Insight Focus

- Weak soybean futures also dragged US corn and wheat lower.

- American corn FOB offers remain too high.

- Ukrainian corn harvest remains very delayed.

Forecast

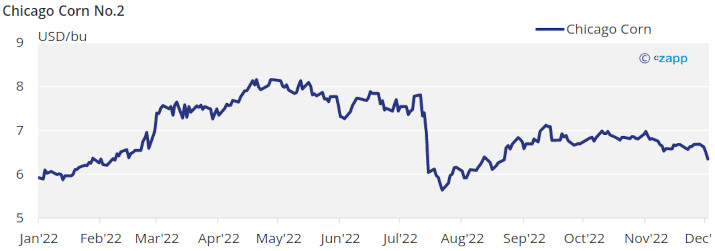

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 5,8 to 6,3 USD/bu with an upside bias depending on Ukraine’s harvest and Argentinian conditions. The average price since Sep 1 is running at 6,8 USD/bu.

Market Commentary

Negative week for all grains in all geographies on good supply data and poor exports data out of the US.

US weekly Corn inspections were sharply lower week on week by the start of last week, same as with Wheat, resulting in a negative start of the week.

By the end of the week, Soybeans plummeted on Environmental Protection Agency (EPA) publishing lower blending mandates and expected and pulling Corn and Wheat lower. It was not official but Reuters published the EPA would propose lower blending mandates on the Biodiesel side which were confirmed later by the EPA.

But the biggest problem for US Corn last week were FOB prices as it is too expensive vs. other origins, especially Brazil and that was seen in export inspections and rumors of China having booked some cargoes out of Brazil. Also Black Sea prices are more competitive than US price hence the downward pressure last week.

By the end of the week, Soybeans plummeted on Environmental Protection Agency (EPA) publishing lower blending mandates and expected and pulling Corn and Wheat lower. It was not official but Reuters published the EPA would propose lower blending mandates on the Biodiesel side which were confirmed later by the EPA.

But the biggest problem for US Corn last week were FOB prices as it is too expensive vs. other origins, especially Brazil and that was seen in export inspections and rumors of China having booked some cargoes out of Brazil. Also Black Sea prices are more competitive than US price hence the downward pressure last week.

The USDA forecasted a 20% growth in Brazilian Wheat production making an all time high.

India is expected to increase their Wheat planting area by 15% due to very remunerative prices and their increasing participation in export markets as they have benefited from sanctions on Russia.

The EC lowered their Wheat production slightly by 206k ton to 127,9 mill ton.

In the weather front, cold weather and rain/snow are expected in the US while Europe is expected to remain cold too, but dry with just some rains in the south. South America is expected to receive good rains. The doubt comes for European Wheat which should not have developed winter protection and could suffer from freezing temperatures.

The trade flow out of Ukraine is suffering from delays in the inspection process done by Russia. But apparently there are no major problems and the corridor continues working.

We now have Wheat planting finished in almost all areas of the northern hemisphere as well as Corn harvesting virtually finished. Ukraine represents the biggest risk in terms of Corn supply as on top of having planted less area, harvesting activities are very much delayed and all is pointing they will not be able to harvest all their Corn. In the southern hemisphere, only Argentina is looking not so good for Corn planting. Winter killing for European Wheat is another potential risk on the supply side.

We have the December WASDE this week Friday which should bring some volatility as players position themselves ahead of the report. This will dominate price action this week. We don’t expect any surprise from the WASDE.