622 words / 3 minute reading time

- Will the coronavirus cause demand erosion or not?

- Weather concerns hit crop expectations in the Northern Hemisphere.

- Uncertainty reigns…

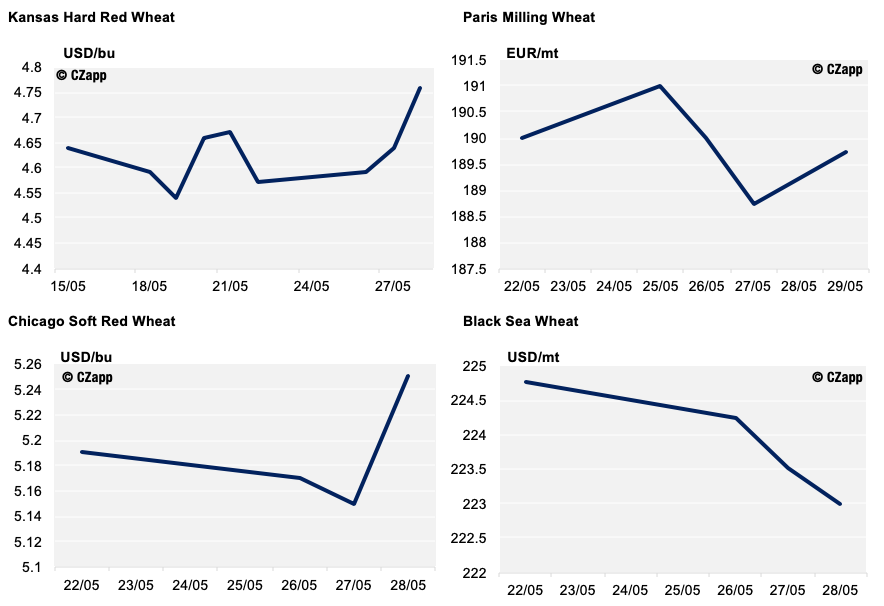

The Key Markets Over the Last Two Weeks

The wheat market has had its ups and downs over the last couple of weeks and is very much in limbo land while sense is made of the price contradicting news.

Falling production estimates around the globe, coupled with economic reports suggesting there will be no money to buy anything in 2020 and beyond, are making any price trend a difficult one.

Buyers and sellers are looking at what will be the overriding driver for this market.

Coronavirus and Wheat Demand

China and news on their economy has made for some interesting reading recently. They have over 50% of global ending wheat stocks this year and it looks to continue to 2021 with end stocks up from 150mmt to 160mmt.

The Chinese state would like us all to believe that their economy is strong and will remain so regardless of the rest of the world, where unemployment soars, economic output slumps and recessions seem inevitable.

As China is the world’s largest wheat producer and consumer, the wheat market needs China’s economy to be strong, or at least stable.

The Chinese state say they will comply with the ‘Phase One Trade Agreement’ with the US. However, the US administration seems unimpressed with China, whether it be in relation to the handling of the coronavirus or Hong Kong.

All this leaves the state of demand in China uncertain, whether it be the economy or trade dispute woes.

We have mentioned previously that Egypt is looking to increase their stockpiles of wheat to ensure food security for the nation. So far, the Government has procured over 3m tonnes of the 3.6m tonne targeted from their domestic harvest.

As the world’s largest wheat importer, prices need a demand story in order to rise, and if Egypt complete the 3.6m tonnes of domestic purchases, international tenders thereafter may help spark more enthusiasm from the sellers.

In the meantime, the absence of Egypt as a buyer keeps the Black Sea export restriction issues, that we have previously discussed, a backseat news story.

Wheat Crop Weather Issues

The last couple of weeks have seen some significant crop reduction estimates from the major exporters.

Earlier this month, Russia was reportedly looking at a wheat crop of up to 84m tonnes. This week, it has been revised down to 76-77m tonnes, due to the warm and dry season.

Ukraine, with similar weather to Russia, has seen their wheat estimates drop from 28m tonnes to as low as 23.3m tonnes this month.

Europe, including or excluding the UK, has seen crop expectations fall by some 10-15m tonnes from 2019’s 154m tonnes of production.

Conclusions

There are many stories pulling the wheat market in either direction, depending upon your stance as a ‘bull’ or a ‘bear’.

The demand situation is far from known. While uncertainty remains until we are the other side of the coronavirus pandemic and economic issues are more understood, it will be difficult to assess what the global trade will eventually be.

Supply and wheat crop sizes are changing by the day, with farmers to processors watching the weather forecasts. Given the proximity of the Northern Hemisphere harvest, which has begun in places, the picture should become clearer over the coming weeks.

We have had ups and downs these last couple of weeks. Some certainty as we, hopefully, start to exit the coronavirus epicentre, combined with more confirmed harvest figures, may yet start to give us all greater direction for the 2020 wheat market.