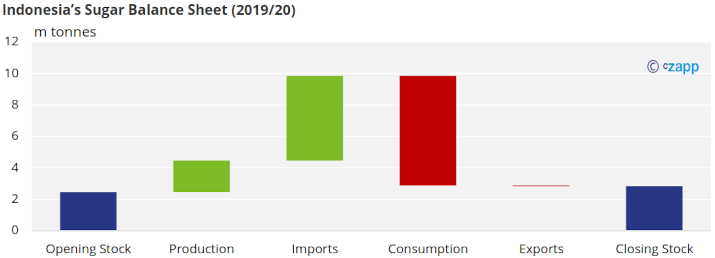

Indonesia is one of the world’s largest sugar consumers and raw sugar importers.

Refiners supply refined made from imported raw sugar to the food processing companies, while cane mills make white sugar for direct human consumption (the ‘wet market’).

The cost of producing wet market sugar is high and meaningful production growth has not occurred in the past decade.

The refineries operate in a protected environment but their aggregate refining capacity exceeds their sales volumes, meaning the sector doesn’t operate as efficiently as it could.

Indonesia gives preferential access to Thailand, Australia and India who are able to export sugar to Indonesia with a 5% duty on raws and 10% on whites.

All other sugar from other countries pay duty at 550IDR/kg (41 USD/mt) for raws and 790IDR/kg (60 USD/mt) for whites.

For more information on the Indonesian sugar market, please subscribe to Czapp Premium.

This Czapp Explainer was Published on the 15th April 2021.

For information on our consultancy offering and other projects, please contact SGeldart@czarnikow.com.