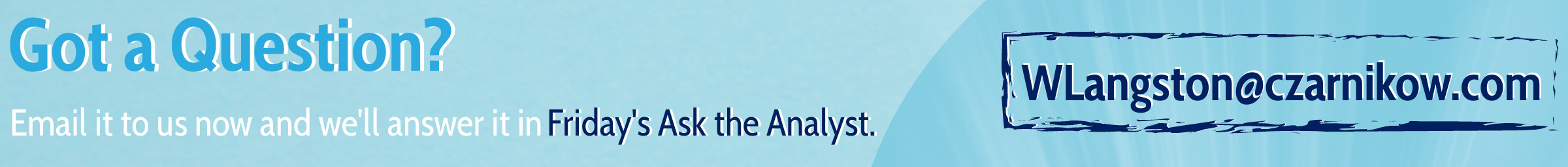

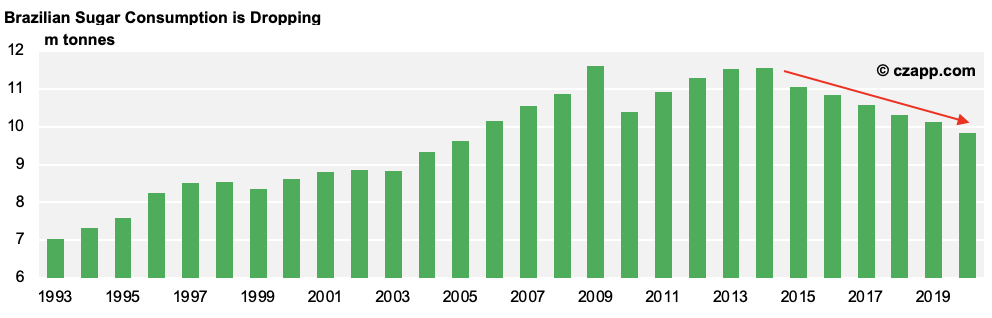

- Brazilian sugar consumption has been falling for almost a decade.

- This is probably due to increased consumer awareness of sugar intake.

- What happens in Brazil is important for the wider sugar market; Brazil is the world’s largest sugarcane grower.

Brazil Consumes A Lot of Sugar…

- Brazil is one of the world’s largest sugar consumers on a per capita basis.

- The average Brazilian eats around 125g sugar per day.

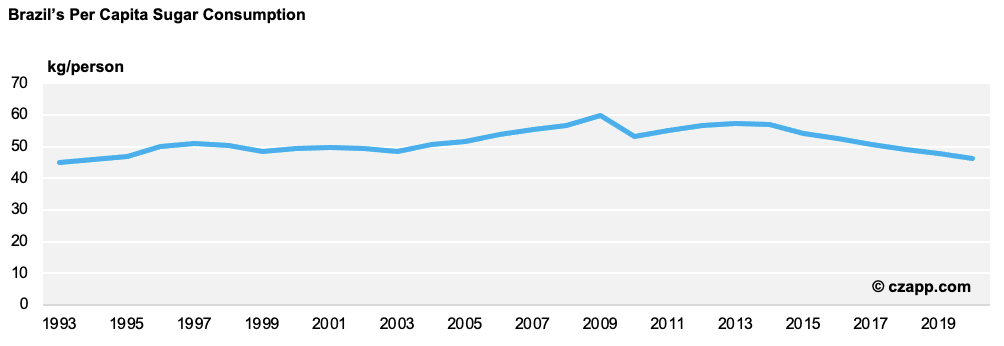

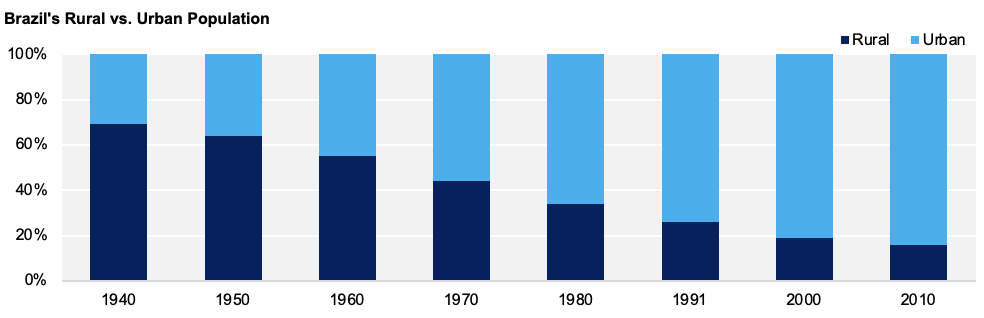

- Sugar consumption tends to be driven by urbanization, wealth and cultural factors (sugar producing regions tend to eat more sugar than those which don’t have a cane or beet industry).

