Insight Focus

El Nino has caused havoc across global agricultural markets. With wet weather dominating in some regions, while droughts persist in others, producers are being forced to reshape trade patterns.

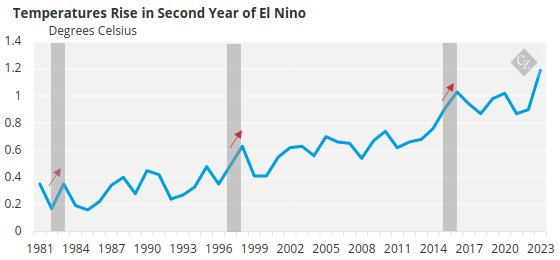

El Nino Raises Temperatures

The Australian Bureau of Meteorology recently declared the end of the most recent El Nino weather pattern. This is a phenomenon that occurs every two to seven years. Although it occurs off the Pacific coast of Ecuador, it brings with it substantial changes in temperatures, atmospheric pressure and precipitation around the world.

Source: Met Office

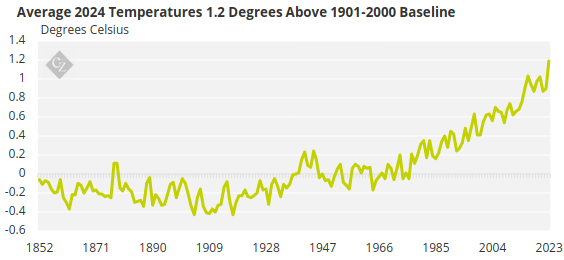

While this El Nino event was relatively short-lived, it can give an indication of what to expect in the food supply chain as the global temperature rises.

Source: Met Office

Specifically, much of the impact has been felt in developing countries, such as Zimbabwe, Zambia and Peru. The weather challenges have even extended to global trade as the Panama Canal faced low water levels as a result of the dry weather El Nino brings to the region.

Grains Suffer in Southern Africa

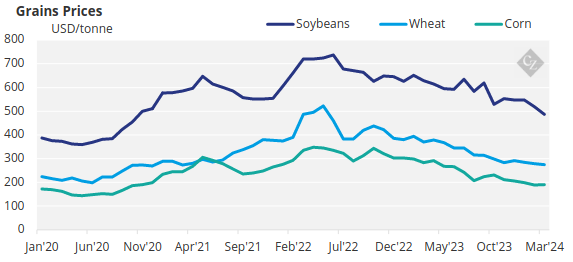

Some countries have benefitted from El Nino for crop development. For instance, in parts of Argentina, El Nino has created ideal warm and wet weather conditions for soy and corn development. After suffering under a drought last year, the country is set for a bumper corn and soybean crop this year.

Source: USDA

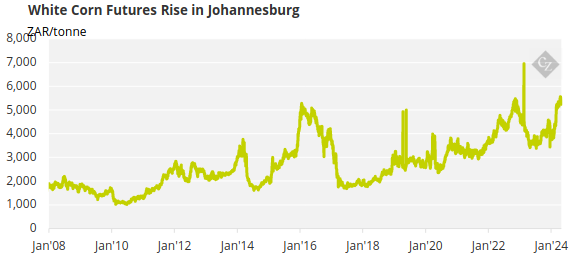

However, in parts of southern Africa, the opposite is true. The USDA expects South Africa’s corn crop to dip substantially this year from 17.1 million tonnes in the previous season to 14 million tonnes this year. This would leave it with ending stocks of just 1.92 million tonnes after exports.

Source: USDA

South African production also largely plugs gaps in lower-income countries Malawi, Zambia and Zimbabwe, which are otherwise self-sufficient in corn. However, all three countries have now declared states of disaster due to the dry spell.

In Zimbabwe, a major dry spell has cost farmers 12% of planted corn. In fact, the drought has gotten so bad that plans to export surplus corn to Rwanda and DRC have been halted, according to the country’s Ministry of Agriculture.

Source: Johannesburg Stock Exchange

While corn prices remain muted internationally, the price of white corn futures have risen on the Johannesburg Stock Exchange.

Source: World Bank

Cocoa Prices Rise Due to Weather

It is not just South African farmers facing difficulties due to intense weather. In West Africa, an intense heatwave at the end of 2023 and beginning of 2024 was attributed to El Nino – in addition to a rise in carbon emissions.

