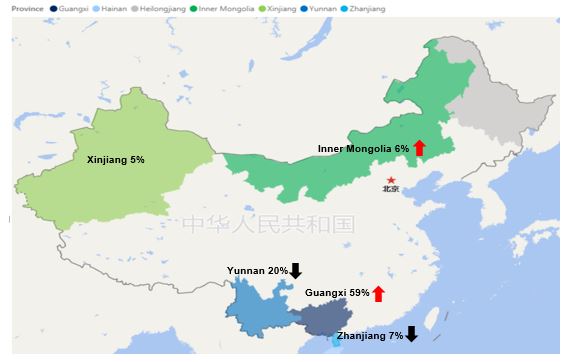

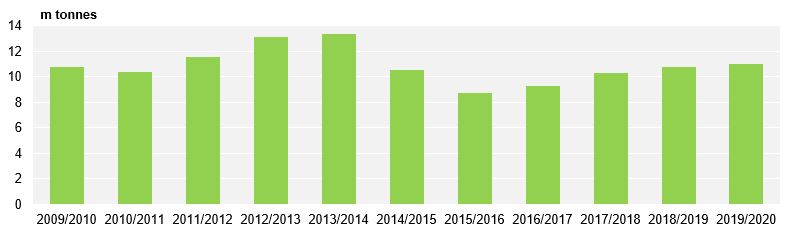

- We think China will produce 11m tonnes sugar in 2019/20, up 200k tonnes from last season.

- This is due to strong beet acreage increase in Inner Mongolia and better cane prices in Guangxi.

- This means China’s import needs will remain at around 4m tonnes of sugar in the 2019/20 season.

Chinese Sugar Production to Increase

- We currently forecast 11m tonnes of sugar production in the 2019/20 season.

- This is below annual sugar consumption, which we estimate at 15.3m tonnes.

- The main threat to this view is recent dry weather in Yunnan, which accounts for 20% of the total production.

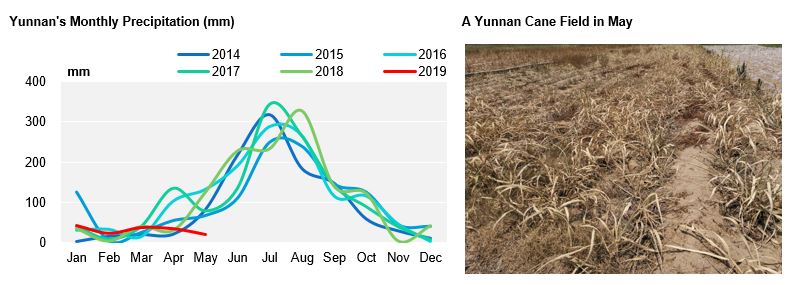

- However we think it’s too early to measure the loss and the impact could be limited.

Chinese Sugar Production by Season

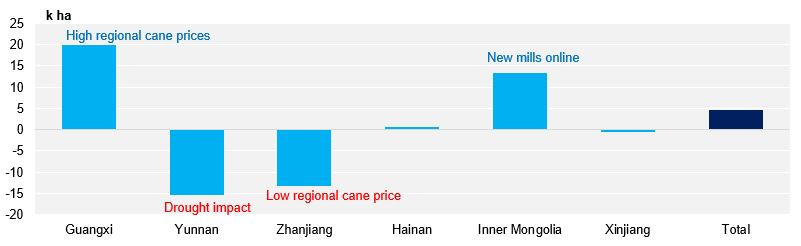

Change in Cane/Beet Acreage

- We could see a small increase in the total cane/beet harvest acreage in 2019/20 season.

- This will offset the acreage losses in Yunnan and Guangdong may reduce due to weather impact and lower cane prices.

Change in Cane and Beet Acreage in 2019/20

Drought Impacts in Yunnan

- Yunnan’s 2019/20 sugar production could fall by 100k tonnes (or 5%) due to drought.

- Cumulative rains by the end of May in main cane regions was only 56% of the 3-year average level.

- And over 5% of the cane has been severely impacted as seen in the photo showed below.

- If the dry weather continues, it may cause further crop losses, perhaps up to 280k tonnes of sugar.