- These factors are significant in Brazil, which is a rapidly developing economy and the world’s largest sugarcane grower.

- In addition, more than 84% of Brazil’s population lives in urban areas.

- This correlates with increased sugar consumption as urban areas are home to more places where the consumption of sugary products is common (bars, restaurants, cinemas, etc).

- Residents in these areas often earn more as well, meaning they’re perhaps more likely to justify spending money on non-essential, yet enjoyable, products.

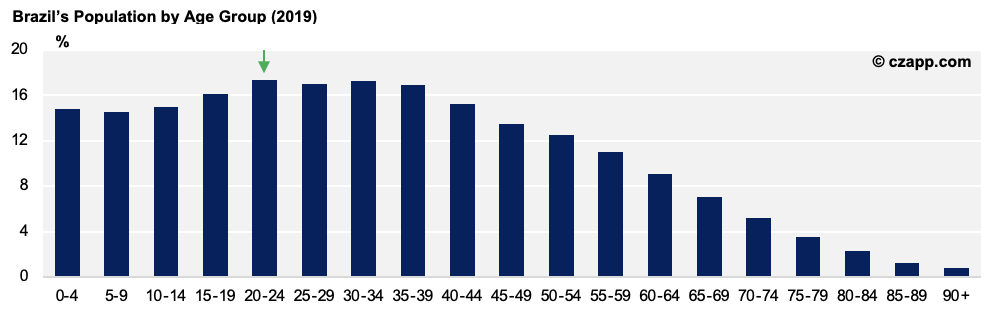

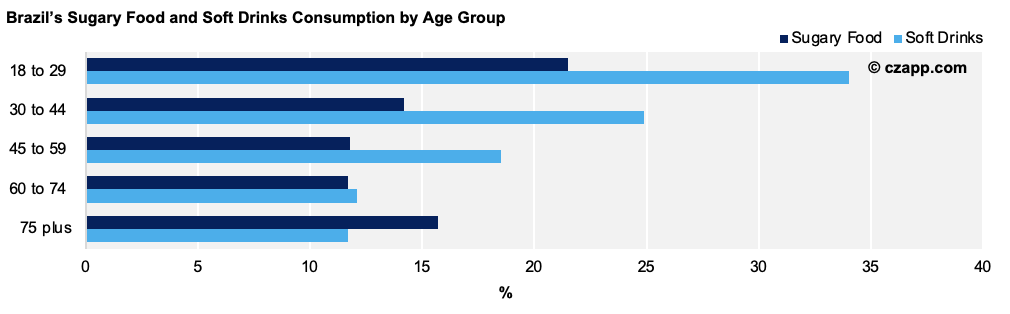

- Urbanisation aside, Brazil’s population is quite young compared to other countries, with more than 68% of its population under the age of 44 (as of 2019).

- In most countries sugar consumption reduces with age, perhaps because tastes change as people move from childhood to early adulthood to late adulthood.

But Consumption is Dropping…

- Brazil’s sugar consumption peaked more than a decade ago and is now falling.

- Per capita sugar consumption has been falling in developed economies like the UK and Australia for decades, but it now looks to be falling in many of the world’s major sugar producers (see our previous articles on Mexico and Thailand).

- We think that this is linked to increased consumer awareness of their sugar intake.

- In Mexico and Thailand, this is perhaps because well-publicised sugar taxes have been introduced.

- But Brazil hasn’t introduced sugar taxes, which suggests that increased awareness of sugar intake can take hold in any country.

