Insight Focus

We’ve hardly left El Niño behind and there’s already talk of La Niña taking over. While the likelihood of its occurring is increasing, there is no consensus on when and how strong it could be. From a Centre-South Brazil perspective, we worry on what impacts could have on cane – or the bottom line, sugar.

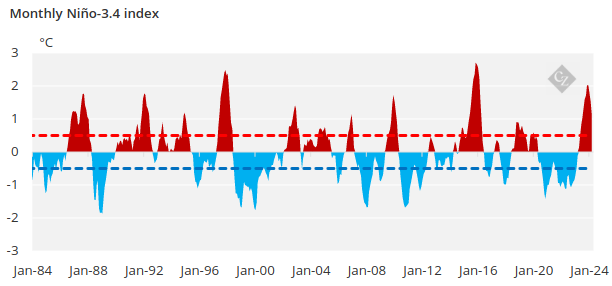

It is official. According to the United States National Oceanic and Atmospheric Administration (NOAA), the El Niño is coming to an end. Now the issue is whether we will see a neutral phase lasting until October, or if the world will go through a La Niña starting in June.

Source: NOAA

The occurrence of a La Niña in CS Brazil will have impacts on this and/or next cane season. See below on what to expect.

What is The Probability?

The meteorological models have been diverging around the predictions of when to expect a La Niña to occur. So, we asked our in-house expert, Wesley Pavan (CZ Energy Manager) for more details.

What do the meteorological models show?

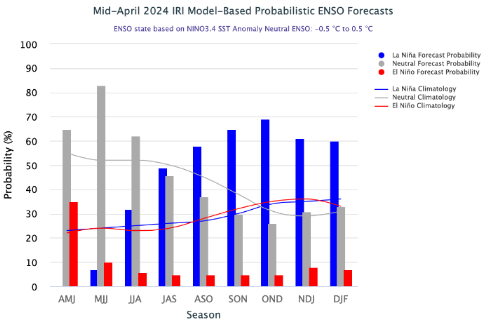

WP: The European model (ECMWF) has showed reduction in the sea surface temperature (SSTs) to a neutrality level or even a weak La Niña. Meanwhile, the American model (CFSV2) is pointing the risk of a strong La Niña. But both are forecasting an occurrence in September.

Which is the best to follow?

WP: Typically, the American model is more reliable for this type of prediction. However, since they are diverging, it may lead some to assume that the probability of La Niña occurring is slightly lower or delayed.

Even if they are diverging, are we safe to assume that we should see La Niña influence in 2024?

WP: Yes, we believe that the change from neutrality to La Niña will likely impact rains from October onwards, when the wet season starts in Brazil.

Given that a La Niña is expected in Q4, winter in CS Brazil should not be marked by extreme frost occurrences?

Source: IRI

WP: Yes, even the IRI (International Research Institute for Climate and Society) has shown a significant reduction of the likelihood of a La Niña for June-July-August. So, the risk of frost occurring in an intensity that could damage large cane areas should be lower.

What Is the Impact in Brazil?

First, we need to recap the impacts of a La Niña on each region of Brazil. The South part of the country tends to be colder and with less precipitation than normal. For North and Northeast regions above-average precipitation is observed.

However, the CS region (where cane is grown) is a transition zone and the La Niña phenomenon does not have a characteristic pattern of change in temperature or precipitation. It will depend highly on the intensity of the event.

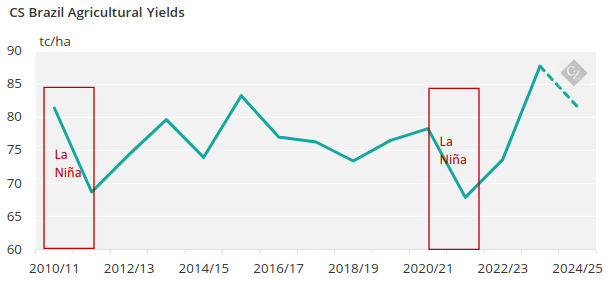

But we must keep an eye, nonetheless. Taking as a reference the latest La Niña events that took place between 2010-2012 and the most recent in 2020, the drought was felt in the region, impacting the agricultural productivity of several crops – including sugarcane.

What Does It Mean for Cane?

Since the models are showing a higher probability of La Niña from Q4 onwards, winter in CS Brazil (June-August) is expected to be within normality, i.e. no extreme frosts.

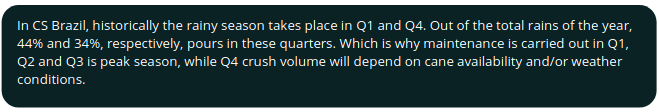

With a probability of less rains from October onwards, it would benefit mills crush in 2024/25. Depending on cane availability, mills could crush well into December – much like last year.

However, it does raise a red flag for 2025/26 season. If it rains less than average in Q4 and Q1, cane development will be affected leading to lower agricultural yields. While our balance currently works with 618m cane crush and 42.3m tonnes of sugar output for 2025/26, a La Niña event could reduce production estimates for next season. On average, 10m tonnes less of cane could reduce sugar production by 700k tonnes.