but your time is precious and so is mine and call me for the full two-hour lecture on commodity economics and delivery trading 101.

Now back to the vegetable oil secular bull market. What do we see after a review of the CME’s soybean oil delivery window? Not much. Get it? The Cargill deliveries from May have been executed into the physical markets or brought back to Cargill’s physical inventory (Cargilltook back a lot of their own receipts shortly after delivering them which is still a headscratcher). ADM and SDSP strangely put some inventory into the delivery window and that is currently executing into the physical markets weirdly enough by Cargill and suffice it to say the delivery window features “not much” inventory. That is always a good sign for the bulls. The below table highlights the last changes to the window: 8-3-23.

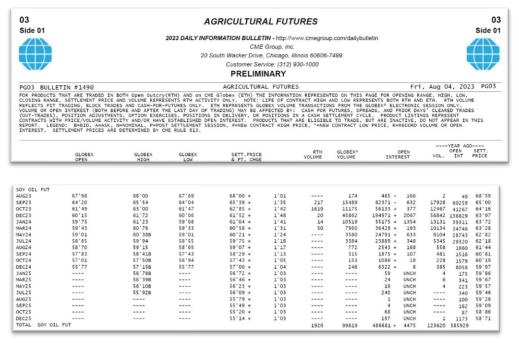

Okay so the delivery window looks nearly empty (and my bet is that it is completely empty in short order) so we go on to the fundament traders’ next most important data input: the futures curve of the soybean oil contract (again, this is a bit commodity trading 101 so this step to the futures curve review would apply to any commodity trade that includes a liquid futures contract with significant commercial participation).

For a secular bull market in any commodity there better be an inverse in the futures curve and looking down the settlement price column below from the CME’s daily bulletin there it is, a completely inverted soybean oil futures curve with each contract into the future LOWER in price than the prior contract. The curve’s economic message reflects demand overwhelming supply and effectively tells the consumer to delay consumption into the future (lower prices) and tells the processor/warehouseman to sell all the inventory today (higher prices), all the signs of a bull market.

The curve displays nearby prices hovering near prices of a year ago (far right column) at the very front of the curve but then current prices steadily become discounted versus a year ago the further out in time on the curve. Huh? A discount in prices versus a year ago with GREATER current domestic demand that is guaranteed to expand given the renewable diesel industry bringing on more capacity. That does not appear to reflect a secular bull market, does it?

There are four quick reasons (again, if you had 2 hours and really wanted to know the full story then we could explore Soy Processing Margins 101 together):

1. The price of the feedstock for processors, soybeans, is much lower versus a year ago given poor US new crop (October-March 2024) export sales due to a record Brazilian soybean crop moving into traditional US export markets PLUS excellent US soybean growing weather so far during the key yield determinant period of August, first half September with ongoing beneficial weather forecasted. Brief aside here: if you are not watching Eric Snodgrass of Nutrien Ag Solutions providing FREE, yes FREE, once again FREE, phenomenal US weather forecasts, and you are a grain trader (or US farmer for that matter), you are really missing out on some seriously detailed meteorology and the opportunity to learn something new every day. The guy has had an incredibly hot hand calling this summer’s very complex maze of twists and turns in the weather and he provides insightful detail on how he arrives at his forecasts. Massive weather shout out to Eric, whom I do not know, but Eric come to Omaha and I’m buying, and also to Nutrien for providing this service. https://www.youtube.com/watch?v=p4qLiQBSefQ

2. Commercials are selling soybean oil at discounts to the spot via their forward crush hedging operations due to excellent margins (cheap soybeans and likely getting cheaper per the above weather comment) with excellent US export soybean meal demand due the Argentine soybean production implosion and subsequent lower than average Argentine crush rates providing a way above average global interest for new crop US soybean meal sales which has contributed to great forward margins. This means commercials effectively sell soybean oil cheaply versus the higher spot futures price given the combined price of purchased soybeans and sold soybean meal and oil provides a profitable margin that is too attractive to pass up.

3. US soybean oil exports have collapsed and will remain “collapsed” for the foreseeable future given the record premium of US prices relative to Brazilian and Argentine soybean oil export prices but more importantly relative to global palm prices, i.e. the function of the market to domesticate US soybean oil for food and biofuel consumption and prevent it from moving into global markets has been achieved at much lower soybean oil prices versus a year ago due to the DISCOUNTS of other oils relative to US soybean oil.

4. This one is a bit of a guess and is more for the pros than the casual readers: it would appear that the renewable fuels industry has purchased a lot of soybean oil (ADM and Bunge earnings calls as the source for that factoid) and fixed the basis but has not priced futures yet as their buying terms are normally price date of shipment, i.e. they take the spot futures price at the time their purchased volume ships from the soybean processing facility (again, if you had 2 hours and really wanted to know the full story we could explore Basis Trading in the Soy Complex 101 together).

Okay, I will finish this “keep centered on the secular bull market for vegetable oils” essay as you traders prepare for the next WASDE report with 3 charts:

1. The spread chart of the September soybean oil futures (next up for delivery) versus the December contract, or the front of the curve. It is a picture of a parabolic, short squeeze panic.

September/December Soybean Oil Futures

Source: Refinitiv Eikon

2. The spread chart of December soybean oil futures versus the July 2024 contract, the middle part of the curve. It is a picture of a market building a base for a sharply higher move that challenges values achieved earlier this summer when those who shorted the soybean oil futures and or the futures curve in anticipation of a bearish market response to the EPA’s finalized RVO for 2023-25 found themselves on the wrong side of a gun.

December/July 2024 Soybean Oil Futures

Source: Refinitiv Eikon

3. Finally, the last step in a fundamentalist traders’ building a market opinion process, a chart of the overall price movement of the spot month soybean oil futures over the last 3 years. It, like the December v July 2024 calendar spread, shows a large base building at a key technical level: the 50% retracement of the explosive move to $.90 per pound that was a feature of a time period of unprecedented increased demand from the biofuel’s industry that I have termed RD 1.0. Per my many recent posts, it is my opinion that the global vegetable oil has now entered into a new secular bull market which I have termed RD 2.0. When does this end?

Dunno.

Spot Month Soybean Oil Futures

Source: Refinitiv Eikon