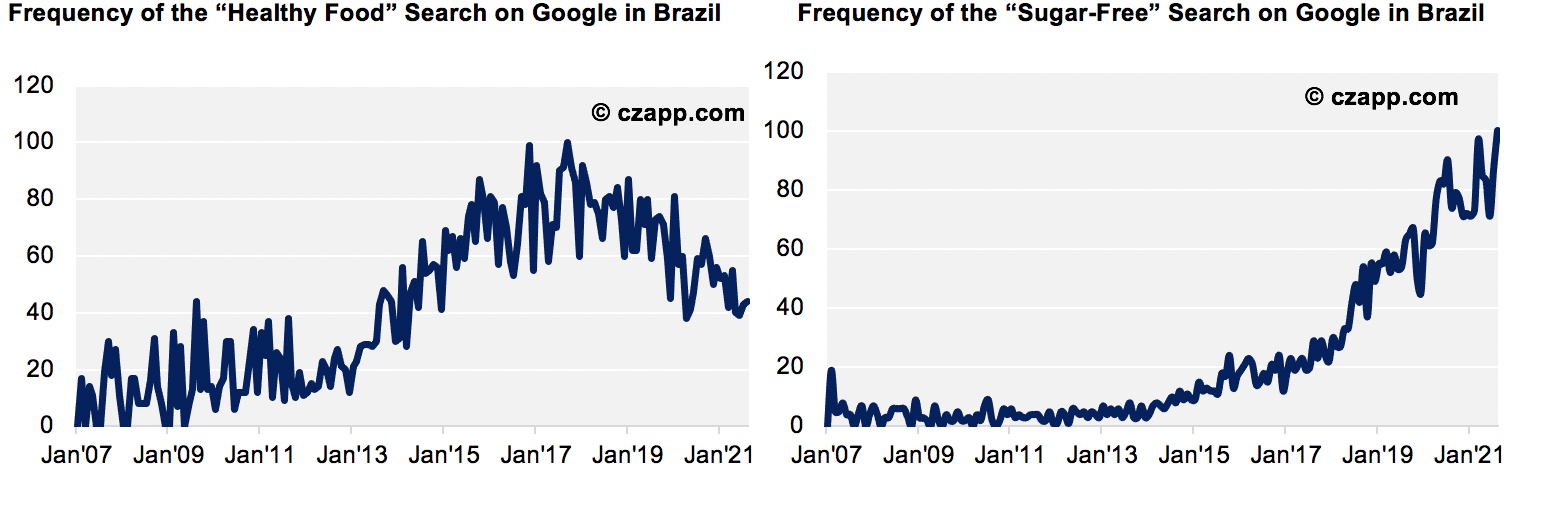

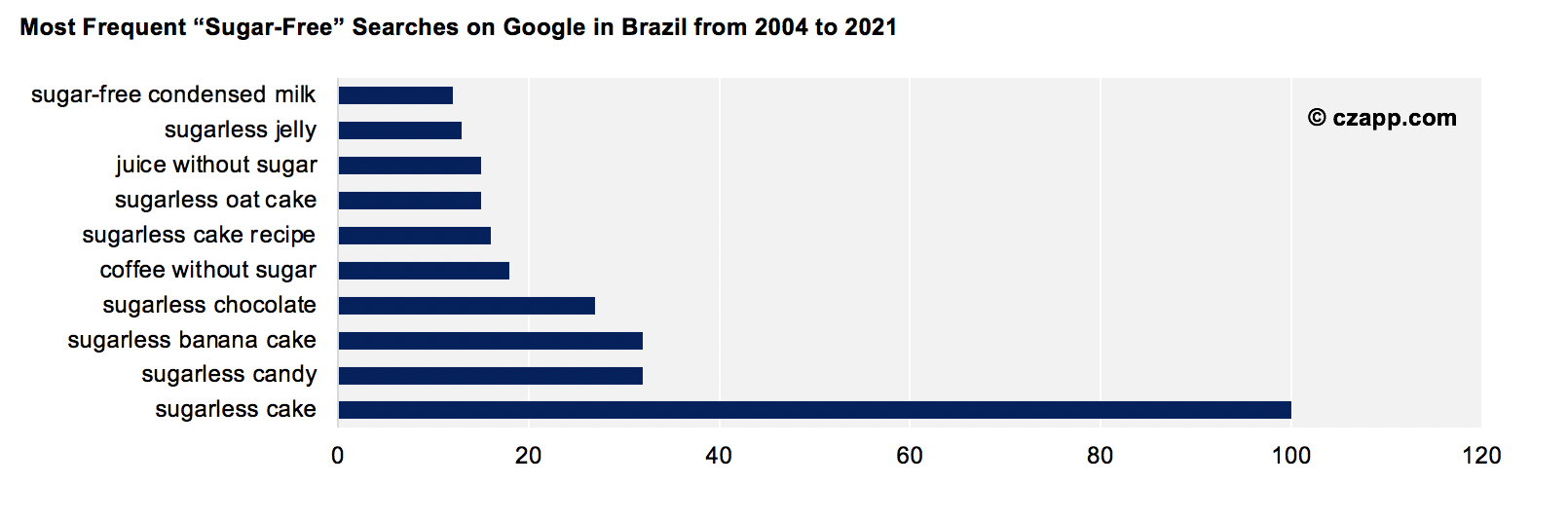

- We can see the increased awareness by looking at Brazilian Google searches since the peak in 2009-14.

