Insight Focus

- Chinese demand for imported liquid sugar has rebounded over the last year after plunging in Q1 2021.

- Regulation may be eased due to a lower-than-expected 2021/22 sugar crop and high sugar prices.

- Surging costs of ingredients and logistics may encourage consumers to seek cheaper substitutes.

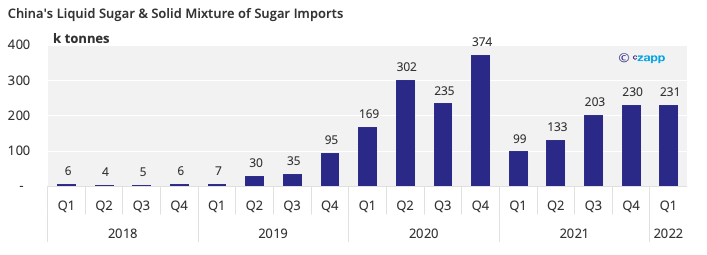

4th Consecutive Increase of Chinese Quarterly Liquid Sugar Imports

- Chine imported 231k tonnes of liquid sugar and solid sugar mixtures in Q1 2022, 2.3 times more than a year earlier.

- There seems to be little intervention on the part of the authorities, unlike in Q1 2021 when imports shrivelled to 99k from 374k tonnes in Q4 2020.

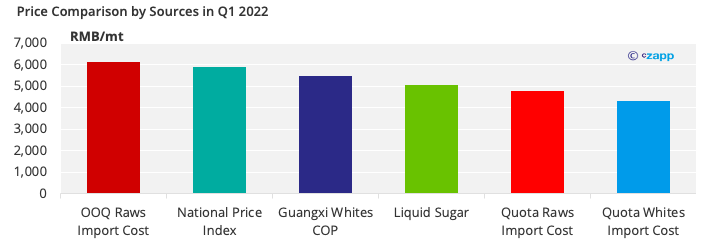

- Unless someone turns off the tap, liquid sugar has a clear price advantage.

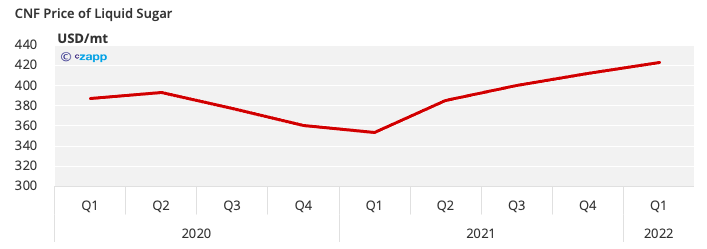

- The average CNF price was USD 423/ tonne in Q1, up from USD 354/tonne a year earlier.

- It’s still below the out-of-quota (OOQ) import price of raw sugar.

- Its import cost is around RMB 5,000/tonne (USD 741/tonne) on a dry basis, 14% lower than the average domestic sugar price, and 17% cheaper than the OOQ raws imports.

- This is because the import duty on liquid sugar is zero compared with 50% for OOQ raw sugar

- Quota imports are subject to a lower duty, but the volume is limited to 1.945m tonnes and it’s allocated to designated importers.

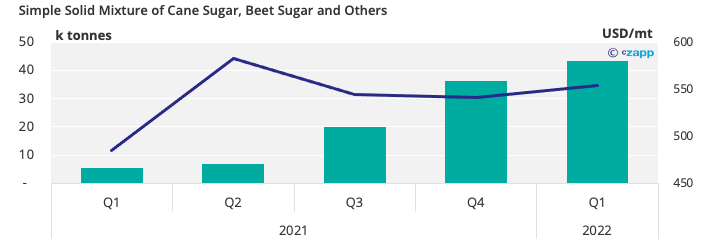

Something New: Solid Mixture of Sugars

- A new product has entered the market with an even greater price advantage – a solid mixture of sugars.

- An example of this is a mixture of 80% crystalized sugar and 20% glucose.

