Insight Focus

- Argentina looks set to grow 25m tonnes soybeans this year.

- That’s half the level forecast for this crop 11 months ago.

- The market will need Brazil’s huge soy crop to compensate.

Argentine soybean production has imploded and the implications have not yet begun to play out in global protein meal markets; that likely evolves in the second half of this year.

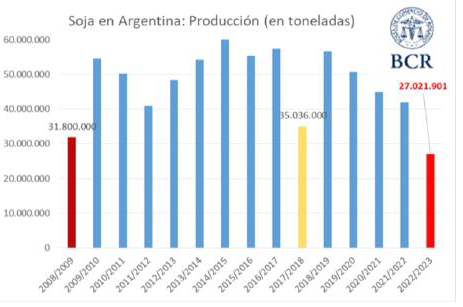

Per prior posts, the USDA’s Buenos Aires based agricultural attaché published the first “official” forecast for this year’s crop nearly 11 months ago with an estimate for 51 million metric tons of soybean production which “makes sense” given the country’s production history detailed in this Rosario (Argentina) Grain Exchange chart below; 51 was, as Nebraskans say, “good enough”:

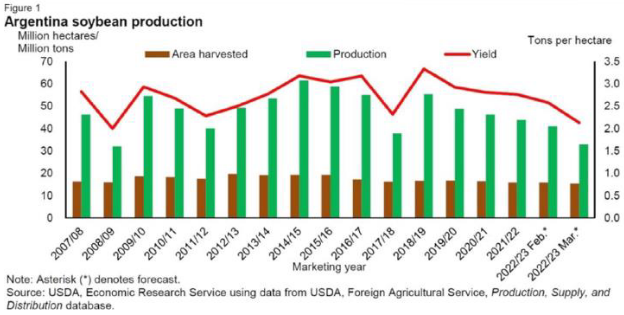

In last week’s World Agricultural Supply and Demand Estimates (WASDE) USDA’s economists forecasted Argentine production at 33 million metric tons, an 8 million metric ton decline from their February forecast (see chart below). The very next day the Rosario Grain Exchange forecasted the soybean crop at 27 million metrics tons (above), 6 million metric tons lower than the USDA, with many knowledgeable private forecasters now estimating a crop size of 25. Remember this all started at 51.

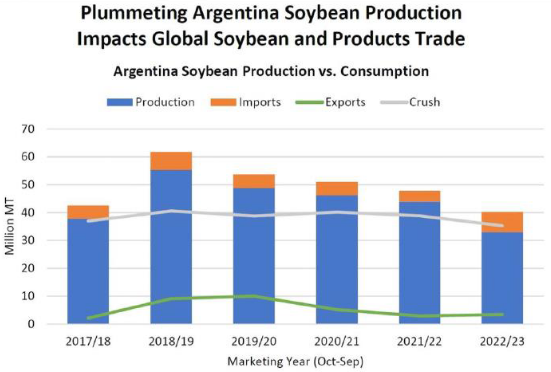

Given this Argentine crop disaster, what are the price and availability implications for global protein meal supplies and what are the scenarios that could unfold? The first and most important implication pertains to the global soybean balance sheet which has evolved from bloated to slim in 60 short days.

