Insight Focus

- Wheat prices have been in freefall for some considerable time.

- Prices have more than halved since the highs in May 2022.

- What does this mean for the market?

The global wheat market has experienced an incredible couple of years. As we approach the second anniversary of Russia’s invasion of the Ukraine, we have seen unprecedented volatility coupled with record highs.

The market is now seeing price lows not seen since the summer of 2021.

Assessing where values are likely to go from here is somewhat of a minefield but gives fascinating food for thought.

Historical Wheat Prices

The charts below summarise the seemingly never-ending fall of wheat prices that have continued since the highs of mid-May 2022.

However, the declines of recent weeks are notable due to the fact that they have not been driven by mad rushes of sellers from the farm producers. Rather, the lack of enthusiasm from all parties has just allowed funds to run their currently significant short positions, keeping the pressure on values.

For more on short and long positions, see our handy guide on how the wheat futures market functions.

It is intriguing to assess wheat values at their current levels and determining what happens to the market over the coming months.

Chart 1 – London feed wheat futures (May ’24) last 12 months

Chart 2 – Paris milling wheat futures (May ’24) last 12 months

Chart 3 – Chicago soft red wheat futures (May ’24) last 12 months.

Source: Barchart commodityview

Potential drivers of the next price move

Looking at the most likely factors to drive values from here, it is useful to consider both the short and long term.

Short term

There has been a material drop in prices over recent weeks.

Funds hold short positions in wheat. Many of these will be making good profit, since they were likely in place since prices were considerably higher.

For the analysts looking at the market charts technically, there is evidence that the market is oversold. This could produce a rally in prices in the near term.

On the physical wheat market, buyers have been in the luxurious position of sitting out of the market, watching it get cheaper by the day. A continuation of this trend will allow them to buy hand-to-mouth as needed, until such time as they are persuaded otherwise.

Long term

The global supply and demand outlook raises some questions around today’s wheat values in the months to come.

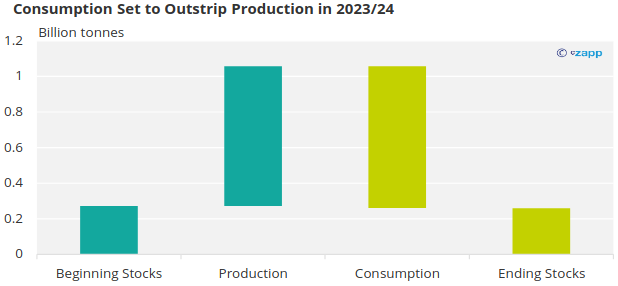

According to the latest USDA WASDE monthly report, world production estimates are not keeping pace with consumption.

Source: USDA

As demand outstrips supply, global stocks of wheat are falling, with a drop of 11.77 million tonnes this year.

Farmers are seeing their lowest prices for three years, while costs are notably higher. Many will say that there is little or no margin in wheat growing at current levels.

Conclusions

Although technically markets are due to bounce, this either requires funds to start buying in their shorts to realise profit and/or users to come to the market buying up cheap wheat.

Prices therefore could drop further before this rally occurs. It is however, almost certainly going to materialise in the short or medium term.

Farmers will remain reluctant sellers until they see profitable prices, which will require a rally.

Weather will always have its impact, but wheat crops for 2024 have many hurdles to overcome before reaching harvest. There is little to suggest a huge reversal for the fortunes in world wheat stocks this year.

Encouraging farmers to produce greater volumes while profitability is marginal is a lost cause. Prices will have to rise to have any real impact on global production and thus stocks.

As is often the case, in the short-term prices could go up or down. However, unless harvests in 2024 surpass expectations it is hard to see prices continuing the bear trend for much longer.

The potential for significantly higher prices far and away outweighs the probability of a huge price decline from where we see values today.

The prospect of the bulls returning to drive a price rally by mid to late 2024 is very real.