- Upon closer inspection, it’s clear that more people are now looking for sugar-free versions of Brazil’s most popular desserts. What’s Driving the Change?

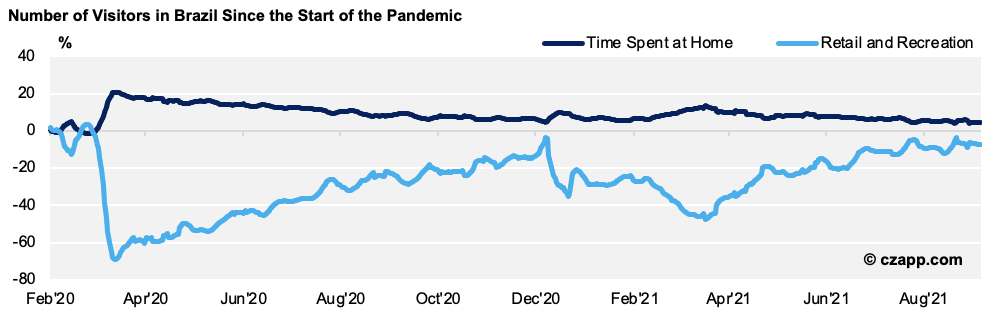

- In this environment, the COVID crisis has acted as an accelerant.

- With the hospitality industry out of action due to COVID-induced lockdown restrictions, out-of-home sugar consumption took a serious knock.

- Although people were still consuming sugar at home, they weren’t consuming enough to make up for the losses elsewhere.

- COVID aside, Brazil’s Ministry of Health is also promoting healthy eating habits, discouraging high salt and sugar intake.

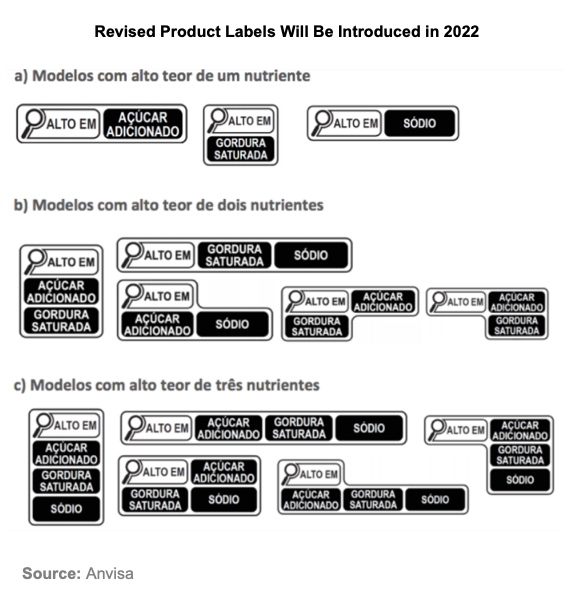

- In October 2022, it plans to intensify the labelling on products that contain large amounts of sugar, fat, or salt.

- Through doing so, it hopes consumers will think twice before purchasing such a product.