- It’s cheap because it pays zero import duty, and it doesn’t have the short shelf-life of liquid sugar.

- The volume is small but growing.

- There are reports that new plants are being built in the Free Trade Zone to produce sugar mixtures.

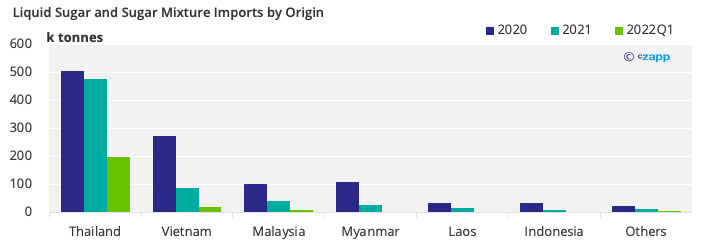

- 85% of imported liquid sugar and solid mixtures came from Thailand due to the recovery in its 2021/22 crop.

End Users Seeking Lower-priced Substitutes

- Demand for lower-priced “sugar” is increasing because end-users have been hit by a surge in the cost of ingredients, energy, logistics and labour.

- For example, a biscuit usually consists of wheat flour, sugar, eggs, butter, and salt.

- Over the past 12 months, domestic wheat prices have soared 27%, the butter price has more than doubled and the ex-factory sugar price has risen 5%.

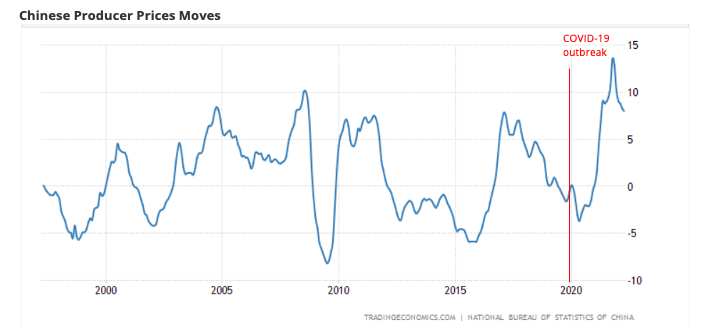

- China’s producer price inflation has been falling back since it peaked at 13.5% year on year last October.

- It reflects the government’s efforts to control surging commodity prices and a power crunch.

- However, the latest figures represent the 16th straight month of increases in producer prices, reflecting a jump in the cost of raw materials and power because of Russia’s invasion of Ukraine and persistent supply chain disruption.

Logistics Costs Surging: Interrupted Truck Driver Mobility

- Consumers are also trying to manage costs and secure supply on the logistics side.

- Some are switching a proportion of their inbound transportation to ships from trucks in case truck drivers become stuck on the roads for days.

- Transportation by sea is usually cheaper as it takes longer than by road.

- Road freight rates have surged because the availability of truck drivers has fallen, and journey times have lengthened due to the expansion and tightening of coronavirus restrictions in some key cities.

- China has 17.28 million truck drivers who move 74% of its freight.

- This is a true story. A truck driver has been living in his cab for nearly 27 days due to his flagged trip code during the Shanghai COVID outbreak this April.

Concluding Thoughts

- The risk of official intervention on liquid sugar imports is probably diminishing.

- We think it unlikely that the government will reduce supply given strong producer-price inflation due to cost pressures and persistent disruption to supply chains.

- The demand for liquid sugar and solid sugar mixtures should be sustained because consumers are trying to manage their costs.

- Therefore, we expect a stable inflow of liquid sugar and sugar mixtures for the rest of the year.

- There is a risk the Ministry of Commerce could move to address complaints from the domestic sugar industry about liquid sugar and sugar mixtures.

Other Insights That May Be of Interest…

Should CS Brazil Fear China’s Sugar Self-Sufficiency Drive?

China’s Sugar Self-Sufficiency Drive Hits Eucalyptus

China’s Coldest Spell in 45 Years Hits Sugar Production

Explainers That May Be of Interest…