Insight Focus

- There’s concern over Centre-South Brazil cane yields following dry weather.

- The new season’s cane crush will be smaller than last season’s.

- Can a higher allocation towards sugar compensate for the cane shortfall?

Story headlines usually grab attention with the outrageous claims, often not fully backed up in the article. This is a major risk for any article in the coming months which looks at cane crop progress in Centre-South (CS) Brazil, the world’s largest cane region. We wonder what will dominate the news: lower cane crushing or strong sugar output?

Less Rainfall

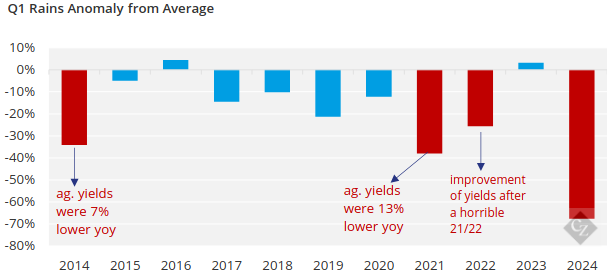

The first quarter of the year is basically done, and we can now confirm that in this period it rained less than 60% of the normal for the period.

It is the worst volume of rains in the past decade. Can it be blamed on El Niño? In part yes. However, since CS Brazil is a transition zone, in years of El Niño occurrence the impact is not so straightforward.

Looking at the chart above, one might think that a catastrophe is imminent for the CS Brazilian cane in 2024/25. However, we cannot forget that the initial threshold is a record…

Record Starting Point

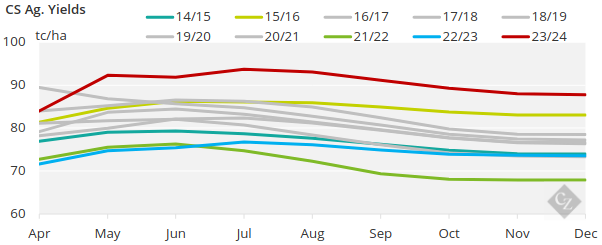

Last year was perfect. Not only were rains excellent in Q1, but throughout the year rains distribution was favourable for cane development. As a result, agricultural yields reached an average of almost 88 tonnes of cane per hectare (tc/ha), which is a record for CS Brazil.

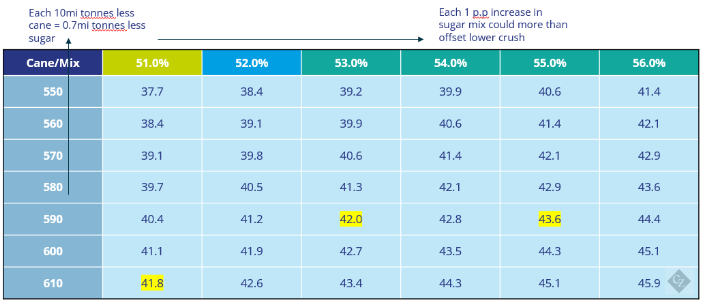

So, even with lower rains this quarter, the starting point for ag. yields it is extremely high. Our initial assessment points to TCH (tonnes of cane per hectare) falling around 7%, down to 82tc/ha. At this level, the cane crush in 2024/25 could easily reach 610m tonnes.

Assuming a higher impact, over 10% reduction in TCH, the cane crush could fall to 580m tonnes. This would be 70m tonnes lower than the previous season. The only other time we saw such a swing in cane crush was from 2020/21 to 2021/22.

But even with a massive reduction in volume processed, should we expect the same for sugar output?

Investments in Crystallization Capacity

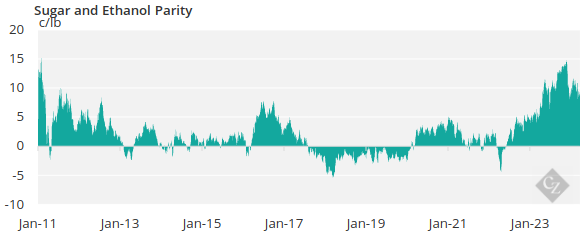

Sugar has been offering higher returns than ethanol since 2022. And each month, the gap has become wider. Since the start of 2023/24 season, this difference has not been lower than 500pts (5c/lb).

Producers have been investing in increasing crystallization capacity as far back as 2022. Either adding sugar plants to existing distilleries or investing in improvements to increase production flexibility to sugar. Discussing in terms of sugar volume is tricky because it will depend on volume of cane crushed.

But one thing is certain, part of the investments was already put into use last season. The sugar mix went from 45.85% in 2022/23 to 48.81% in 2023/24. And this with a record volume of cane crushed… in fact, doing a simple exercise, if the volume of cane crushed is 590m tonnes, to produce the same amount of sugar as last year the sugar mix would have to be almost 53%.

We stress that this is an extremely simplified exercise on the production in CS Brazil, there are other variables such as sucrose content, pace of operations, days lost, etc. that will have an impact on overall sugar output.

Enough to Offset Less Cane?

One thing is given, there will be less cane in CS Brazil this season. However, more investments have been made last year to begin this upcoming season, so a higher sugar mix is a reality. Are they enough to offset a lower crush?

We believe that considering the investments made in crystallization capacity over the past couple of years, depending on the volume of cane crushed there is a risk that CS Brazil could establish another record in sugar production.

What will the headlines read? Less cane or same sugar?