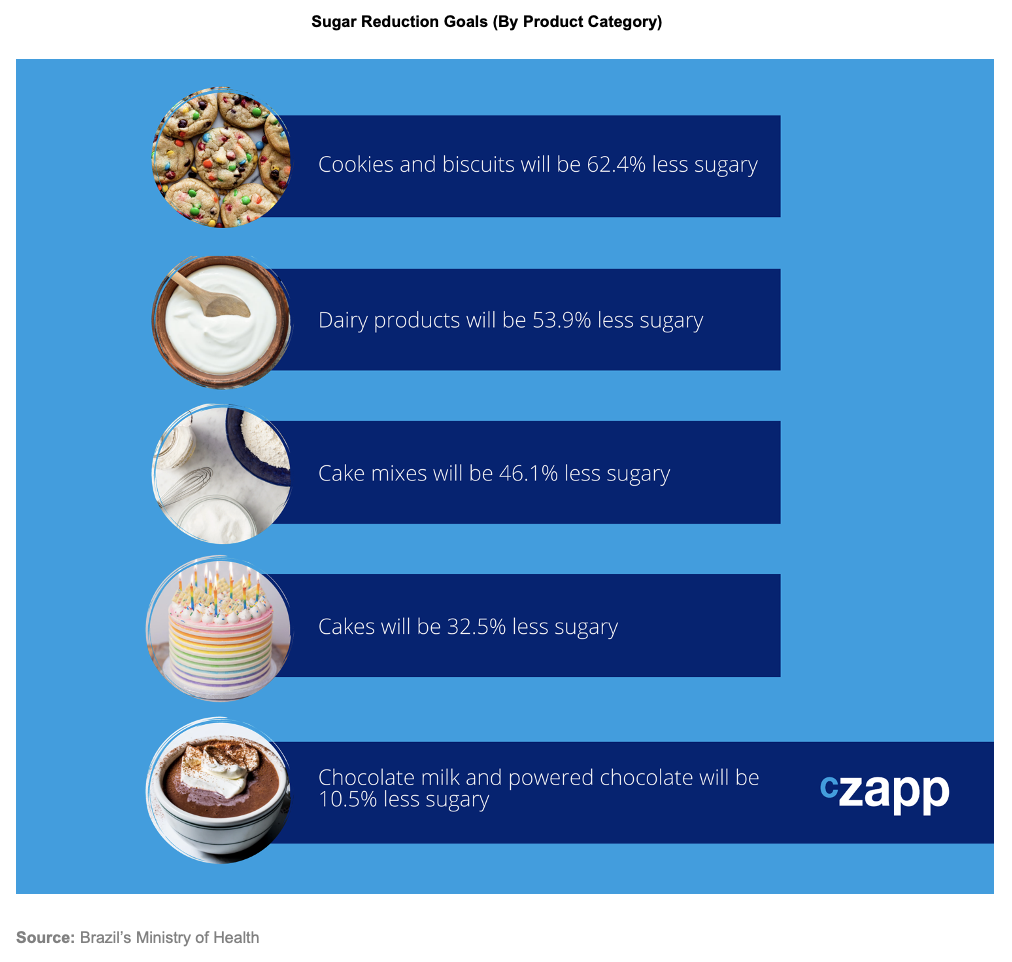

- The Ministry of Health is also encouraging food and beverage producers to reformulate their products before the new labels are rolled out.

- In an ideal world, it’d see 144k tonnes less sugar going into the following products by October 2022: cake mix, dairy products, sugary drinks, and biscuits.

- However, removing sugar from these products is not as simple as it sounds:

1. Sugar Provides the Sweet Taste

Consumers find sweet tastes pleasant, so producers can be reluctant to remove it from their products. This applies to those that produce savoury products too, where sugar can help balance out the other flavours.

2. Sugar Attracts and Retains Moisture (It’s Hygroscopic)

This means sugar can act as a preservative, as it’ll draw moisture out of bacteria, slowing growth. It also contributes to a pleasant mouthfeel.

3. Sugar Adds Bulk

A cake without sugar is a flat and sad affair.

4. Sugar Caramelises

This helps cereals and biscuits to crisp, helps crust formation in bread and gives baked goods an appealing brown colour.

- Product reformulation is therefore quite tricky; all the above benefits could be lost if producers reduce the amount of sugar in their products.

- However, there’s no doubt that new food labels and reformulation will drive even more consumer awareness about their sugar intake.

Are Sugar Taxes a Possibility?

- The Federal Government’s economic team is currently assessing various proposals for sugar taxes, but nothing concrete has been decided as of yet.

- As it stands, it seems any new sugar tax would replace the current ‘IPI’, which taxes almost all goods that are imported or produced in Brazil.

- It’s still early days, with any proposal likely being revised several times, so we’ll keep an eye on how things progress.

Final Thoughts

- Brazil is the world’s largest sugar producer and so falling consumption has wide implications for the sugar market.

- Some of the sucrose, which would have been used to make white sugar for human consumption, can instead be made into raw sugar for export, increasing global sugar supply.

- Alternatively, the spare sucrose could be turned into ethanol for Brazilian motorists.

- Taken together, our recent analysis of Mexico, Thailand and Brazil shows that sugar consumption is shrinking in many countries around the world, not just some of the most highly developed economies.

- While everyone in the sugar market now accepts it’s not a fast-growing sector, it’s possible that sugar consumption may not be growing at all.

- We’ll continue to investigate other major sugar consuming regions in the near future, including India, the world’s largest sugar consuming nation.

- Returning to Brazil, we’ll continue to monitor new developments in the future.

- It’s interesting to note that the proportion of obese people over 20 in Brazil doubled between 2003 and 2019 (going from 12.2% to 26.8%).

- It’s not yet clear if falling sugar consumption will lead to improved health outcomes; this is something else we will follow.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…

- Czapp Explains: CS Brazil’s Sugar Industry

- Czapp Explains: The North-Northeast Brazilian Sugar Industry