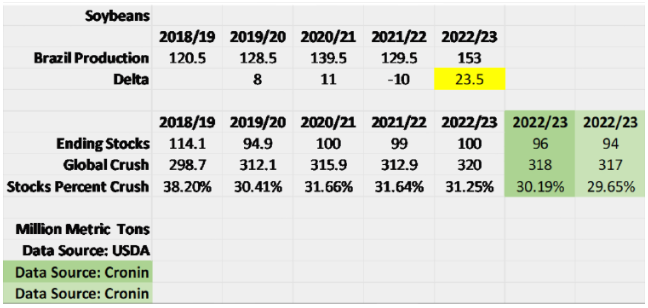

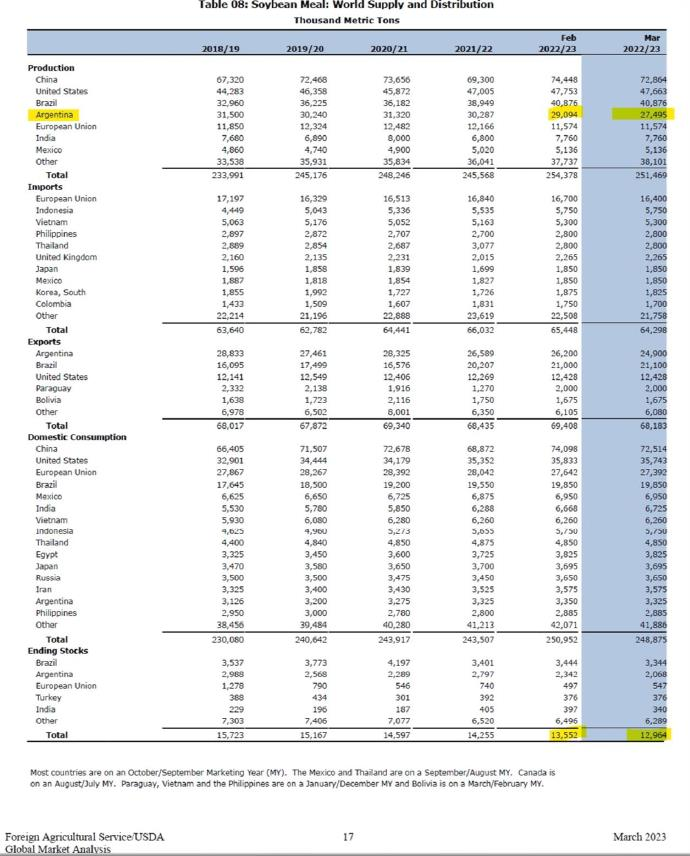

Consider the above data table which uses last week’s WASDE forecast to highlight what the market has focused on and what the market has not focused on, all, of course, in my humble opinion. The highlighted yellow box above, the 23.5 million metric ton year over year expansion in Brazilian production, a tonnage record, has received great acclaim and focus from global oilseed traders. “Wow,” they exclaim, “look at the size of that crop…it is huge”! Right, I agree, no argument here. Huge.

Now let’s put the “huge” into perspective and here I will focus on the relationship between two USDA statistics, crush, or the processing of soybeans into the two primary components soybean meal and soybean oil, and ending stocks, or the available soybeans at the end of September that remain in storage as soybeans and not crushed (often referred to as “carryover” as in carryover to the next crop year). We grain and oilseed traders like to express ending stocks in relation to demand (in this case crush) so we can put the ending stocks into perspective relative to other years’ since grain and oilseed traders primarily forecast prices with a view to ending stocks and the stocks-to-usage ratio (Grain Economics 101).

What we observe in the above table is that the USDA’s current forecast for global soybean ending stocks at 100 million metrics tons divided by a global crush forecast of 320 million metric tons yields a ratio of 31.25% stocks to demand ratio and when looking at other years we can observe that 31.25% is pretty normal, not that special, and so that “huge” Brazilian soybean crop will get consumed and not lead to burdensome supplies. Get it? While the global oilseed trade cannot stop talking about Brazilian “huge” the reality is that the record crop will not yield excess available supplies but normal supplies. What does that mean? Global food security did not increase with the Brazilian record production, it remained the same. Get it? Brazilian “huge” is not so “huge.”

Now look at the green boxes above. These are now my estimates after adjusting USDA data for global soybean crush and ending stocks because the USDA is likely currently overstating the Argentine crop according to Argentine official resources (Rosario Grain Exchange) and private crop estimators. In the darker green box I reduce the global ending stocks by a conservative 4 million metric tons and the global crush by 2 million metric tons due to less available Argentine supply and now the ending stocks ratio comes to 30.19%; in the lighter green box, with even lower ending stocks and crush, a bit less conservative, I arrive at a ratio of 29.65% or the lowest available stocks relative to crush demand in 5 years. Not “huge.”

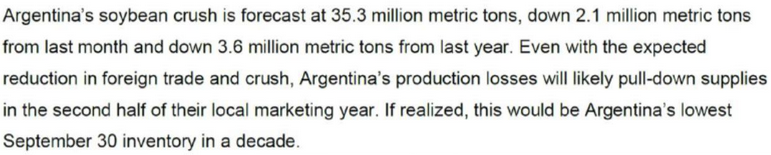

What does the USDA have to say about their current 33 million ton Argentine forecast (and what will they say next month?):

What once appeared to be a potential for a global soybean surplus centered primarily in Brazil now brings the global “surplus” back to a normal level that leaves global ending stocks much tighter than most forecasted and it kind of feels to me like not many in the global oilseed trade are paying attention.

Note two points made in the above summary from the USDA’s Economic Research Service Oil Crop’s Outlook March 2023: “production losses will likely pull-down supplies in the second half of their local marketing year to the lowest September inventory in a decade.” And remember, the USDA is overstating the Argentine soybean crop so the highlighted values below are going lower.