- However, the increase in Guangxi and Inner Mongolia could be more to offset the reduction in Yunnan.

High Cane Price & New Crushing Capacity

- We forecast Guangxi sugar production to increase over 150k tonnes because of the increase of cane acreage and the recovery of sucrose yields.

- This is because farmers are still happy to grow canes under current cane price as discussed in previous report “Guangxi Stop Setting Cane Price”.

- And we expect sucrose yield to recover from 11.6% in 2018/19 to above 12%, which is the average level in history.

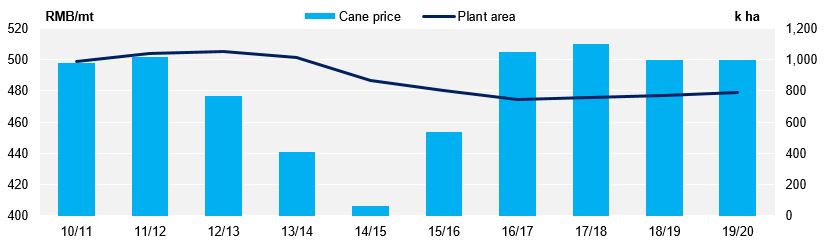

Guangxi Cane Acreage and Cane Price

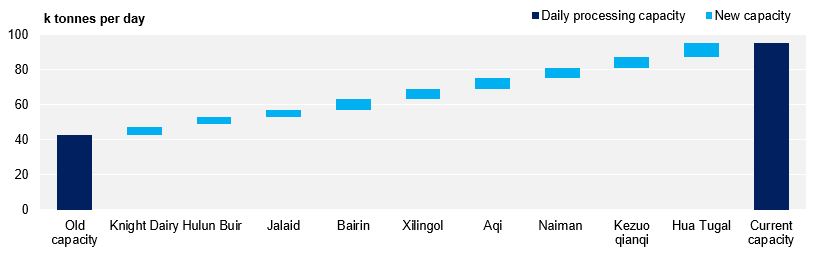

- We also expect an increase of about 100k tonnes sugar in Inner Mongolia if the weather favours the crop.

- This is mainly because the release of fresh crushing capacity of new sugar mills.

- Some other sugar mills decided to reduce their output because they want to have a better control of beet quality and therefore reduce the cost of production with a higher sucrose yield.

Inner Mongolia’s Daily Processing Capacity

Other Regions

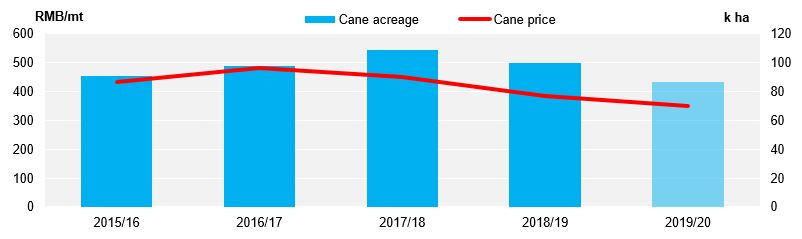

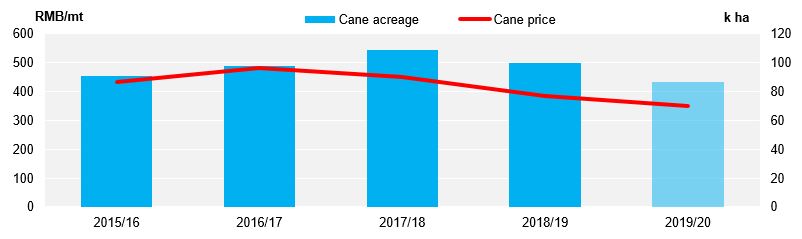

- Zhanjiang 2019/20 cane acreage may also drop due to a lower cane price.

- The average cane price in 2018/19 season was RMB 386 per tonne, 14% lower y-o-y.

- This could bring another 90k tonnes sugar reduction for 19/20 season.

- We don’t expect further reduction as 40% of the cane land is owned by Zhanjiang State Farms, the top sugar producer in Zhanjiang.

Zhanjiang Cane Acreage and Cane Price

Map of Chinese Acreage Changes