Insight Focus

- Russia’s invasion of Ukraine has sent the wheat market into overdrive.

- Here, we look at these price rises and assess whether they can continue.

- We also consider the longer-term prospects for the value of wheat in 2022.

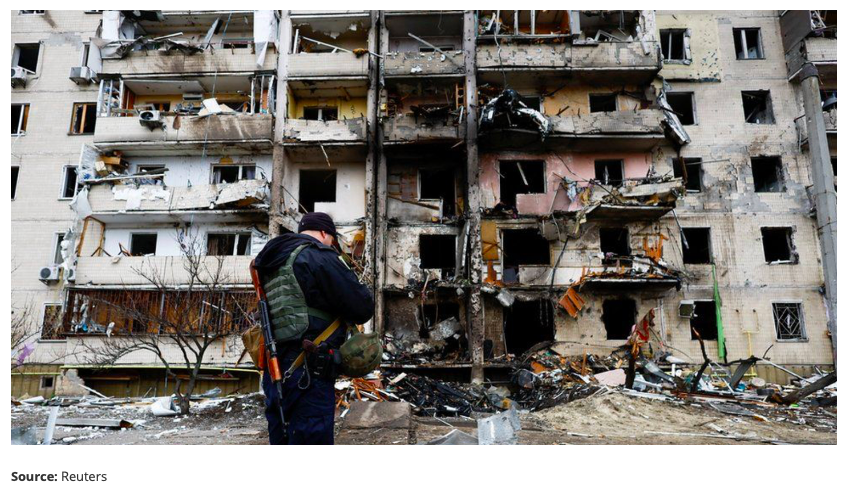

As I write, Russia has begun an invasion of Ukraine.

Leaders in the Western World have been scathing and committing to hold Russia accountable for the actions of their leader, Vladimir Putin, committing to large scale sanctions on Russia in response.

In the East, President Xi Jinping of China has called for talks to de-escalate tensions and has fallen short of criticising the Russian leader. Meanwhile, Beijing has approved the imports of Russian wheat, which had previously been shut out due to contamination concerns.

Wheat prices have risen at an unprecedented rate on markets across the globe.

Putting High Wheat Prices into Perspective

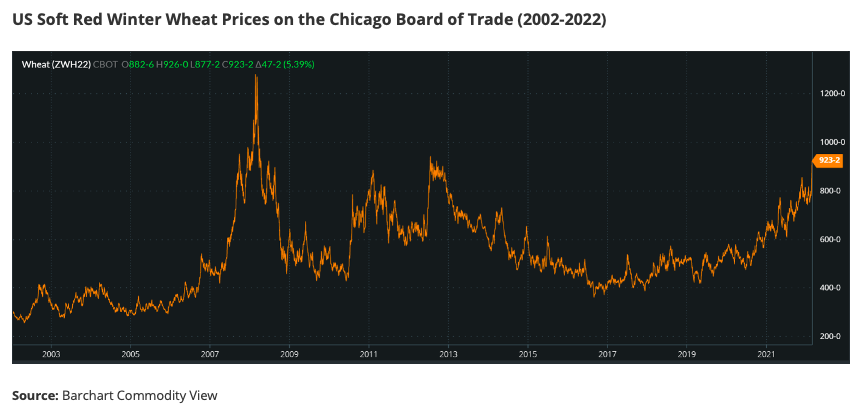

Following the news of Russian troops moving into Ukraine, Thursday 24th February saw the US wheat markets, during the overnight session, trade up by the daily limit of 50 c/bu.