The issue is that Ghana and Ivory Coast are the world’s biggest cocoa producers, accounting for around 54% of global production.

Source: FAOSTAT

Weather is just one of the challenges facing cocoa farmers, who also have to contend with high poverty levels, human rights issues and low farmgate prices. As a result, global cocoa prices have been soaring and structural issues do not look like they will be alleviated any time soon.

Fruit Production Volatile in Latin America

El Nino brings different climates to different regions. While in the South Pacific, around Australia and Indonesia, dry and warm weather prevails, in the Eastern Pacific, off the coast of Peru and Ecuador, there tends to be heavy rains and flooding.

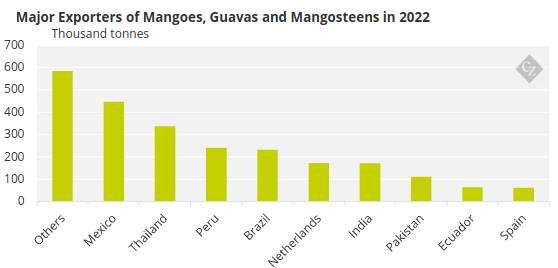

This year, Peru’s mango farmers are facing a disappointing season. Exports are down over 65% compared to last year, largely due to extreme weather conditions. These are causing early fruiting among mangos. Peru is a major mango exporter.

Source: UN Comtrade

Peruvians are also dealing with high lime prices after too much rain. Even in Brazil heavy rains are slowing down harvesting, which is reducing international availability and pushing lime prices up.

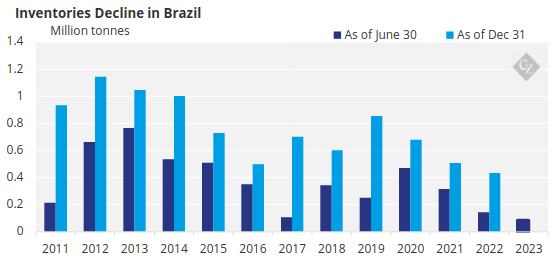

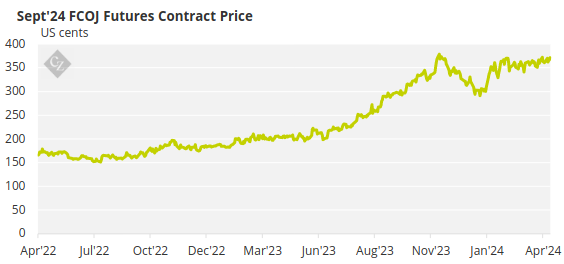

Likewise in Brazil – a major orange producer – weather conditions in key growing regions has compromised the quality of oranges. The oranges that have been harvested are smaller than anticipated, which is exacerbating an overall inventory decline in Brazil.

Source: CitrusBR

As a result of production issues in Brazil, as well as problems in the US, orange prices are rising steadily. The US and Brazil are two of the largest orange producers and exporters in the world.

Source: ICE

Rice Price Rise Could Cause Unrest

Rice prices tend to be a pretty good barometer of global food security. As a basic staple feeding billions of people each day, any rise in the price of rice creates a huge impact on food affordability. There is a notable correlation between high rice prices and periods of unrest.

Rice prices have been steadily rising since 2021 due in part to food inflation and also partly as a result of a rice export ban in India.

Source: World Bank

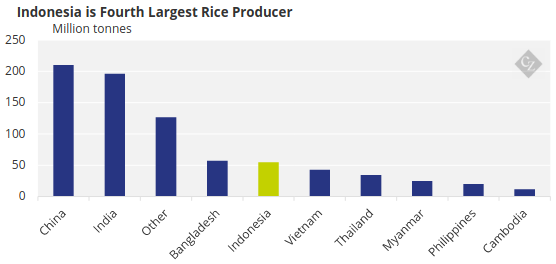

This has been exacerbated by El Nino-related droughts in rice-producing countries Indonesia, Thailand, Vietnam and the Philippines, among others.

Source: FAOSTAT

Reshaping Trade

- As the world moves into a La Nina phase, the aftermath of the El Nino weather pattern continues to impact food producers.

- The phenomenon demonstrates how vulnerable food production systems are to extreme weather – particularly in the global south.

- Extreme weather in the future will cause some countries to create trade barriers – such as limiting exports to guarantee domestic food security.

- Other countries – especially the most vulnerable – will be at the mercy of rising international food prices.