371 words / 2.5 minute reading time

- Vietnam is importing lots of sugar because their import rules have changed.

- The Government has removed the high-duty import quotas for sugar coming from ASEAN origins.

- Vietnam has already imported 100k tonnes of refined sugar from Thailand this year, topping 2019’s total imports two months in.

The ASEAN Trade Agreement (Association of Southeast Asian Nations)

- Vietnam’s domestic sugar producers used to be protected by import quotas.

- The quotas meant exporters had to bid for import licenses which would allow them to import up to 100k tonnes of sugar before paying 85% duty on it.

- The ASEAN Trade Agreement means the Vietnamese government have had to remove these barriers for ASEAN origins.

- This is the first year Vietnam has allowed unrestricted 5% preferential-duty access for ASEAN origin sugar.

The Surge in Vietnamese Refined Sugar Imports

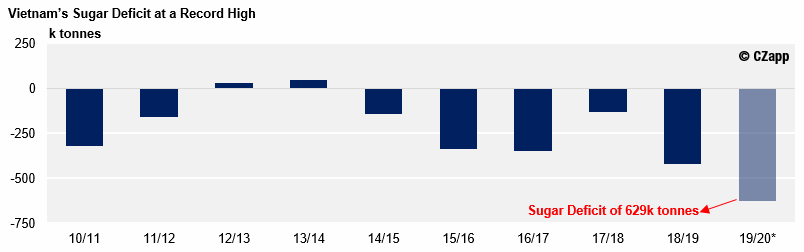

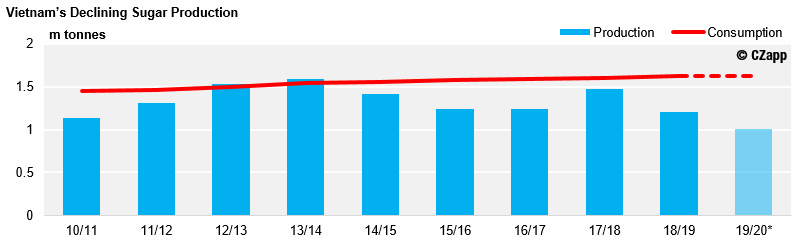

- Vietnam doesn’t produce enough sugar to meet domestic demand.

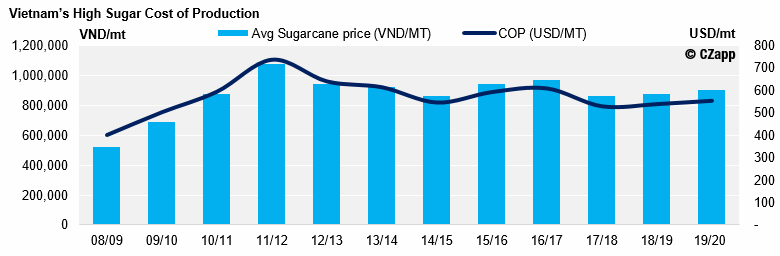

- The cost of production (COP) is high, meaning domestic importers often decide to import from other cheaper origins, such as Thailand.

- Production has been declining almost constantly since 2013.

What Does This Mean?

- Domestic prices could converge with Thai import parity, meaning Vietnamese mills will be operating at a loss.

- We therefore think the Vietnamese government will apply non-quota trade barriers to control the flow of refined sugar imports.

- We currently expect Vietnam to import 300k tonnes of refined sugar from Thailand, but this could extend to 600k tonnes if the Government does not block this new trade as some point this year.

Vietnam’s Sugar Industry Faces Long-Term Challenges

- This agreement could potentially undermine the future of Vietnam’s cane industry.

- This is because Vietnam’s COP for refined sugar is currently around $560/mt, compared to $490/mt in Thailand cost and freight.

- Domestic sugar production has fallen due to lower cane profitability and drought.

- We subsequently anticipate just 1m tonnes of sugar production this season, down from 1.2m tonnes last season.

- With poor cane returns, farmers, particularly in the South are switching to fruit crops like mango and pineapple

- The cane area has thus reduced this season by 18%.