618 words / 3 minute reading time

- Prices have been under pressure with Northern Hemisphere harvest beginning

- Buyers are gently appearing with tenders for wheat as price support levels are in sight

- What will influence the market over the coming few weeks?

The Recent Wheat Market

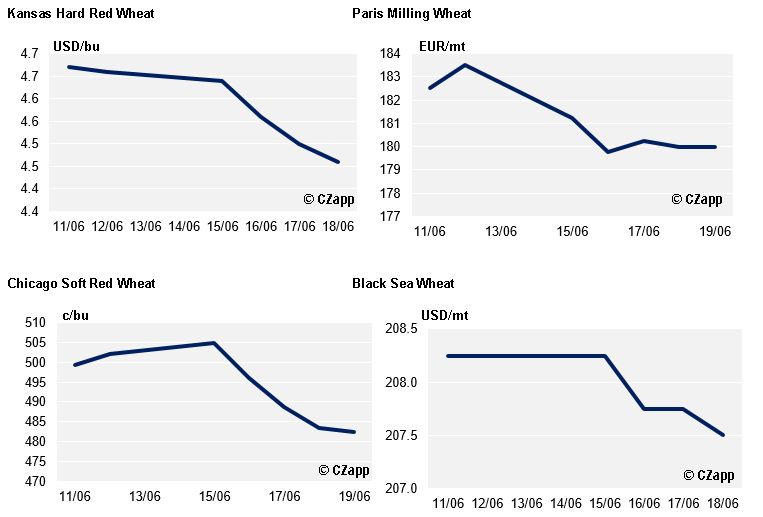

There has been little to support the wheat market over the last week, with favourable weather for the 2020 wheat crop in most corners of the World. This has led to a continued slide in the major futures market prices.

There is much uncertainty, as we have discussed previously, with regards the upcoming crop. However, the good conditions have encouraged the funds to go short and with record global wheat stocks predicted by the USDA WASDE report last week, the market needs something to stop the downward slide.

Harvest Begins

In the US the harvest for 2020 has begun and reports are variable. We have heard that in the HRW areas in the South yields started off poorly but are picking up, with bushel weights generally good but protein on the lower end of expectations. In the SRW areas yields have been a little disappointing but there is a long way to go and the

next couple of weeks will start to give a much clearer picture of what we can expect from the crop as a whole.

We await the European harvest with interest given the contrasting estimates that have recently been published, as mentioned last week.

Buyers Looking Around

With the fall in prices we are starting to see more action from some of the World’s big buyers, especially in Africa.

This week has seen another tender by Egypt, who bought 240,000mt yesterday. 120,000mt from Russia and 60,000mt from each of Ukraine and Romania. There were more offers than last week’s tender and the price was a few dollars higher.

We note the following other wheat tenders this week, among others:

- Thailand 240,000mt

- Tunisia 176,000mt

- Jordan 120,000mt

- Ethiopia 400,000mt

This suggests that as we near technical price support levels and even contract lows, buyers will return to look for wheat.

To add to the mix there have been reports that China have been enquiring about wheat prices over recent days.

France, who have had an active year relative to past performance in shipments to the World’s most populous country, have noted interest.

The US Hard Red Wheat is also a potential target for the Chinese. The Phase One trade agreement signed in January is still a talking point and wheat purchases are certainly on the cards.

On the exporters side of things, Russia have this week stated that there will be no export restrictions placed on wheat for the first half of the marketing year 2020/21. The situation will be reviewed towards the end of 2020 heading into 2021.

With Australia looking at a large 26mmt wheat crop at the end of the calendar year, this Russian news looks like prompting the Black Sea to be, as is often the case, aggressive sellers in advance of the Australian harvest.

What Next?

As harvest gets rolling across the US and Europe over the next couple of months, we will get a much better grasp on supply and the inevitable price impact.

Will buyers support this market at current levels following the big drop we have seen? Technically it looks like the market is in a price range, at which we now find ourselves at the lower end, so maybe.

Lastly, will we see Global Coronavirus cases slowing down, or a second wave as lockdowns ease? The answer to this question will possibly be the most significant!