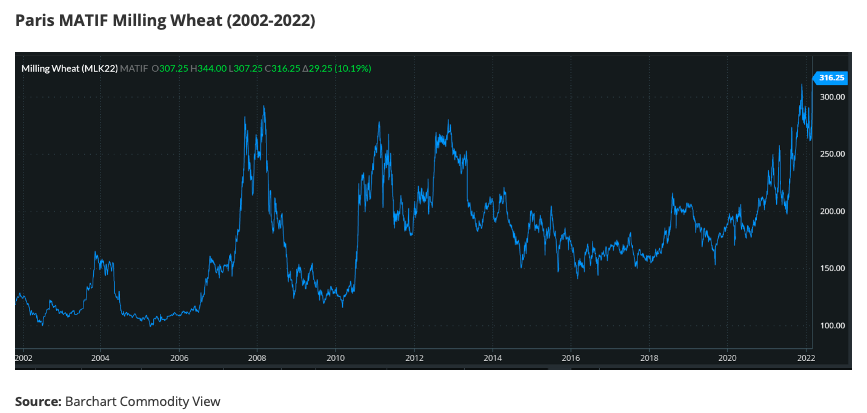

Meanwhile, the May 22 contract on the Paris milling wheat market traded as high as 341.75 EUR/mt, up 47.75 EUR/mt from the Wednesday closing price. They have since cooled off a little.

The below charts show prices of the last 20 years. These illustrate the dizzy heights at which the markets currently find themselves and the all-time highs being experienced in the European markets.

February 2008 saw Soft Red Winter Wheat prices spike above 13 USD/bu, but they were short-lived.

Examining the Sustainability of High Prices

Simple economics tell us that prices are driven by supply and demand.

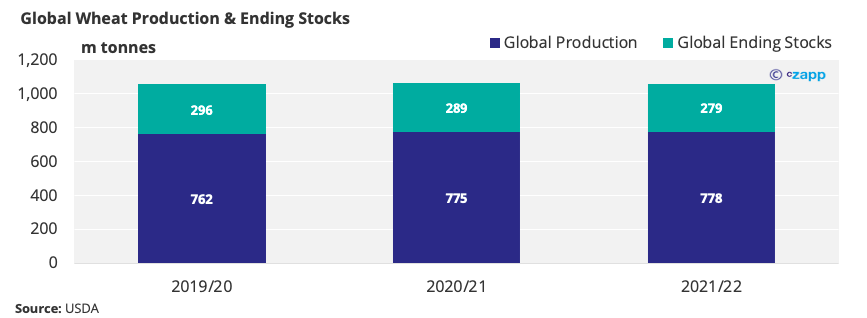

Current supply is adequate, although global wheat stocks have been slightly lower year-on-year for the past couple of seasons.

As can be seen in the charts above, wheat prices have steadily increased while ending stocks have reduced.

The longer-term issues, with prices being driven up by the conflict in Ukraine, is what the buyers are having to deal with.

We accept that the arable farmer producing the wheat gets a greater return for his labours as prices rise. We have considered the increased fertiliser costs in the past and prices have risen at a disproportionate rate to cover these.

However, there will come a point where we start to see demand erosion due to either people’s inability to pay high prices, or an increase in acres planted, thus an increase in supply.

It’s not so long ago that we saw the Arab Spring uprisings in 2010 and 2011 impact the North African countries. As the largest importers of wheat in the world, including Tunisia, Egypt, Libya, Algeria and Morocco, the politicians will be acutely aware of the potential impact of not being able to feed their populations. Sanctions or not, Russia should be able to continue to supply large volumes to this market.

An interesting point of note is the Chinese agreement to import Russian wheat, thereby potentially reducing the significant amounts bought in recent times from Europe, particularly France.

Concluding Thoughts

The full-scale invasion of Ukraine will undoubtedly create numerous logistical issues within the country.

It’s highly likely that Russia will have control of the Black Sea ports in Ukraine and thus continue to supply the North African countries wishing to buy the cheapest wheat available.

No politician in the East or West will want to be accused of encouraging another Arab Spring in 2022/23.

With crops looking healthy in Europe, and still several months before the first combines get rolling in the Northern Hemisphere, there’s every reason to be optimistic about global wheat production in 2022.

The trade from Europe to China may be replaced by Russia and hence trade flows may change, but this should not have any notable impact on overall prices.

It seems improbable that the current spike in prices is sustainable in the longer term once the new harvest begins in the summer of this year.

Supply may yet be adequate in 2022, potentially leading to an increase in ending stocks for 2022/23. This, in turn, will pressure prices leading to a cooling down period, even if it doesn’t send prices crashing.

I am ever hopeful that peace and stability is on the horizon for all people and their wheat.

Other Insights That May Be of Interest…

What the Conflict Between Russia & Ukraine Means for Wheat

High Fertiliser Prices and the Wheat Industry

Explainers That May Be of Interest…