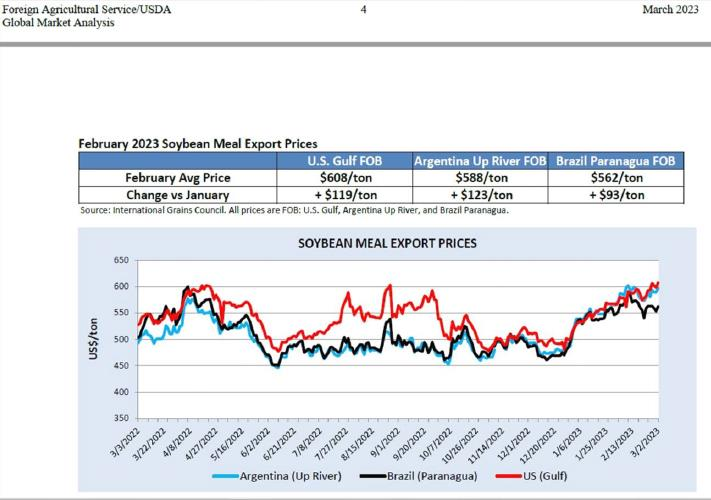

And all the above is causing global soybean meal prices to move higher but is it high enough to keep global protein meal balance sheets from becoming super tight?

And what does the Argentine farmer do because of this hot mess? Is he a hoarder seller of his soybeans?

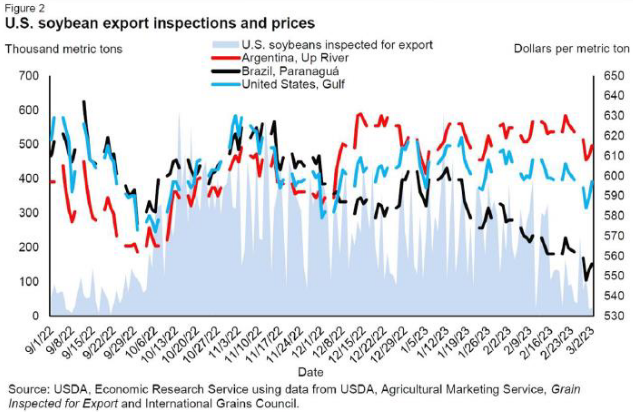

And that “huge” Brazilian crop? Some of it, a record amount, is coming to Argentina according to the USDA and it should given its “cheapest in the world export price status” detailed in the chart below:

The other function of the market, as stated in prior posts, is for Brazilian soybean prices to go to levels that incent global consumers to take Brazilian origin soybeans and no other origin’s soybeans and it looks below like the market is efficiently doing that.

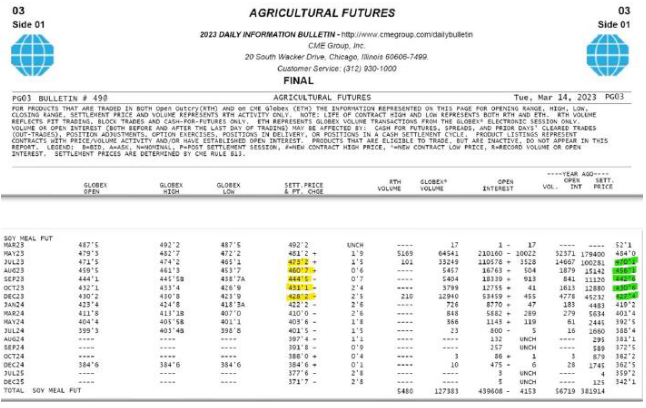

BUT…Brazilian soybeans primarily flow to China to be processed in China with the soybean meal and soybean oil consumed in China…so…the global supply of soybean meal…does not improve when Brazilian soybeans flow to China only when they flow to Argentina and the US and to a lesser extent Europe…and they get to the US and Argentina via MUCH HIGHER soybean meal prices. And those prices, yesterday’s settlements highlighted in yellow below, are nearly exactly the same as they were last year, highlighted in green, and the global balance sheet is tighter and getting more tight than it was a year ago.

The 2023 above prices are pricing the global soybean meal supply as if it were the same as a year ago…and it is not…and those 2024 prices at a $100 per ton discount to current spot price look very attractive.

Three flies in the ointment (circled in yellow below) that may keep global protein meal prices flat and not fully pricing the Argentine soybean production implosion and the additional risk to global protein meal supplies if weather produces oilseed losses in North America this summer: